Ski resorts pay high price to survive

Large Swiss ski resorts are gradually pricing themselves out of their home market in a bid to remain competitive in an increasingly global industry.

But it is an uphill struggle for most ski areas to find the funds that will help secure their future by investing in amenities and infrastructure, such as luxury hotels and snowmaking.

“If you target the wealthy, you will have stable and higher revenues in the long-run,” said tourism expert Thomas Bieger, explaining the dilemma facing many resorts.

Bieger, head of the Institute for Public Services and Tourism at St Gallen University, was speaking at a recent ski industry symposium in Zermatt, one of the best-known Swiss destinations.

He believes only around 20 of today’s 164 medium-to-large ski resorts in Switzerland can be competitive internationally.

And the large investments being made by these top 20 are reflected in the price.

A family of four must pay more than SFr200 ($183) just for a day of skiing in Zermatt, not including food or transport to the resort. It really adds up if accommodation is factored into the costs.

Bieger told swissinfo that property in alpine resorts was affordable 30 years ago, enabling many middle class Swiss to have a weekend home in the mountains. But today, holiday chalets and apartments are unaffordable.

The problem is not limited to Switzerland either.

High price

“The price of real estate is getting bid up so high that this component of the ski vacation is getting quite expensive,” Rusty Gregory, CEO of California’s Mammoth Mountain ski area, told swissinfo.

With land in resorts in short supply, Gregory said the increase in demand meant higher property prices – leading to a situation where only the wealthy could afford to spend their vacation on or near the slopes.

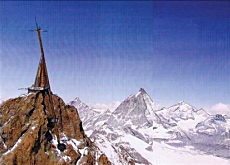

Zermatt’s international reputation, due to its trademark mountain, the Matterhorn, means it generates enough revenue to invest in its future, and can afford to focus its attentions on wealthy holidaymakers.

The Swiss still account for about one-third of all nights spent in Zermatt’s hotels or apartments, but tourist director Daniel Luggen says the number of Swiss visitors has decreased over the past five years.

“One of the reasons is that Zermatt has increased capacity [to meet foreign demand],” Luggen told swissinfo.

Survival strategy

Medium-sized ski areas have less reason for optimism. The Swiss market is stagnating and owing to thin profit margins they do not have the means to cast their net wide enough to draw holidaymakers from abroad.

A recent study found that one in three Swiss ski lift companies could not afford to upgrade its snowmaking infrastructure – considered a vital survival strategy nowadays.

This puts them on thin ice with banks and outside investors. It has become a Catch-22 situation since the very thing the ski areas have to combat – global warming – is scaring off moneylenders and investment capital.

On top of that, investors are only interested in “integrated” models where the infrastructure – from the lifts and sport shops to the hotels and restaurants – are under single management. But there is no one company running everything in the typical Swiss resort.

“Investors need to be able to make money from income streams that aren’t completely snow-related,” Gregory explained. “It’s very important to consolidate these income streams before [they] can bring capital in to improve the lifts and other aspects of the resort.”

Egyptian financing

Large sums are being pumped into Andermatt, a village in the central Swiss Alps with a medium-sized ski area. Egyptian businessman Samih Sawiris decided to invest in Andermatt since its tourism infrastructure was so underdeveloped – it has only a few small budget hotels – that he is being allowed to call the shots.

Sawiris’ company, Orascom Hotels and Development, purchased a large chunk of land on the village periphery and is building a self-contained resort with 800 guest rooms. There is a good chance the project will propel Andermatt into skiing’s big leagues where it will join Zermatt.

“Other resorts are only active in small markets and so it will be much more difficult for them to attract capital or foreign investors,” Luggen said. “I’m convinced that some of these resorts will have to close in future.”

swissinfo, Dale Bechtel in Zermatt

There are 164 medium and large ski areas in Switzerland. But in total, the country has 650 mountain transport and ski lift companies. They provide access to 12,000km of ski slopes.

With 11,000 employees, the companies are a key economic factor in mountain regions.

They have a combined annual turnover of approximately SFr840 million ($769 million).

The ski lift company of Zermatt has begun work on the expansion of its facilities on the 3,883 metre-high mountain, Kleine Matterhorn.

A gondola currently takes skiers to the summit of the Matterhorn’s little sister peak, but the plans include the construction of a new cable car to provide easier access for tourists coming from the Italian side of the ski area.

The new lift, according to the ski lift company, is important to satisfy the needs of tour operators wishing to offer the mountain excursion to tour groups landing at Milan’s Malpensa airport – about two hours to the south.

Zermatt also says it wants to build a hotel on the summit as well as an observation tower, which will extend the peak to 4,000m.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.