Swiss postal bank turns up digital dazzle to arrest declining fortunes

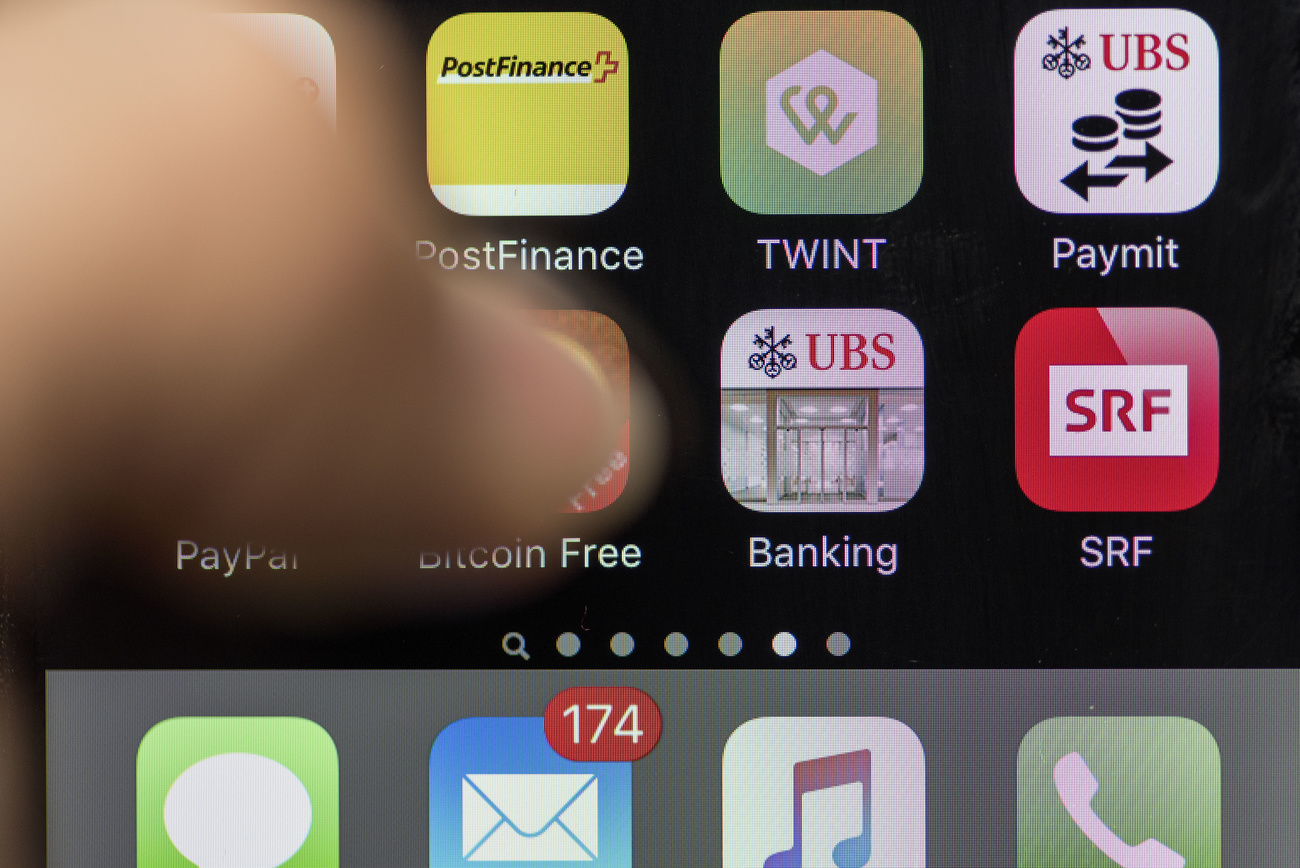

The financial arm of the Swiss post office is offering clients access to cryptocurrencies and the chance to buy fractions of company shares. PostFinance has teamed up with online trading platform Swissquote to launch a digital app named Yuh.

PostFinance announced the collaboration in November, promising a “radically new” digital banking strategy. The project comes at a time of declining numbers of banking customers and difficult trading conditions.

In 2020 the number of PostFinance banking clients fell to 2.69 million from 2.74 million the previous year. The company saw operating profit nearly halve to CHF131 million ($145 million) from CHF246 million. At the same time, operating expenses increased by CHF18 million.

Part of the blame for declining performance was laid at the door of negative interest rates and the coronavirus pandemic, which stopped clients from travelling and making payments abroad. As it is majority owned by the state, PostFinance is also banned from offering mortgage or business loans in competition with privately held Swiss banks.

CEO Hansruedi Köng has lamented this lack of potential revenue streamsExternal link and has responded with a “Speedup” strategy to bring the conservative banking unit into the modern digital era.

Transition

The Swiss banking scene is undergoing a transition with the arrival of new home-grown challengers like Neon, Alpian and Yapeal, foreign competitors like Revolut and the launch of new digital services from traditional banks. At the same time, there is a growing trend towards fewer brick-and-mortar bank branches.

Switzerland is perceived to have been slower than countries like Britain or Germany to adopt the latest digital financial advances at scale, but the list of new entrants jostling to grab market share in the Alpine state is now growing.

The Yuh (pronounced “yoo”) financial app is the latest entrant, offering payments, savings and trading options. On the trading side, it will allow clients to buy fractions of shares – for example half a Roche share. Recent Swiss banking arrival Flowbank said last year that it would also offer this.

Yuh has also launched a digital rewards token called Swissqoin, backed by Swiss francs, that runs on the Ethereum blockchain. Clients can earn the crypto tokens by performing trades, using the Yuh Mastercard or referring new clients. The hope is that the tokens will gain in value in line with Yuh revenues, allowing holders to cash them in for francs at a later date.

Booming scene

The merger of cryptocurrencies and blockchain technology into the traditional financial world is also speeding up in “Crypto Valley” Switzerland and other parts of the world. The first two Swiss “crypto banks”, SEBA and Sygnum, were granted licences in 2019 and Switzerland is rolling out a series of legal amendments to incorporate blockchain finance this year.

Swissquote has recently reaped the rewards of the booming cryptocurrency scene. By the end of February this year, it held CHF1.8 billion worth of clients’ cryptocurrencies in custody – up from CHF1 billion at the end of 2020. The bank forecasts revenues from the cryptocurrency trading business to double this year to CHF32 million.

There is also evidence that clients are pushing other banks and financial companies into this market. The Swiss stock exchange recently announced it would incorporate cryptocurrencies and decentralised blockchain finance into its new SDX digital assets trading platform.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

Join the conversation!