Computers can learn empathy but make unlikely Swiss bankers

Switzerland has a world-beating position in cross-border investing: its finance industry last year managed SFr6.6tn of assets on behalf of institutions, companies and the rich.

So Swiss bankers have a keen interest in the technological revolution sweeping global finance, which has profound implications for the way markets operate.

More

Financial Times

External linkThat includes some of the more fantastic ideas about handing the management of clients’ assets entirely to computers – creating “self-driving portfolios” in the way the automotive industry is creating self-driving cars.

To outsiders, it may seem a true clash of cultures: Swiss banking means old-fashioned, personal service – as well as caution, secrecy (and until a global clampdown a decade ago, helping clients evade tax).

Yet Switzerland – surprisingly, perhaps – is ahead of the game in some of the thinking about the use of computers that think for themselves and outperform humans.

One pioneer is Jürgen Schmidhuber, professor of artificial intelligence at the University of Lugano in Italian-speaking Switzerland, whose work on complex speech recognition systems has been adopted by Google. The best voice systems can distinguish commands even against loud background noise, such as in restaurants.

Bumpy road

At a conference for professional investment managers in Zürich this month, he set out how neural networks – complex systems designed to mimic how the brain learns using millions of examples – could be transplanted to finance, shifting out patterns from background noise.

Such ideas have been around for decades. While AI in cars grabs more headlines, hedge fund managers have long profited – and crashed – on its output.

But the argument of scientists such as Prof Schmidhuber is that the rapid expansion of computer power and “deep learning” systems – the next generation of neural networks – has reached a point where they could realistically replace humans across the investment and banking industry.

“Everything that humans can do will be done better by artificial intelligence,” Prof Schmidhuber told me confidently, although he admits that “on the way, you will see lots of failures”.

Yet generally Swiss bankers do not believe their livelihood is in danger. As elsewhere in the world, they are automating processes to cut costs and use “robo advising” for more basic investment services. But computer power is regarded as something to assist – not replace – humans.

Unlikely bankers

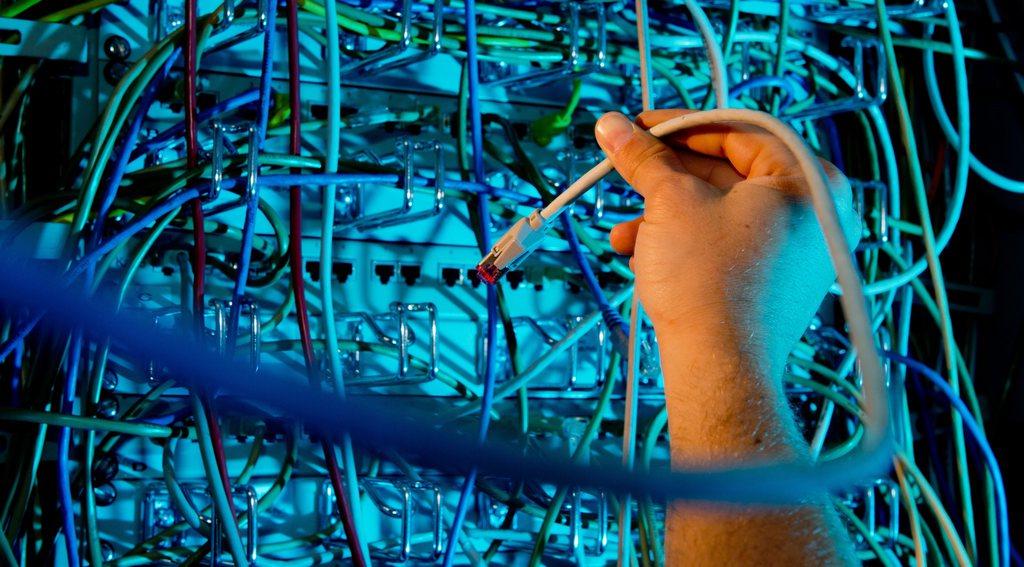

Investment managers I spoke to pointed out the many trade-offs they had to judge, including for regulatory and accounting reasons. Already, large portfolios can be managed by a few people – so potential savings are modest. Then there were the dangers of computers increasing the risk of “flash crashes” and exposure to hackers.

A more pertinent objection is whether intelligence based on patterns from the past can cope with unprecedented events – the election of Donald Trump as US president, for example. Moments of geopolitical instability are when the world’s rich are happiest knowing their money is looked after by a familiar banker in Switzerland.

Prof Schmidhuber says such objections can be overcome. Neural networks can optimise trade-offs and process political events by scouring news reports. They can also foresee events which have not happened before. The explosion of the sun has not happened yet but scientific analysis predicts it will (in a few billion years hence).

However, he did not impress the audience at last week’s Zürich Uhlenbruch professional investment managers’ conference. While more than half believed AI could support humans in executing trades, just 10 per cent believed it could help with portfolio management.

Even in a tax-compliant world, Swiss banking thrives on the perception it offers the individual touch. One senior Swiss private banker said he acted as a “shrink” for clients and would not dream of telling them their money was managed by a computer.

Of course, as Prof Schmidhuber points out, computers can also learn empathy, using cameras to recognise emotions in faces. But they still make unlikely Swiss bankers.

Copyright The Financial Times Limited 2016

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.