‘Tax cheats will have nowhere to hide’

G20 finance ministers meeting in Australia have put their seal of approval on the global standard for automatic exchange of tax information (AIE). Switzerland helped set the regulations and welcomes the implementation, but political debate is inevitable.

The communique from the weekend meeting endorsed a plan to automatically exchange the information on a reciprocal basis “by 2017 or end-2018”

“We support further coordination and collaboration by our tax authorities on their compliance activities on entities and individuals involved in cross-border tax arrangements,” it said.

The agreement represents an important milestone for the Organisation for Economic Cooperation and Development (OECD)External link, which has been working on the AIE standards since April 2013.

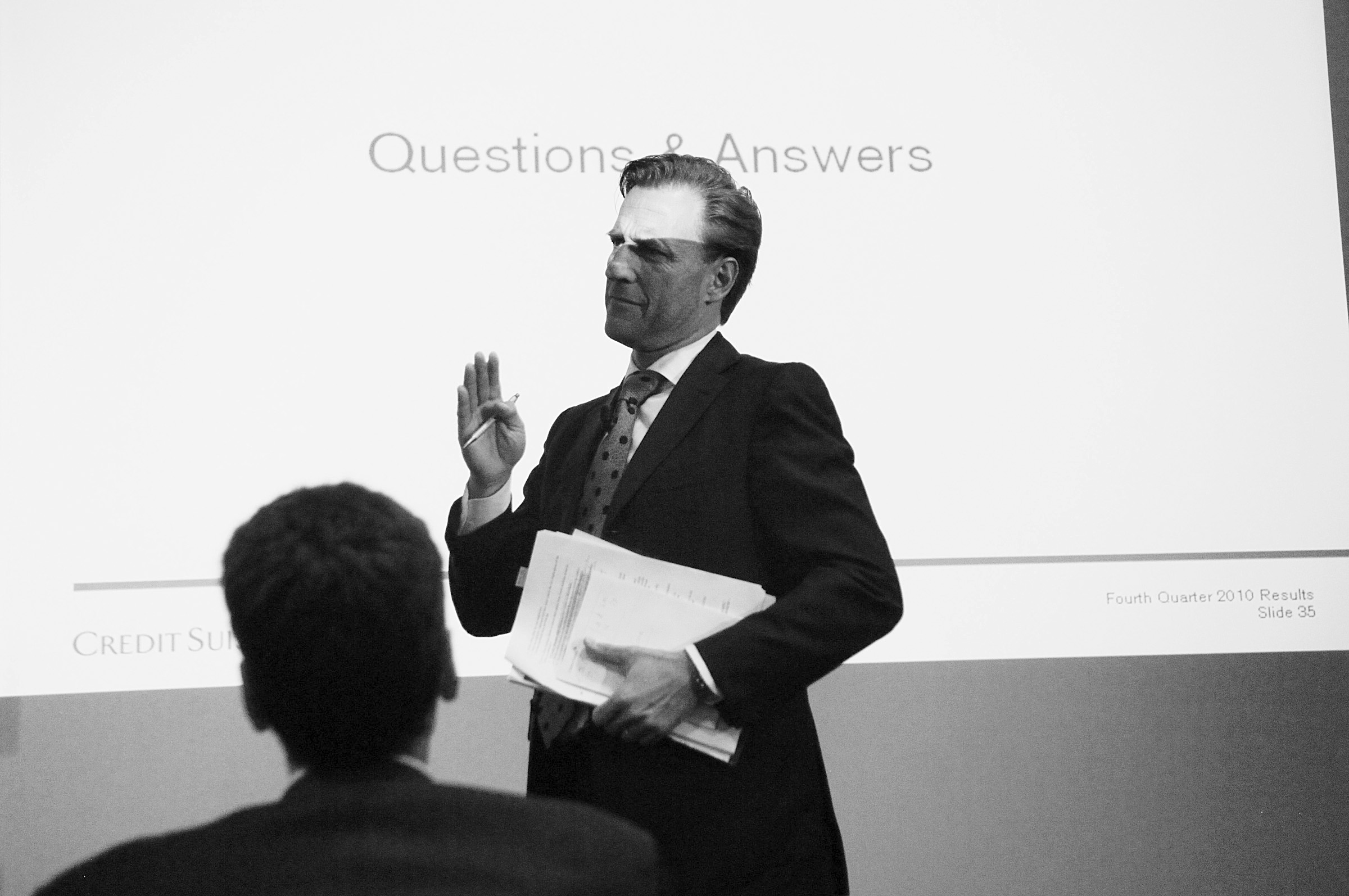

“Almost overnight legal business practices become unacceptable,” said Patrick Odier, president of the Swiss Bankers AssociationExternal link this week at the bank umbrella group’s annual general meeting.

“I’ll put it simply: the banks in Switzerland accept AIE. We’re not doing it because it’s the best solution. We’re doing it because it has prevailed internationally,” said Claude-Alain Margelisch, chief executive of the association.

And with those statements, the two prominent bankers summed up the rapid paradigm shift witnessed in the past 18 months. Switzerland has resisted AIE, but banking secrecy for foreign clients has definitely been given up for dead.

No more exceptions

“The signs were in the air for the last three or four years. I don’t believe that any bank was surprised by the changes, but they were surprised at the speed of them,” Peter V. Kunz, professor of business and comparative law at the University of Bern, told swissinfo.ch

“I think that probably a not insignificant number of banks had hoped that Switzerland could be an exception to the rule. That hope has now become a huge disappointment.”

More

For top diplomat, international cooperation suits Swiss banks

“Behind closed doors, a few bank directors have already been saying for three or four years that we should make arrangements for AIE, so as not to fall behind,” said Sergio Rossi, economics professor at the University of Fribourg.

“Officially, of course, the Bankers Association has led the opposition and held on tightly to the myth of banking secrecy. It was all about not worrying foreign clients and retaining their trust.”

Fears of being blacklisted

The time has long passed since top Swiss politicians and bankers declared banking secrecy was untouchable and tax evasion was a trivial offence. This policy landed Switzerland on the OECD’s grey list of tax havens.

To prevent further reputational damage, and to keep off the OECD’s black list, the government broke a taboo in 2009 by promising enhanced administrative assistance in cases of tax avoidance and no longer just in cases of tax evasion.

From that time on things moved quickly. With the Foreign Account Tax Compliance Act (Fatca), the United States moved unilaterally to chase down missing tax revenues.

The withholding tax model, which allowed tax evaders to remain anonymous in exchange for paying owed taxes, broke down at the end of 2011 when Switzerland’s most important trade partner, Germany, rejected the deal.

“Success of financial diplomacy”

In June 2013 the cabinet explained that as a member country of the OECD, Switzerland would be working alongside others on developing AIE standards and putting its own demands forwards.

“We can boast of successful Swiss financial diplomacy,” said Jacques de Watteville, state secretary of the finance ministry after the OECD defined the AIE standards and published them.

More

Bank it

Switzerland insisted that the principle of mutuality should be contained within the global standard.

It also successfully pushed for transparency of constructions such as trust funds and the principle that information should only be used for tax purposes, thus preserving data protection.

The AIE “brings us a step closer to a world where tax evaders have no more hiding places,” OECD Secretary-General Angel Gurria said at the unveiling of the standards in June. He outlined an ambitious schedule for its implementation.

This weekend in Australia finance ministers of the 20 most powerful countries in the world will declare AIE as politically binding. The standards will be officially signed at a G20 meeting in Berlin at the end of October.

Wide support

More than 60 states have already pledged their support to AIE, including Switzerland, Liechtenstein, Luxembourg, Germany and France, as well as Singapore and well-known British overseas territories tax havens such as Cayman, Bermuda and Gibraltar.

The OECD wants AIE adopted as a global standard, but it there are still notable geographical gaps at present. Significantly, many Asian and Latin American states, plus the tax havens of Monaco and Hong Kong were not part of the joint declaration on adopting the standards.

The United States has already unilaterally established an exchange of information with more than 100 other countries under Fatca, but has so far not fully answered the question of reciprocity of AIE.

AIE will be implemented from January 1, 2017, according to the OECD timetable. The Swiss government is expected to receive a mandate to deal with AIE from parliament in October. Both chambers of parliament have in principle agreed to its adoption in Switzerland, but domestic debate on AIE could well spark a referendum.

“Originally, I said AIE would be introduced in Switzerland in 2018, but events are moving so fast that it is possible to see it established in January 2017,” said Kunz. “However, that would only be possible without a referendum. There is still a lot of political discussion to be made.”

Kunz has no doubts that Swiss banks will be technically prepared to apply the standards by 2017. “But I have my doubts whether other countries will reach this same level by 2017.”

“I believe that the goals can be achieved,” said Rossi. “My only concern is whether all countries will really apply to all the rules. It requires controls.”

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.