UBS woos clients with Churchill-era war games

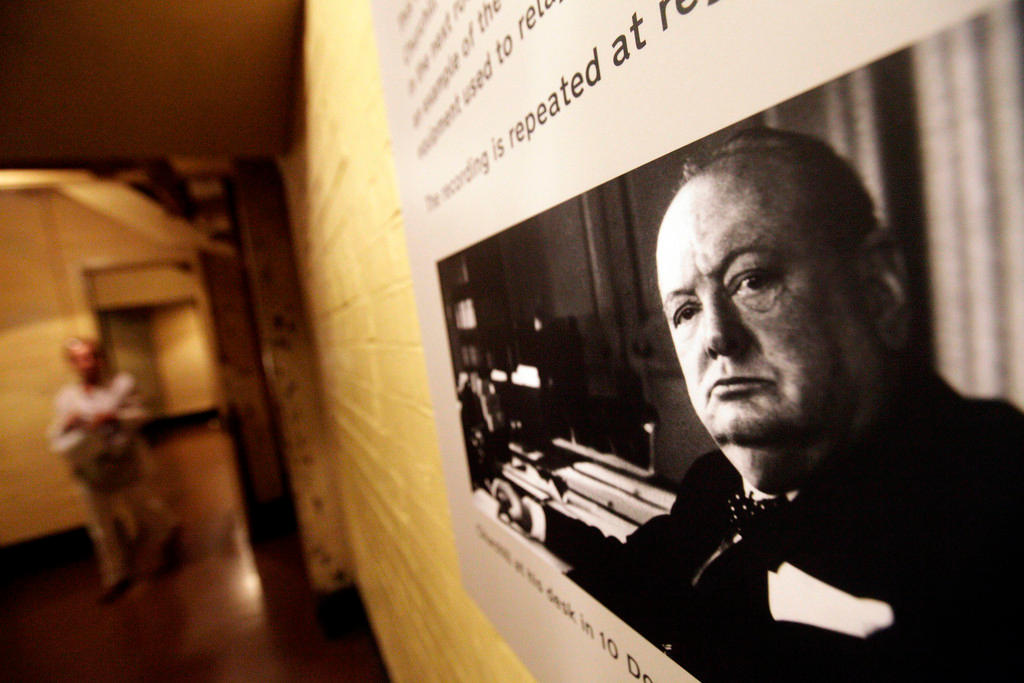

UBS invited some of its wealthiest clients to London this month to fight war games in Winston Churchill’s underground bunker, Britain’s headquarters during the second world war.

The world’s largest wealth manager says the war-gaming exercise was part of a drive to find innovative ways to engage with its clients to counteract falling profits. Pre-tax profits for UBS’s wealth management division dropped 23.5% in the first half of 2016 compared with the same period last year.

Invitees were either owners or managers of private companies. UBS says insights collected from these clients are being used to challenge its own “house” views and to develop short-term trading ideas as well as longer-term investment themes.

More

Financial Times

External link“We bank half of the world’s billionaires and have a tremendously valuable network of clients among private companies. We share the information gathered through that network with them to identify risks and opportunities for their businesses,” says Mark Haefele, global chief investment officer of UBS Wealth Management.

Alongside employing new digital tools, artificial intelligence and big data, Haefele says the Swiss company is experimenting with cameras that can measure facial micro-responses to assess clients’ reactions when shown how their portfolios might perform during a variety of growth and inflation scenarios.

Paolo Sironi, a fintech strategist at IBM, the US technology company, says regulatory changes and downward pressure on fees are transforming the business model of private banks.

“It is no longer enough to be a packaging machine for financial products. Private banks need to demonstrate the value of their investment advice and help clients become more capable of dealing with the uncertainties of financial markets,” he says.

‘Very novel’

John Hulsman, a foreign policy expert, presented two negative scenarios to clients to discuss during their time at the Churchill War RoomsExternal link. The first examined how the Syrian war and refugee crisis might threaten political and financial stability in Europe and the second focused on the threat of another financial crisis.

In the first scenario, participants concluded that more than a million immigrants were likely to enter Germany next year, precipitating the downfall of Chancellor Angela Merkel and widespread political disarray across Europe.

In answer to the second scenario, participants felt that the structure of the EU was a potential catalyst for a wider financial crisis because of the challenges facing its overly complex and inflexible political system.

A crisis originating from China was also identified as a risk, as participants felt it was difficult to assess the contagion effects of any significant weaknesses emerging in the country’s economy.

Haefele says: “These scenarios have been repeatedly highlighted in our conversations with these clients as the key risks that would have the greatest impact on their businesses.”

Greg Davies, a former head of behavioural finance at Barclays Wealth, says banks organise war games for their own staff but it is “very novel” to see clients invited to such an exercise.

“War games help the military prepare for uncertainty and teach them how to adapt dynamically when their plans no longer work in the real world. Investors often have very blinkered views, which is dangerous in financial markets, and a war game allows ideas to be challenged in an acceptable way,” he says.

Copyright The Financial Times Limited 2016

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.