Regulator flexes muscles to protect investors

The Swiss financial regulator is getting tough to protect the interests of small investors by closing down 66 firms that were selling products illegally.

The news follows an announcement two weeks ago by the Financial Market Supervisory Authority (Finma) that it would crack down on operations giving misleading or false information on the products they sell.

Small retail investors in Switzerland have long endured a rough ride at the hands of the country’s powerful financial sector, according to watchdogs.

Finma has stated that it intends to swing the balance more in favour of individuals who invest savings in financial products. But consumer protection experts believe the agency lacks the necessary legal clout to carry out all of its plans.

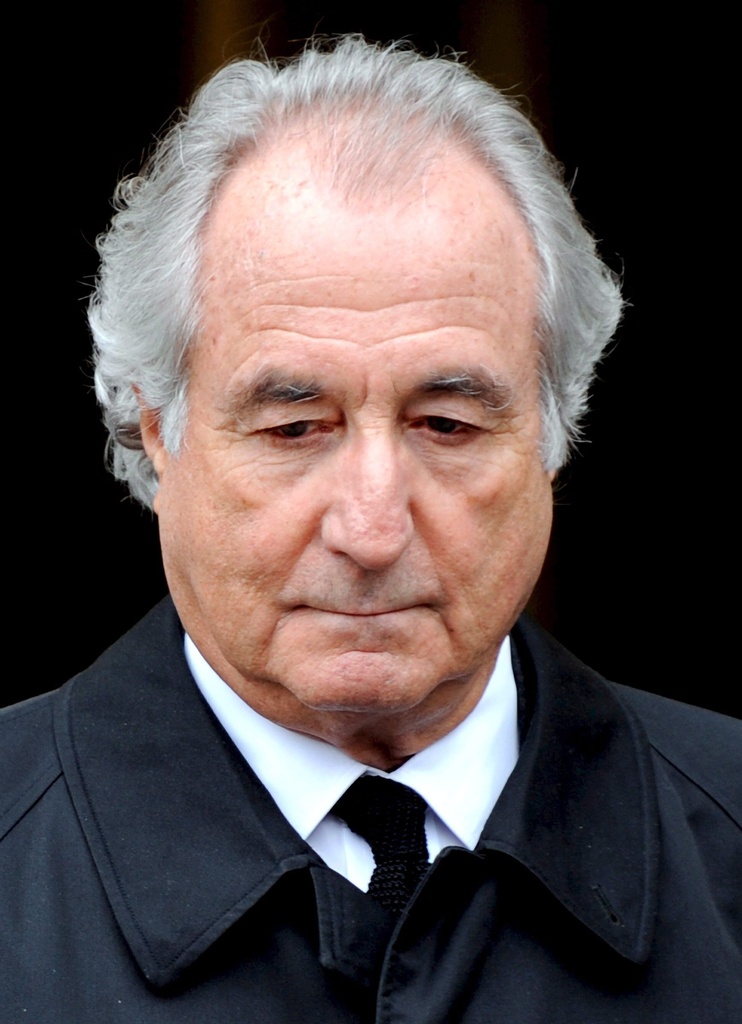

The announcement that Finma has put 66 shady financial intermediaries out of action follows legal cases brought by small investors caught out either by the collapse of the United States investment bank Lehman Brothers or by outright fraud – such as the Madoff Ponzi scheme.

Finma said on Wednesday that the 66 illegal operators had inflicted losses amounting to SFr220 million ($222 million) for some 13,000 unwitting investors. One of the culprits, an enterprise called Infina Group, operated a pyramid scheme similar to the one run by convicted US fraudster Bernard Madoff.

Unscrupulous and brazen

The regulator said many “unscrupulous and brazen financial service providers” were cashing in on a desire by small and often uninformed investors to enhance the value of their investments in the light of poor returns on traditional products such as bonds.

“There is therefore a great temptation for investors to entrust their assets to providers that promise to achieve significantly higher returns,” a Finma statement said. “Providers offering such tempting returns are frequently dubious or unprofessional.”

Finma spokesman Tobias Lux told swissinfo.ch that the financial sharks that have been caught could be just the tip of the iceberg.

“There may very well be many more people out there who are losing their money right now,” he said.

The illegal operators target amateur investors and suck them in with internet advertisements, cold calling, sending out prospectuses by post or even inviting people to seminars on how to invest their money.

The main areas of current fraudulent activity are gold trading, selling shares in start-up companies, investment schemes or clubs, foreign exchange deals and offering insurance on rental deposits.

Clients in the dark

Such operations often use Switzerland as a base to target people outside the country.

“They are using the good reputation of Switzerland to attract foreign clients,” Lux told swissinfo.ch. “They are often set up by foreign nationals who target investors of their own nationality.”

Two weeks ago, Finma launched a consultation exercise with legitimate banks and financial advisors to work out a system of better protecting small investors who are sold complex financial products.

Finma said that firms selling financial products had a duty to properly inform clients about the potential risks after thousands of investors lost millions of francs on Lehman Brothers products.

The regulator proposes forcing firms to use simpler language in prospectuses and to better explain risks. It also wants to set up a body that has the power to randomly test financial firms.

But Sara Stalder of the Swiss Consumer Protection Association was dubious about how many of the regulator’s proposals would be put into force after the consultation period ends on April 15.

“Finma can write a lot, but I do not know how many of these proposals will be watered down in the end,” she told swissinfo.ch. “Finma has the will but lacks the muscle, as the Swiss financial industry is powerful and the laws that back Finma up are not strong enough.”

She added: “Small investors in Switzerland have had a rough ride for quite a while.”

Small investors in Switzerland – like many others around the world – found that their investments were wiped out or severely dented following the financial crisis.

While many of these losses could simply be explained by an abrupt free fall of stock markets, some investors felt they had been duped by false promises or outright fraud.

The majority of these cases related to Madoff’s Ponzi scheme or the collapsed Lehman investment bank. These instances sparked a series of legal cases against institutions that sold the investments.

Although it did not admit liability, Credit Suisse settled with compensation of SFr50 million awarded to some 1,700 clients that had been sold Lehman products by the bank. But some clients that were left out of the deal are still taking legal action to recover losses.

Foreign clients of Swiss banks have also been legally active after suffering losses on investments, particularly in the US.

It was announced on Wednesday that Swiss bank UBS was being sued to the tune of $2 billion by the US trustee who is winding up the Bernard Madoff investment firm. The trustee claims that UBS made around $80 million helping to spread the Madoff pyramid scheme around Europe.

While Madoff is serving a 150-year jail sentence in the US, many investors are still fighting to get some of their investment back.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.