Niche watchmakers join forces to weather storm

Currency fluctuations and other challenges have small, independent Swiss watchmakers gathered in Geneva cautious about the future.

“It’s a nightmare. I don’t know how we’ll cope,” declared Amarildo Pilo, the founder of the Geneva-based watch brand Pilo & Co.

The founder of the small specialist watchmaker, established in 2001, is still in shock at the recent decision by the Swiss National Bank (SNB) to axe its CHF1.20 exchange rate peg against the euro.

The SNB move adds to a growing list of challenges for small watchmakers: an increase in prices of raw materials, difficulty of getting watch movements, strengthening of “Swiss-made” regulations, the economic crisis, and clampdowns in China, not to mention war in Ukraine.

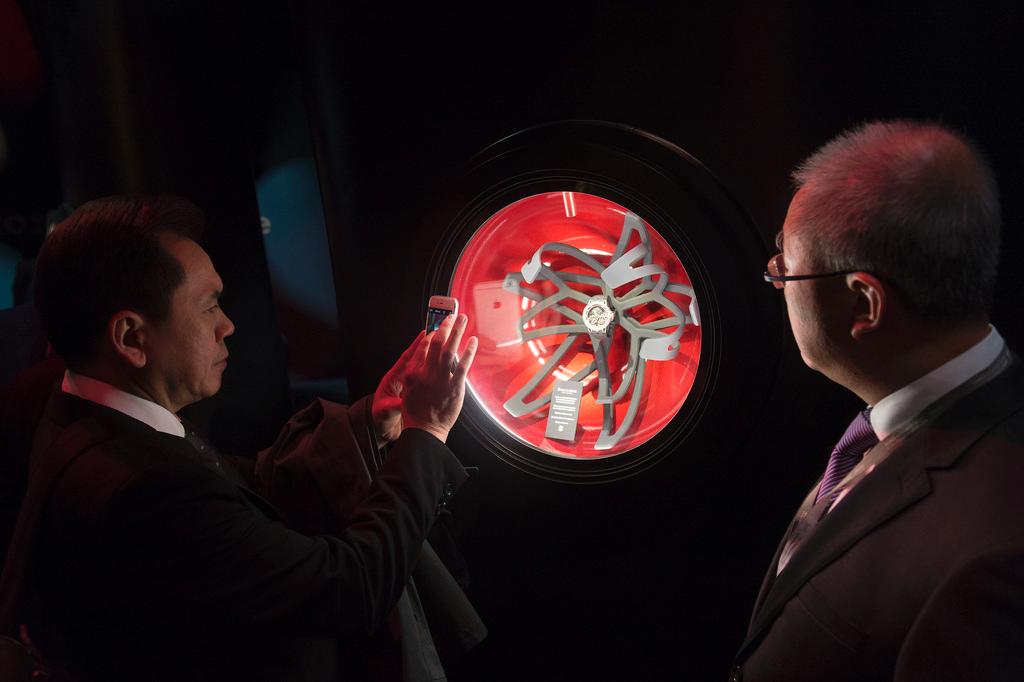

Despite the shock SNB news, Pilo tries to remain upbeat. This week he is organising the first Swiss Independent Watchmaking Pavilion (SIWP)External link, held at the Casino du Lac near Geneva airport, presenting original creations and a “different face” of the watchmaking industry.

Some 15 small independent Swiss brands are exhibiting their luxury wares in two rooms at the casino, next to spinning roulette wheels and clinking slot machines.

The SIWP replaces a similar satellite show, the Geneva Time Exhibition, which closed in 2013 after three editions. After relocating from the city centre, it is now only a five-minute taxi ride from the much larger Richemont-run Salon International de la Haute Horlogerie (SIHH)External link at the Palexpo exhibition hall, whose clients they are also keen to woo.

Full house

Pilo said he was happy with the initial turnout at the SIWP.

“It was full. We had 480 people through the doors for yesterday’s opening cocktail event, mostly Swiss, Chinese, a few Russians and lots of journalists,” he declared. “People know that local producers exist and believe in their value and want to support small watchmakers. We have a great future, but we need to stick together.”

Pilo & Co. sells between 8,000-12,000 watches a year, but apart from a few special orders for private customers, like his series of six hand-painted diamond-encrusted watches each depicting a Tibetan godExternal link and worth CHF150,000 apiece, it focuses mainly on mid-range models where business is ferocious.

“The Swatch Group wants to control the whole market,” he declared.

The last couple of years have seen slower growth in China following the clampdown on corporate gift-giving and civil unrest in Hong Kong, but Pilo remains confident in the world’s biggest watch market.

He proudly shows me a photo of his new shop “Master Craftsmen” in Guangzhou in southern China – a joint franchise venture with five other independent brands.

“With this multi-brand boutique concept we are able to make ends meet,” he said. “But trying to break into new distribution channels under the current market conditions is crazy.”

Upside Down

Sporting a ponytail, heavy glasses and several of his own hand-made watches, Ludovic BallouardExternal link is full of praise for the independent show that allows small brands to tap into potential buyers from the SIHH.

“Union is our strength,” he declared.

The French-Swiss dual national, originally from Brittany, sells around 30 high-end watches a year costing between CHF30,000-75,000, including models like his unique Upside Down watch.

Business is really tough at the moment, however, he declared.

“People are not spending money or are just buying brands from the big groups,” he added. “I can’t seem to sell. If I made watches with tourbillon movements, I wouldn’t manage to get by.”

Ballouard said he regretted the SNB decision, but said it was “unavoidable” and “unsurprising”.

“I’ve been adapting to the new situation for the past five years. It’s not as if it came out of nowhere,” he said.

One immediate consequence for him will probably be an increase in his price tags.

“Many people have criticized me for not being more expensive,” said the watchmaker.

Opposite direction

At the other end of the room, Antoine PreziusoExternal link remains a model of calm amid the current storm.

“I’m confident. Over the past 35 years I’ve been through lots of crises and economic problems but as an independent I haven’t been affected,” declared the owner of the small family-run Geneva watch brand, which specializes in luxury models ranging from CHF8,000-800,000.

“We don’t make watches, we make art. This watch is made from a piece of a meteorite. You have to have your head in the stars in this business,” he says pointing at a watch in a display cabinet. “When the industry goes in one direction I launch myself in the opposite direction and it always works.”

Preziuso said he was generally unaffected by Swiss franc/euro exchange rate problems and built everything at his own workshop so faced few issues with suppliers or retailers.

“It’s 99% made in Geneva. The one per cent is the crocodile strap, which you don’t find in Lake Geneva,” he quipped.

While he admitted to noticing a certain economic slowdown his wealthy customers mainly from Russia, Ukraine, Japan, the Middle East and Geneva continue to flock to his exhibitions, he added.

Huge offer

While more established niche firms are able to find their way through the current jungle, newcomers will find it much harder, watchmakers agree.

The success of watchmaking over the past ten years has resulted in a huge offer which is problematic, said Vincent CalbreseExternal link, one of the founders of the Horological Academy of Independent CreatorsExternal link, who had a stand at the SIWP.

“Today there is a vast offer. Lots of big watch firms now also manufacture their own complications and specialist parts. The importance of craftsmen has been minimised,” he declared.

“Also, people are only buying based on information they get in advertising from the big groups who we can’t compete with. Watch shops take commissions from them and the brands act as mafias banning competitors. On top of this the general public is only interested in what’s fashionable.”

“This whole period of renaissance risks dying. One of the aims of this pavilion is to resist the pressures from the big watch groups,” said Calbrese.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.