Drug giants see outsourcing as key to staying ahead

Big pharmaceutical companies such as Roche and Novartis are increasingly outsourcing the research and development of new drugs to smaller biotech firms.

Both Swiss firms recently signed deals with United States companies to licence drugs at the early development stage rather than forking out billions to take over competitors.

Novartis last month signed a deal with Infinity Pharmaceuticals, and will pay that company to develop cancer treatments. Roche’s collaboration with Amira, agreed in January, went a step further, forging an alliance which allows both firms to licence clinical programmes from each other.

Cash-rich pharmaceutical companies have recently found themselves relying on enterprising biotech firms to keep new drugs coming, according to Karl-Heinz Koch, an analyst at private bank, Lombard Odier Darier Hentsch.

“The huge cash flows generated by recent blockbuster drugs made many pharmaceutical companies complacent. The low hanging fruit has been picked and now the trees are looking bare,” he told swissinfo.

“This is combined with more aggressive competition from the generics industry resulting in the early termination of patents. To make matters worse, an increased emphasis on safety has raised hurdles for new product development.”

Cancer

Smaller biotech firms have proved particularly adept at developing drugs in previously neglected areas, such as cancer and multiple sclerosis.

“More effective treatments for terminal illnesses are keeping patients alive for longer, so you are adding new patients every year. That has turned products [with limited sales potential] into multi-million dollar drugs,” Koch said.

“This has attracted pharmaceutical firms into speciality markets which have traditionally been the home turf of biotech companies. You need to be present in a certain area before someone else gets there.”

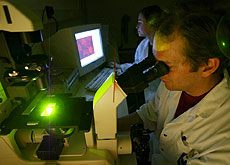

Roche and Novartis are both keen to stress that they have strong in-house research and development (R&D) divisions to complement outsourcing. But they admit that to keep up with developments in new areas they have been forced to look outside their own laboratories.

Costly takeovers

One method of accessing new research areas is simply to buy companies. But a recent spate of takeovers has pushed up prices to such an extent that worthwhile acquisition targets are becoming increasing rare.

Novartis went on a spending spree last year, snapping up vaccine maker Chiron, generics company Hexal and over-the-counter drugs manufacturer Bristol-Myers Squibb. But the company has become more cautious recently, rejecting Berna Biotech and Serono, in favour of collaborations.

Roche has taken a more imaginative route by licensing drugs – effectively paying biotech firms to research and produce products for them. In 1990 the pharmaceutical company bought Genentech, but granted the US biotech complete autonomy in R&D.

“It is important to note that in-licensed programmes are treated the same as in-house projects,” Roche spokesman Alexander Klauser told swissinfo.

“A strong in-house R&D is also important to attract alliance partners as we have both the expertise and the critical mass to partner with biotech companies.”

Spreading risk

This year’s deal with Amira breaks further ground by giving the biotech rights to some of Roche’s own projects. The deal allows Roche to buy in to a potential blockbuster drug for a fraction of the cost of acquiring a company while spreading the high risk of research failure.

At a recent meeting in Zurich, Dr Peter Corr, senior vice president of science and technology at the world’s largest pharmaceutical company, Pfizer, revealed that 75 per cent of R&D spending yields nothing of value for the company concerned.

The vast majority of funding is injected into the initial testing stages which also has the highest failure rate, Corr said.

“When we are talking about meeting unmet medical needs and bringing innovative medicines to the patient, we are describing experimental medicine, which by its very nature is unpredictable and brings with it a certain level of risk for all those concerned,” said Roche’s Klauser.

“What is important is to be able to provide a certain level of flexibility when building partnerships, including the awareness of a potential need to change and accommodate new circumstances as and when the need arises.”

Analyst Koch agrees that sharing the risk of failure is a smart move on the part of pharmaceuticals.

“You would probably like to outsource that early research risk somewhere else. At the end of the day it is spreading your bets,” he said.

swissinfo, Matthew Allen

Novartis is the world’s fourth-largest pharmaceutical company by sales (5.05% global market share), according to a 2005 report by medical market research company IMS Health. Roche was ranked eighth with a market share of 3.48%.

Roche spent some $5.7 billion on research and development in 2005 compared with $4.8 billion shelled out by Novartis.

Novartis strategic alliances have spawned some 400 collaborations (120 with biotech firms and 280 with academic research institutions) in more than 20 countries.

Roche has partnerships with 60 companies worldwide. The number of licensing deals has risen from 14 in 2001 to 31 in 2005.

Novartis key figures (2005):

Net profit: SFr7.8 billion (up 10%)

Group net sales: SFr41.73 billion (up 14%)

Number of employees 90,924

Roche key figures (2005):

Net profit: SFr6.730 billion (down 5%)

Group net sales: SFr35.5 billion (up 20%)

Employees: 68,218

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.