Swiss banks reject links between investment and apartheid

Switzerland's two biggest banks say claims that their investments in South Africa helped prop up apartheid are completely unjustified.

Credit Suisse and UBS are among 20 companies being sued for their dealings with the country’s former apartheid regime.

United States lawyer Michael Hausfeld filed the lawsuit in New York on Monday on behalf of thousands of victims of apartheid.

As well as Credit Suisse and UBS, firms such as the oil companies Exxon and Shell, and carmakers Ford and General Motors are named in the lawsuit.

Hausfeld is seeking compensation from the firms, which are accused of propping up South Africa’s former regime.

The class-action suit alleges that the firms bear direct responsibility for some of the personal injury caused during the apartheid era because of their dealings with the South African government of the time.

More Swiss companies are expected soon to be added to the list of defendants in a class-action suit brought by another US lawyer, Ed Fagan.

A spokesman for Fagan said on Wednesday that the technology group and former arms manufacturer Unaxis, the cement company Holcim, and the specialty chemicals groups EMS would soon be named in a suit seeking damages on behalf of apartheid victims.

Denial

UBS’s chief executive, Peter Wuffli, said the bank’s activities during the Apartheid regime had not violated human rights, and UBS would defend itself.

UBS spokeswoman, Monika Dunant, told swissinfo that the bank regarded “the apartheid regime as a huge injustice.

“But we don’t see any connection between the activities of the banks and the suffering of South African citizens under apartheid.

“International investors in a country cannot be held responsible for the activities of the government there.”

Andreas Hildenbrand, spokesman for the Credit Suisse Group, said the lawsuit was completely unjustified.

“There is no basis in fact or law for this or any other lawsuit,” Hildenbrand told swissinfo. “Attaching responsibility to the Credit Suisse Group for the injustices of the apartheid regime is unsubstantiated by the facts.”

Defied sanctions

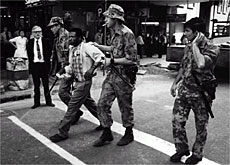

US lawyer Michael Hausfeld is representing Jubilee 2000, a coalition of South African church groups and unions, which is seeking compensation for those who suffered under apartheid including parents of children killed in the Soweto uprising.

The lawsuit claims that the companies defied United Nations sanctions imposed in 1985 by continuing to lend money to South Africa.

However the Swiss banks say their investment activities were in line with Swiss government policy of the time.

“Credit Suisse operated at all times according to all applicable laws, and according to the Swiss government regulations for doing business with South Africa,” said Hildenbrand.

“Credit Suisse did not violate or circumvent any applicable international sanctions.”

Big investors

But non-governmental organisations such as the Swiss Campaign for Apartheid Caused Debt Cancellation and Reparations claim the two Swiss banks were among the biggest investors in Apartheid South Africa.

“If any banks have to make reparation then Credit Suisse and UBS will be among them,” said Mascha Madörin, spokeswoman for the organisation.

“These two banks, together with German banks, played a very important role in South Africa, even after the sanctions were introduced in 1985 and other banks had moved out,” she added.

Hausfeld and Fagan are best known in Switzerland for their actions in the Holocaust dormant accounts affair.

In 1998, after years of international criticism, the Swiss banks agreed an out-of-court settlement worth $1.25 billion, in the face of an impending class-action suit brought by Holocaust survivors and relatives of victims.

Holocaust reparation

However, UBS and Credit Suisse insist the Holocaust case should not be seen as a precedent for the apartheid lawsuit.

“At this stage, with the complaints filed so far, we see no reason to enter into a settlement negotiation,” said Dunant. “This is really a very hypothetical question.”

Credit Suisse’s Hildenbrand went even further. “There is no connection at all between these two cases,” he insisted.

Asked if he would rule out a settlement, Hildenbrand replied “yes”. However Jubilee 2000 believes its case for compensation is strong.

“The corporations [investing in South Africa] aided and abetted a crime against humanity whose persistent social damage requires urgent repair,” said the organisation, in a statement to mark the filing of the lawsuit.

swissinfo

Swiss banks UBS and Credit Suisse are among 20 companies targeted by a new class-action suit on behalf of victims of apartheid.

The lawsuit – seeking compensation for more than 30,000 victims – was filed in New York on Monday by US lawyer Michael Hausfeld. Hausfeld represents the South African coalition Jubilee 2000.

The banks claim any connection between the injustices of apartheid and their investment policy in South Africa during the apartheid regime is completely unjustified.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.