Regulator moves to protect small investors

In 2006, Gabriela Fischer invested SFr50,000 ($55,000) in a “100 per cent capital protected” financial product, only to see it vanish into thin air two years later.

Despite having misgivings about the sale of such complex products to small retail investors, the Swiss financial regulator found itself powerless to intervene. Now, the body wants to close loopholes with new laws.

The Swiss Financial Market Supervisory Body (Finma) proposed new laws on Friday aimed at protecting small investors while driving out rogue investment schemes that blacken Switzerland’s reputation with sharp practices.

Finma wants the Swiss financial sector to catch up with international regulations by forcing institutions to apply for a permit before being allowed to sell products.

At present, there are an estimated 2,000 unregulated wealth advisors operating in Switzerland. Two years ago Finma closed down 66 of the shadier operations that had been conning investors out of their money.

Bust bank

The regulator also proposed a uniform system of training for salespeople and strict rules on how products are marketed – with clients made aware of all the risks.

If adopted by parliament, Finma wants these proposals to form a new set of laws governing the entire financial market, as opposed to the current patchwork rules that cover separate segments.

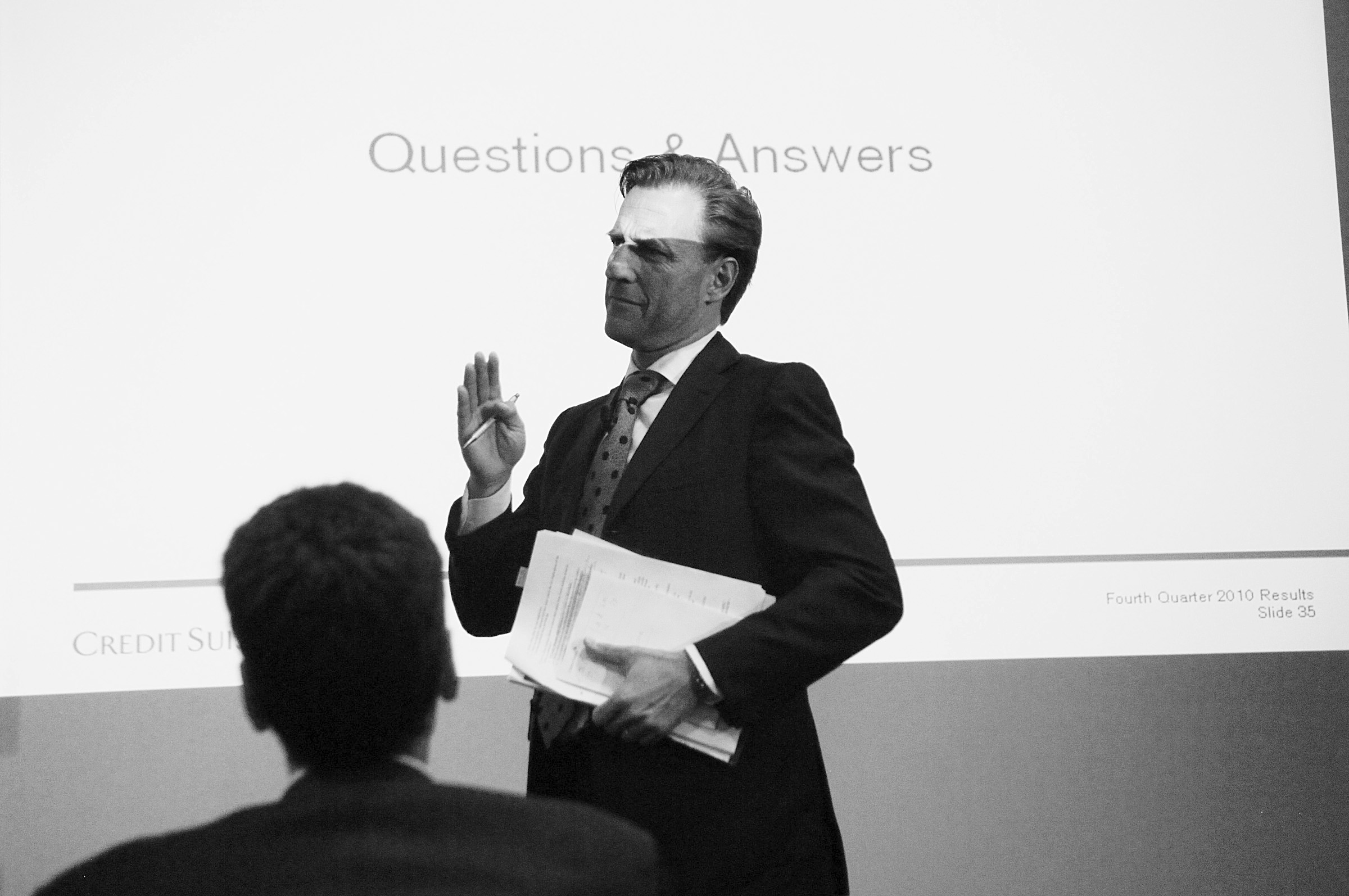

“By themselves these laws could not prevent past problems, but they fill a very important gap by applying new rules of sales conduct, particularly when selling savings products to retail investors,” Finma director Patrick Raaflaub told swissinfo.ch.

But the new laws will still take some years to come into force and would in any case come too late for Gabriela Fischer and hundreds of other small investors.

Fischer eventually recovered SFr35,000 of her investment after a long legal battle, but she still feels she was hoodwinked by Credit Suisse into buying a Lehman Brothers product that evaporated when the United States bank went bust.

Lost faith

“I was left extremely upset and disappointed by the whole process,” she told swissinfo.ch. “It appears that all people are equal in Switzerland, but that the powerful banks are more equal than the ordinary citizen.”

“The SFr15,000 I lost had been invested for my retirement or to fund my daughter’s [now aged 10] education,” the 49-year-old added. “I can only work part time and spend all my earnings on getting by, so there is no opportunity for me to earn more money or spend less to make up the losses.”

Fischer and others also feel cheated by the system despite many investors getting some of their investment reimbursed by Credit Suisse as part of a SFr150 million goodwill payment in 2009.

Some investors still feel let down, not just by the banks but also by Finma, the banking ombudsman and the legal system.

“It is all very well that Finma wants to tighten up the laws, but it cannot plan for the future before it solves the problems of the past,” Fischer told swissinfo.ch. “I will have no trust in the system until people have been held to account for their failings.”

Information is power

Patrick Raaflaub of Finma said the regulator simply lacked the power to deal with the fallout of the Lehman related losses.

“When the Lehman event happened we assumed that we would find sufficient legal basis in supervisory law to deal with cases of miss-sold products,” he told swissinfo.ch. “We clearly found that we did not have enough of a legal basis.”

Part of the problem, Raaflaub explained, lay with the inability of the supervisory body to encroach on the territory of the civil legal system. And where Finma had clear jurisdiction, such as the marketing and selling of products to clients, the rules lacked enough clarity to make clear judgments.

Finma’s proposed laws would go some way to clearing up the confusion, according to Stephan Pöhner, a lawyer at Zurich-based firm Fischer and Partner that represented some 500 clients in the Lehman Brothers case. But Finma’s proposals would still not go far enough, he argued.

“The proposed changes only deal with the point of sale of products, but not what happens after clients have invested their money,” he told swissinfo.ch.

“In the case of Lehman Brothers, most investors would not have suffered any losses had the banks that sold the products passed on their knowledge that Lehman was in trouble.”

Arbitrator with teeth

Pöhner also called on the Swiss legal system to adapt in order to accept mass class action suits and for sellers of financial products to be made to electronically record advice they give to clients.

Fischer and Partner is currently discussing a new arbitration system with major Swiss banks that could deal with disputes more effectively than the banking ombudsman – which lacks the power to force its verdicts on banks.

The proposed MedArb (short for mediation and arbitration) system would give the new body powers to make binding decisions on disputes. Banks are currently engaged in constructive dialogue about such a scheme, according to Pöhner.

The Swiss banking ombudsman was stretched to its limit following the financial crisis that exploded after the collapse of Lehman Brothers in September 2008.

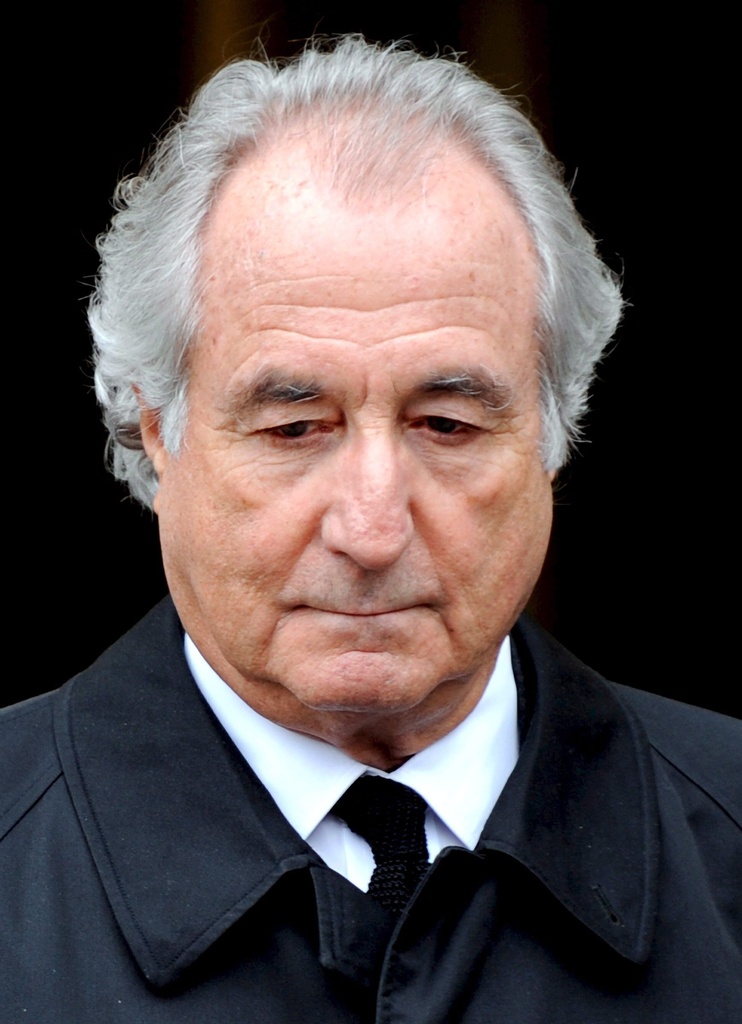

The arbitration body was inundated with a record 4,757 complaints in 2009 (up 14% on the previous year), mainly related to Lehman products, the Madoff ponzi scheme and the collapsed Icelandic Kaupthing Bank.

But banks responded by pulling up the drawbridge, accepting a mere 73% of the ombudsman’s rulings in 2009 compared to up to 95% in previous years.

The ombudsman’s lack of firepower led to a comprehensive review of the body, undertaken by former Swiss Bankers Association chief executive Urs Roth.

His recommendations, published earlier this month, fell short of giving the ombudsman powers to force binding decisions on the banks.

Instead, he limited his thoughts to tightening up statutory rules on the body’s governance and exploring ways of accommodating collective disputes.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.