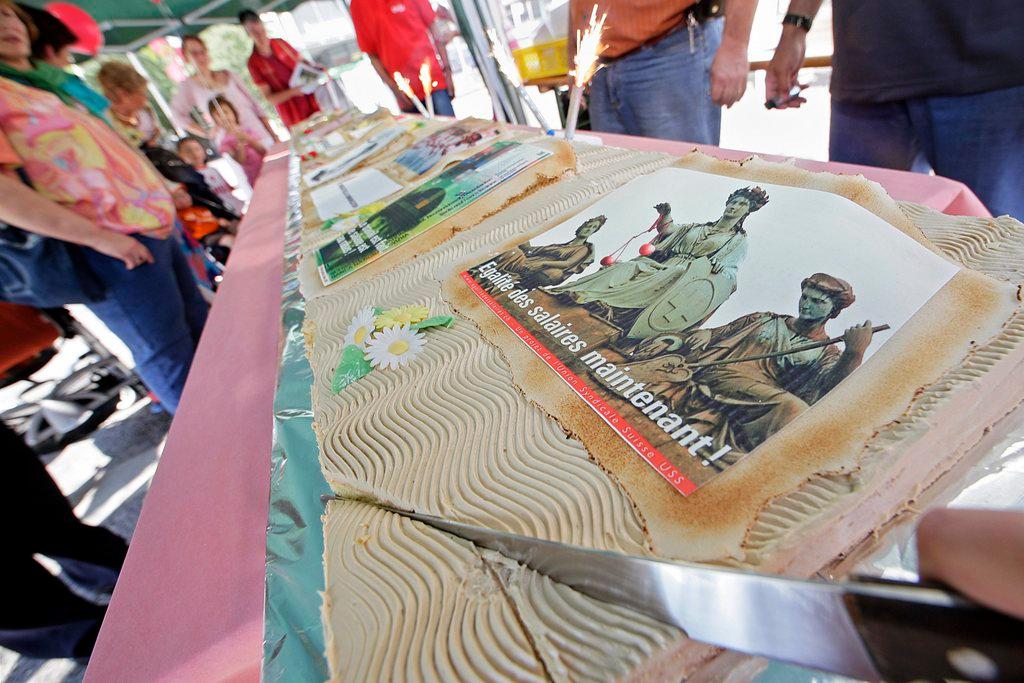

‘Antisocial’ tax policies blamed for growing wage gap

Lower earners have hardly any more spending money than 14 years ago – the opposite of high earners, according to the Swiss Trade Union Federation. It complains that while poor people are struggling to pay health insurance premiums, rich people have been enjoying tax cuts.

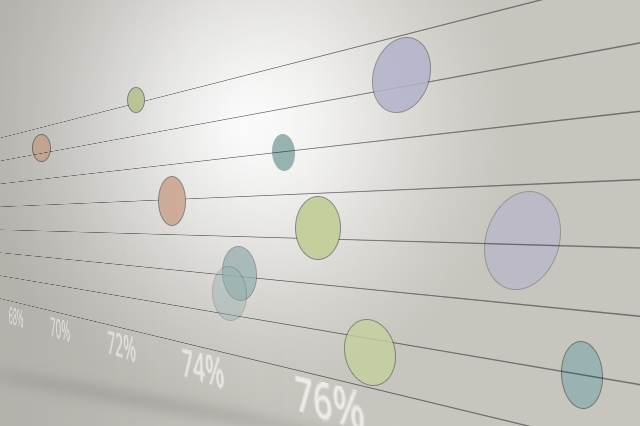

In its latest report on wealth distributionExternal link, published on Wednesday, the federation highlighted a growing income gap.

“The hope that, following the financial crisis, the wage excesses of top earners would be corrected has been shattered,” said the federation’s economist Daniel Lampart. “Although low and medium wages have increased, higher taxes have almost completely eroded the rise in wages.”

He calculated that, after paying rent and health insurance premiums, a married couple with two children in the lowest income bracket would have CHF40 ($40.50) more a month today than 14 years ago. Single people would even have CHF40 less.

Middle-income families would have CHF320 more, whereas families in the top 10% of earners would have almost CHF3,000 more in their pockets at the end of the month.

Poor hit hardest

The cause of this, according to the Trade Union Federation, was “antisocial tax policies”, with the main problem being health insurance premiums.

“Since the introduction of obligatory health insurance [in 1996], premiums have almost doubled,” Lampart said. “Premium reductions, which on average have increased by 35%, haven’t kept pace.”

In recent years, he said they had even gone down as a result of cantonal cost-saving measures. These would have hit low and middle incomes especially hard.

According to Lampart’s calculations, in 2000 around 6% of the income of a low-income family of four would have gone towards health premiums. Today it is 11%. For those with two children who are studying, it is 14%.

The federation’s president, Paul Rechsteiner, said the declared goal of the 1996 health insurance law – to limit the amount spent on health premiums to 8% of taxable income – was “receding into the distance for more and more households”.

He called on the government and cantons to top up the premium reductions with some CHF2 billion a year so that no more than 10% of net income must be paid towards health premiums. This, he believed, was realistically possible.

The Trade Union Federation also criticised tax cuts. It said the top 10% of earners were the only group that today paid less towards the state and social security than in 2000.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.