Swiss take aim at excessive debt

Switzerland is one of the only countries in Europe that does not offer debt relief to those in severe financial difficulty. Parliament is calling for the law to be changed.

It’s difficult to get out of debt if you owe a lot of money in Switzerland. There are provisions in the law to help, but these don’t really apply if you have little resources. “Many of those affected have very little realistic prospective of living debt-free,” said a recent government reportExternal link into debt relief procedures for private individuals.

A first step was taken on Monday: both the House of Representatives and the Senate supported a parliamentary motionExternal link by the Social Democratic senator, Claude Hêche, aimed at changing the law on debt collection and bankruptcyExternal link to allow the short-term economic integration of those in heavily in debt. It would also foresee the introduction of a mechanism to wipe out debts under certain circumstances.

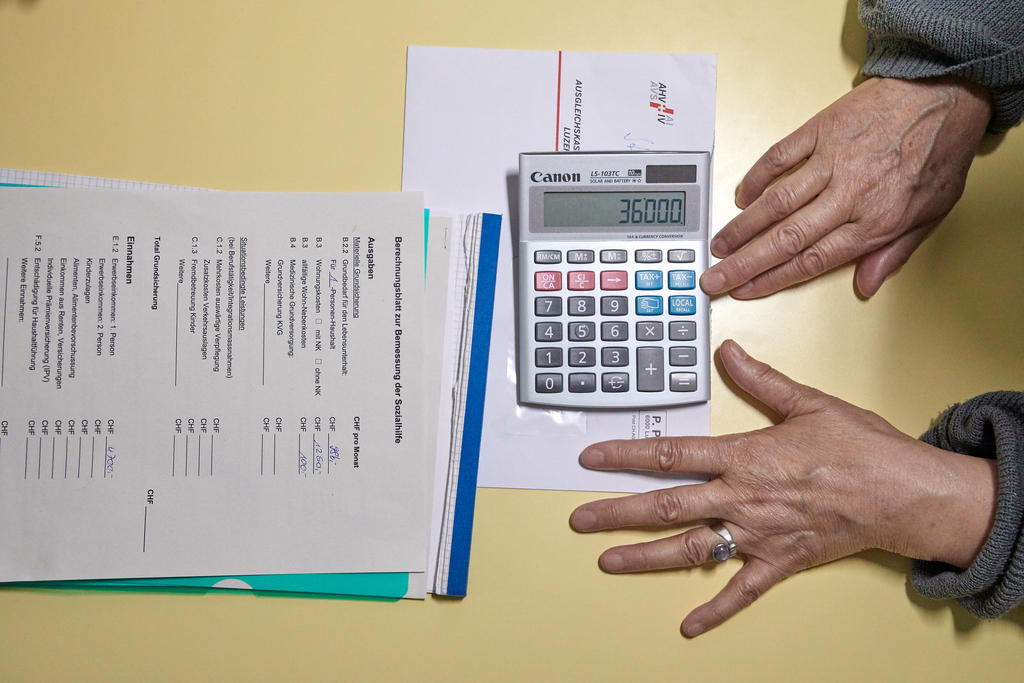

Excessive debt

According to the definition of the the Swiss conference of social action institutions (CSIAS), “over-indebtedness occurs when the share of disposable income after the minimum subsistence level is insufficient to meet financial obligations within a reasonable period of time”.

Swiss exception

Switzerland has no debt relief procedure, which makes it an exception in Europe. The European Commission, the United Nations, the Organisation for Economic Co-operation and Development (OECD) and the World Bank all recommend having this as a way of reducing debt enforcement costs, giving those affected a second chance and encouraging entrepreneurship.

“Switzerland lags behind because parliamentarians have shown little interest in the topic,” said Sebastian Mercier, general secretary of Debt Counselling SwitzerlandExternal link, the umbrella group of debt advisory centres. “Our system creates and increases over-indebtedness,” he said.

There are several avenues if you get into debt: your salary can be seized, you can declare yourself bankrupt, or you can make a repayment agreement with your creditors or the court directly. But these procedures make it difficult for the affected person to get out of debt, as they are often expensive, time-consuming and complicated, experts say. They also do not stop new debts from piling up and extending over a long period of time.

No stats

There are also very few statistics on debt in Switzerland. The most recent data from the Federal Statistical Office come from the 2013 Statistics of Income and Living ConditionsExternal link (SILC) report. It showed that 18.5% of the population live in a household that has at least two types of debt and that 31.8% of the population live in a household that has received at least one loan.

Mercier says Switzerland does not really want to recognise debt as a problem, and this is reflected in the lack of statistics. “The SILC report only gives a vague overview and the debt enforcement offices do not make a difference between individuals and companies,” he pointed out.

The SILC report of 2008 estimated that 570,000 people lived in households with problems paying back overdrafts and arrears. “This number sounds about right,” Mercier said.

There are many reasons for getting heavily into debt, and the process is often complex and long-term. “The most common objective criteria that we come across are joblessness, divorce, illness or your own business failing,” Mercier said. “On top of this are subjective criteria like having problems with organisation and admin.”

In general, an unforeseen event occurs and it’s no longer possible to pay for everything. People end up juggling the bills and paying the most urgent things. “Tax bills come in later, which is why there are more tax debts,” Mercier explained. “The social costs of debt reduction are enormous, especially for society. Getting heavily into debt creates health problems, those affected are often stressed and save money where they can, meaning they eat badly and go without medical treatments.”

The government must now draw up a law change and put it before parliament. It favours two approaches: the obligation of creditors to reach an amicable settlement and being able to cancel debts under certain circumstances.

Mercier says it is a good start but that the real work will start when measures that everyone agrees on have been found. A good, quick to implement option would be to improve current procedures. A parliamentary initiativeExternal link on this, also from Hêche, has been handed in but not yet discussed. As for Mercier, he hopes that the future law changes will improve and not worsen the situation for those who have managed to free themselves of debt.

Translated from French/ds

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.