Cantonal bank employees charged in New York

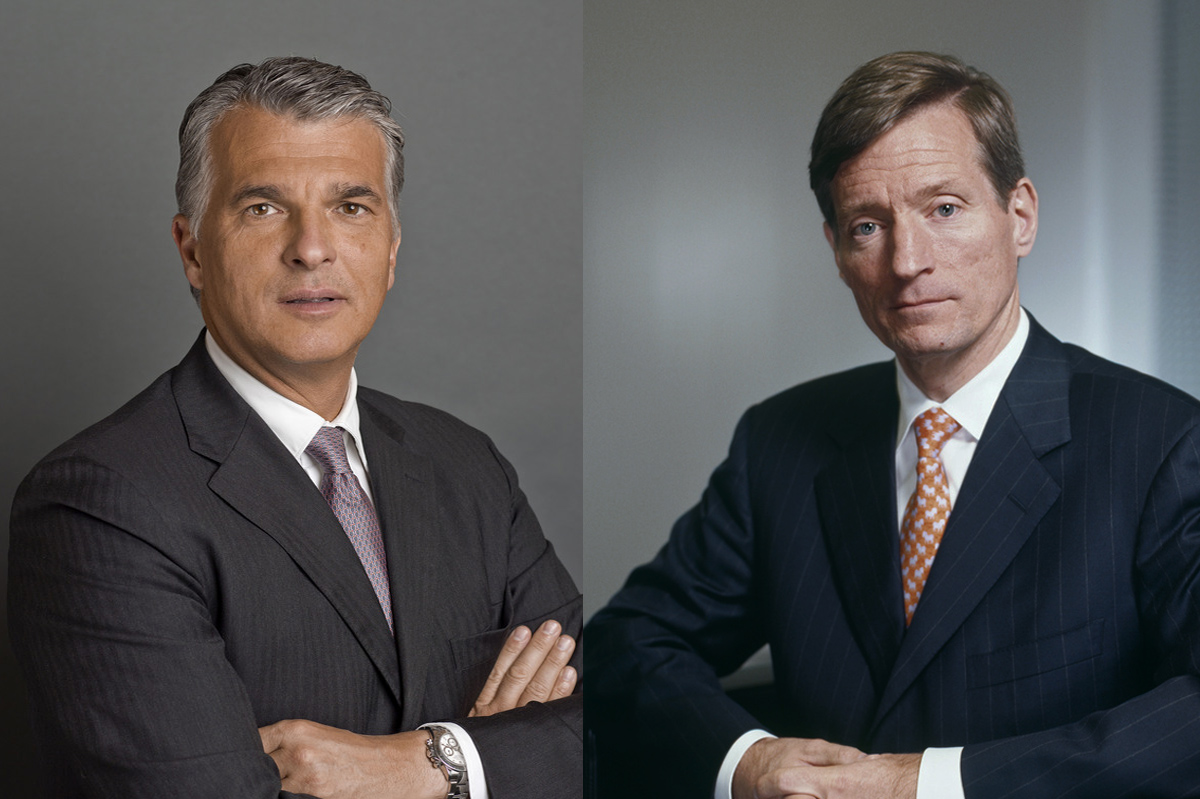

Three employees of the Cantonal Bank of Zurich have been charged in New York City with helping US clients evade taxes, according to the bank and the US Attorney’s Office in Manhattan which brought the charges.

The bank employees, two current and one former, were charged with helping American clients evade more than $420 million (SFr382 million) in taxes. All three live in Switzerland and have been charged but not arrested, according to the US prosecutor’s office.

The Cantonal Bank of Zurich is the largest of Switzerland’s regional-owned cantonal banks. This marks the first time employees of a cantonal bank have been indicted in such a case, though employees of other Swiss banks, including UBS and Wegelin, have been charged with aiding American tax evaders in the past.

Wegelin, long Switzerland’s oldest private bank, has since gone under.

The Cantonal Bank of Zurich confirmed that the three men charged had worked or continue to work for them but said in statements that it could not comment on the charges against them.

However, bank spokespeople have said the institution is continuing to cooperate with the US investigation while abiding by Swiss law.

Continuing discussions

According to Finance Minister Eveline Widmer-Schlumpf, the Cantonal Bank of Zurich itself is not under threat because the US has agreed to continue discussions with Switzerland over the Foreign Account Tax Compliance Act (Fatca) agreement and negotiate solutions for a group of banks instead of targeting individual institutions.

The Cantonal Bank of Zurich is on that list of about a dozen banks, along with the Cantonal Bank of Basel and Credit Suisse. However, Widmer-Schlumpf added that prosecutions of individual bankers by US authorities could not be avoided.

Switzerland and the US have long been at odds over how to preserve Switzerland’s treasured banking secrecy laws while ensuring that Americans don’t use them to evade taxes.

The Swiss authorities and a group of banks had hoped to come to an agreement by the end of the year over taxing US assets in Swiss banks at a fixed rate while keeping client names under wraps. However, no such agreement has yet materialised.

The Foreign Account Tax Compliance Act (FATCA) was passed in the US in 2010 as part of the Hiring Incentives to Restore Employment Act.

Fatca was designed to close loopholes in existing tax compliancy regulations, known as the Qualified Intermediary (QI) accord.

The law obliges foreign firms to report offshore accounts and security trades by US clients that amount to more than $50,000 (SFr47,942).

If they fail to do so, they will be hit with a 30% withholding tax.

The US expects the new legislation to net $8 billion inside ten years.

The estimated annual cost to each foreign bank to implement the law has been put at $100 million.

The US plans to bring Fatca into force in stages, starting as early as next year.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.