Swiss “must act now” on banking secrecy

Supporters of the end of banking secrecy say Switzerland needs to accept it as the way forward and see the benefits of pulling the plug sooner rather than later.

The Swiss government has vowed to maintain its position against the automatic exchange of bank information between countries in suspected tax fraud cases.

Such an exchange would signal the end of Swiss banking secrecy, which has been demanded by the European Union, among others, and international tax lawyer Philippe Kenel says there is no way around it for Switzerland.

The automatic exchange of information is considered essential by Brussels and it will not give up its fight to make it compulsory, Kenel told the Tribune de Gèneve newspaper.

“We are not going to dupe the EU. It is necessary to immediately begin Switzerland’s move towards the automatic exchange of information by negotiating a long transition period and to obtain the maximum [benefits] in return,” said Kenel, who also heads the Swiss Chamber of Commerce in Belgium and Luxembourg.

Waiting any longer would cause customer confidence in banking secrecy to further erode.

“Switzerland’s only chance is to negotiate the end of banking secrecy while it is still worth something,” he noted. “Judging by the erosion of banking secrecy, [to wait] while we have our backs against the wall, would be like waiting to be shot down. At that point we would receive nothing in return.”

Level playing field

Pro-transparency non-governmental organisation Tax Justice Network argues that Switzerland stands to benefit from putting such a system in place.

Spokesman Markus Meinzer believes it is a question of months, not years before it becomes law.

“A lot of Switzerland is warming to this system. Really because several of the crassest, thinnest arguments against it are being proven to be nonsense,” he told swissinfo.ch.

Meinzer says people’s privacy will only be infringed to a certain extent. “Already with the [current system of] exchanging information on demand, information can only be transferred to public authorities that are involved in tax administration and tax justice. A citizen cannot obtain the data.”

He notes that Switzerland has rightly resisted one-sided criticism of banking secrecy, after having been singled out for attacks while secret trusts and companies still exist, for example in United States or British tax havens.

By introducing automatic exchange Switzerland could make a worthy contribution to creating greater equality in global tax competition, he says.

“Only then can Switzerland contribute to a level competitive playing field, and legitimately raise this issue [of tax havens] in international negotiations. This is necessary because the problem of trusts and secret companies has not been resolved internationally,” he notes.

More

Banking secrecy

Transparency trend

According to Kenel, any system of automatic information exchange would take years to implement, foreseeably by 2018, which would give Swiss banks and their customers time to get used to the new situation.

In the meantime, he says, the government could introduce a temporary solution of a flat withholding rate, as suggested by Swiss banks in December, which aims to ensure foreign-domiciled clients comply with the income tax laws of their relevant tax domicile.

The so-called Rubik plan would involve a flat rate tax on interest accrued by the assets – a deal which would interest countries keen on recouping tax earnings – but which still protects client anonymity.

A government strategy paper published in December looks to a final withholding tax as the way forward and says that in the interest of bilateral cooperation the cabinet would examine measures to ensure a “more thorough taxation of capital assets and their earnings”.

Both would be a step further than Switzerland’s current EU withholding tax option. Nevertheless, the principle of withholding tax was dismissed by the EU’s ambassador to Bern last month as an outdated concept that aims to preserve anonymity instead of transparency.

“I do not think that foreign countries will accept such [a move],” added Meinzer.

“Countries would no longer able to apply their own tax rates. The trend is clearly towards transparency and information exchange, which a withholding tax attempts to override.”

Jessica Dacey, swissinfo.ch (With input from Renat Künzi)

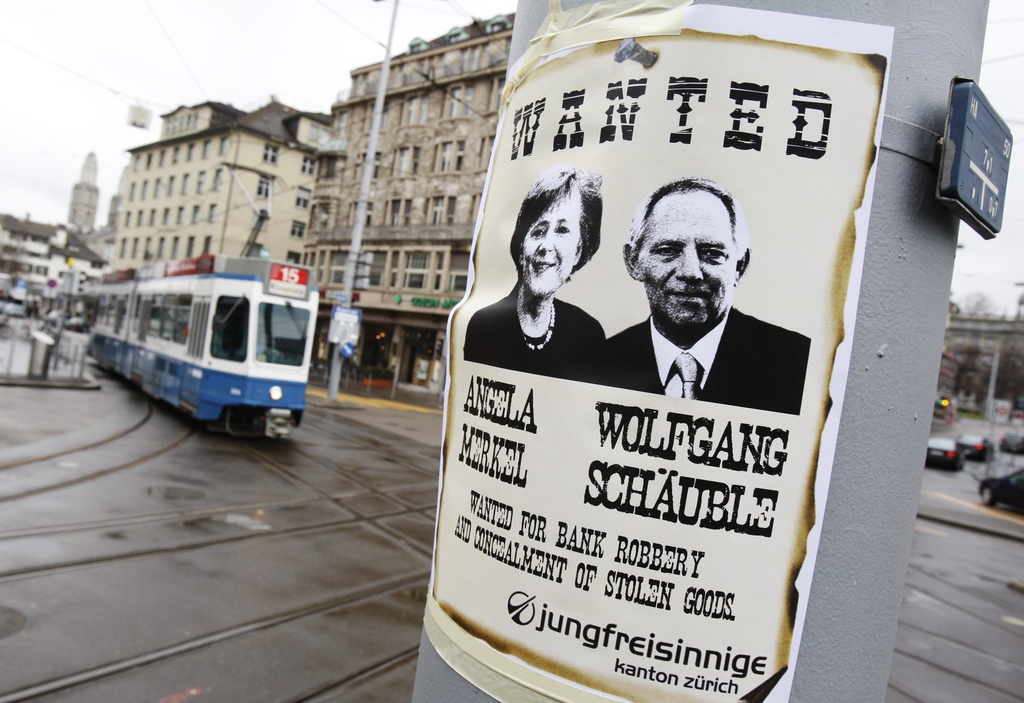

Banking secrecy was enshrined in Swiss law in 1934. For the past year Switzerland has been under continuous attack for helping foreign tax evaders hide their assets.

The OECD placed Switzerland on a “grey list” of uncooperative tax havens in April 2009. The Swiss were removed in September after renegotiating more than 12 double taxation treaties, but they have refused to automatically transfer information to tax investigators without proof of crimes.

Several countries, including Italy, France, Britain and the US, launched tax amnesties last year in an effort to repatriate assets from tax cheats. These are forecast to damage the Swiss offshore banking industry.

Switzerland was particularly annoyed at the aggressive Italian amnesty that saw surveillance and tailing of cross border suspects entering Switzerland. The Swiss suspended talks on the new double taxation treaty in protest.

The most damaging tax evasion case involved the activities of UBS bank in the US. A year ago, UBS was fined $780 million after admitting helping US citizens dodge taxes. It also handed over data of 285 account holders.

In September, the Swiss government agreed to transfer the details of 4,450 UBS clients to the US – in effect violating Swiss banking secrecy to prevent a ruinous court case for UBS.

Also last year a former employee of the HSBC private bank in Geneva ran away with client data that he handed over to the French authorities.

In January 2010 an informant offered to sell the authorities in the German state of North Rhine-Westphalia the data of about 1,500 possible tax evaders with bank accounts in Switzerland. Similar data has since been offered to more German states, triggering heated debate in both countries.

In February the OECD further increased pressure on Switzerland by saying it would soon regard tax evasion as a precursor to money laundering and would be prosecuted.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.