Jail time demanded for bad bankers

The latest scandal to hit the banking world has led to renewed calls for the authorities to finally clamp down on malpractice by jailing traders. But will the foreign exchange fraud, the latest in a long list of malpractices, force banks to change their ways?

“In most businesses, the normal penalties for defrauding a customer include the risk of a jail sentence,” read a recent Financial Times editorial. “If the authorities really want to change the culture of the trading desk, criminal sanctions must become a more vivid possibility.”

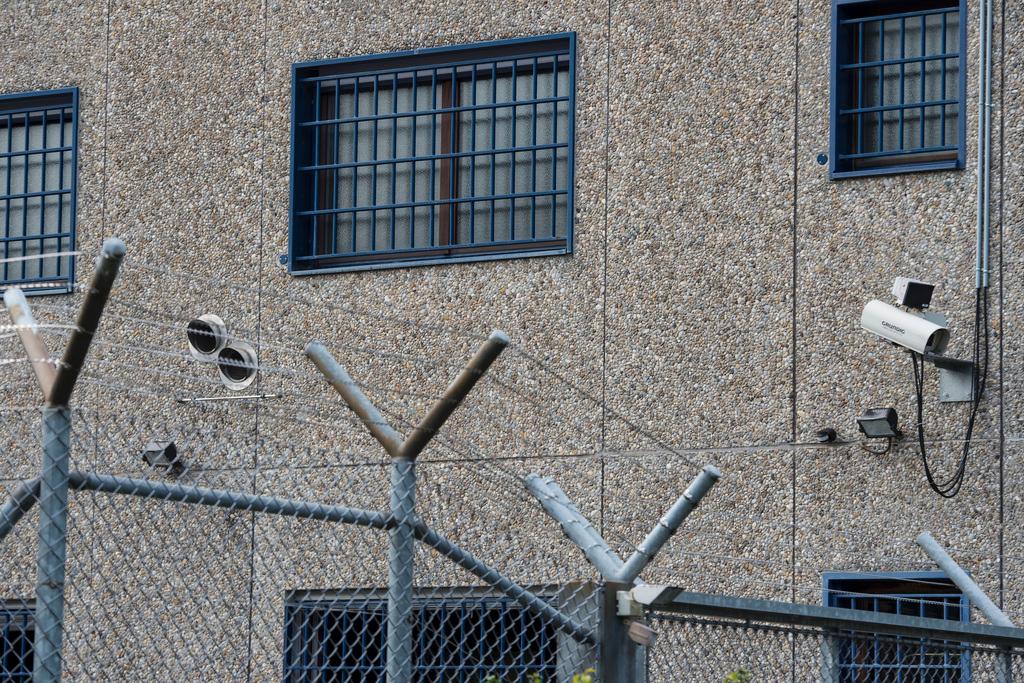

Switzerland’s public prosecutor appears to have opened the door to this possibility by starting criminal probes into several people connected with forex fraud at UBS. The allegations of financial mismanagement and breaching banking secrecy laws carry respective penalties of up to five and three years in prison.

The Swiss Financial Market Supervisory Authority (FINMA) is also investigating 11 individuals, including managers, having until now only demanded that UBS hands back CHF134 million ($140 million) in fraudulently obtained profits.

More

The ‘cartel’ at centre of forex rigging probe

The introduction of potential criminal sanctions is overdue, according to many observers and large sections of the public.

“More drastic measures are overdue in this industry. Individuals need to be held responsible for their actions (and omissions) and they need to know that there are real consequences for their behaviour,” Florian Wettstein, director of the Institute for Business Ethics at the University of St Gallen, told swissinfo.ch.

“If they know the bank will pay fines, backed by the taxpayer, then there is no incentive to change. If they know they may go to jail as a consequence of their behaviour, things will change.”

Break-up banks

Marc Chesney, vice-director at Zurich University’s Department of Banking and Finance, goes one step further by demanding the break-up of banks that are deemed so important to the Swiss economy that they would be bailed out by the state rather than allowed to go bust.

“As long as big banks are too big to fail and some individuals are too big to jail these scandals will keep occurring. We need to separate commercial banks from investment banks to force them to be more responsible,” he told swissinfo.ch.

“If they know that they might suffer or possibly go bankrupt by engaging in dubious and risky operations then it would force them to be more cautious.”

Global banks have repeatedly been caught with their trousers down in the last few years in variety of scandals that includes market rigging, tax evasion, embargo busting, rogue trading and mis-selling a variety of products to unwitting customers.

After each scandal banks apologise, at times blaming the unhappy episode on a few rogue employees acting under the radar and promise to clean up their acts. Employees are disciplined or sacked while huge bonus systems are tinkered with – while the profits keep rolling in.

Authorities scared

Daniel Fischer, a Zurich lawyer who has represented clients in various civil claims against banks since the financial crisis, believes that the authorities may have been overawed in the past by the power of big banks and their importance to the economy.

“The lack of credible action gives the impression that big banks have enjoyed a certain protection from the authorities,” he said. “This has to change.”

UBS chief executive Sergio Ermotti came into office in the wake of a rogue trading scandal in 2011 that claimed the head of his processor Oswald Grübel. “As I have said previously, no amount of profit is more important than safeguarding the good name of our firm,” Ermotti wrote in an internal memo sent to staff upon his appointment.

Three years later, FINMA director Mark Branson (himself a former UBS executive) was left scratching his head as to how scandals continued to hit the bank.

“What is troubling here is not only the poor behaviour of the traders but also that UBS did not identify these risks and did not have the appropriate controls for this business,” Branson told journalists in the wake of the forex fraud.

“And this is after the repeated scandals of the last few years. A clear failure of compliance.”

Embedded culture

This shows that the culture of the bank, at least in some divisions, has not changed since Ermotti took over, according to Wettstein. “The whole culture at the bank has to move away from the ‘bad apples’ mentality. It is not sufficient to look away from the real problem by blaming a few individuals and saying that everything else at the bank is fine.”

Wettstein believes that a large part of the problem remains with the bonus system, which FINMA found amounted to up to seven times the base salary of some traders.

“It is easy to say what the right values should be, but you also have to incentivise them correctly,” Wettstein said. “You can talk about integrity all you want, but If the incentive system is based purely on money then people will still be driven by bonuses.”

“It makes Ermotti’s statements about cultural change seem like empty words. If UBS was really serious about changing the culture they should have started with the bonus model.”

The bad behaviour of banks is causing far more serious problems than damaging the reputation of individual institutions and the Swiss financial centre, according to Chesney. The implications spread right down to the person on the street.

“Banks continue to make profits at the expense of clients and the economy,” he said. “This is simply not a stable economic model. As a result, we can observe that the financial crisis is still not over six years after it first began.”

Banking scandals

On November 12, UBS was among five global banks to be hit with fines in relation to a forex rigging scam. UBS was ordered to pay around $800 million by Swiss, British and US regulators. Analysts expect further penalties to arrive in relation to the malpractice, most notably from the US Department of Justice. The bank is also bracing itself against potential civil lawsuits from disgruntled clients, including hedge funds and pension funds.

FINMA listed a catalogue of abuses conducted by certain staff at the banks forex and precious metals trading desks. These included ripping off clients and passing on their details to third parties. UBS traders colluded with employees at other banks to rig benchmark rates, often through social media chat rooms. In addition to investigating 11 UBS staff, FINMA has ordered the bank to curb some bonuses and conduct 95% of similar trades by automated means in future.

In 2012 UBS was fined $1.5 billion after traders were found guilty of manipulating LIBOR benchmark interest rates. A year earlier, the bank was hit by a $2 billion rogue trading scandal. UBS has also been fined in the US for tax evasion offences (2009) and faces similar charges in France.

Several other Swiss banks have also been fined for US tax evasion (Credit Suisse & Wegelin) or are either under current criminal investigation or part of a non-prosecution programme if they reveal details of their US activities.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.