Swiss to relax banking laws

Cabinet has decided to relax Swiss banking secrecy laws to fall into line with regulations set by the Organisation for Economic Cooperation and Development.

The decision will permit the exchange of customer information with other countries in individual cases where a specific and justified request has been made, a government statement said on Friday.

“The cabinet acknowledges that the wish of the people of Switzerland for appropriate protection of personal privacy is still firmly entrenched,” it said.

“For this reason, it fully endorses banking secrecy and resolutely rejects any form of automatic exchange of information. The privacy of customers will continue to be protected from unauthorised access to information concerning private assets.”

Switzerland had previously refused to commit to the OECD standards – set in 2000 for countries working together against tax evasion – for fear of compromising banking secrecy rules.

Finance Minister Hans-Rudolf Merz said the change would “increase the acceptance of the [Swiss] financial centre and give customers greater confidence” and safeguard jobs.

He stressed that Switzerland would maintain banking confidentiality for clients unless foreign governments produce concrete evidence of tax evasion.

Earlier on Friday Austria’s Finance Minister Josef Pröll said his country’s banks would begin to share more information on a case by case basis if there was “justified suspicion” of tax fraud.

Luxembourg Finance Minister Luc Frieden followed with an announcement that it was prepared to exchange bank data with other countries in cases of “explicit proof” of fraud.

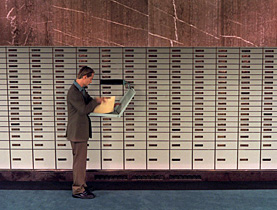

Banking secrecy is a fundamental pillar of the Swiss financial centre and has helped it corner nearly a third of the world’s private banking business. But it also stands accused of helping wealthy foreigners dodge taxes in their own countries.

The government was expected to make some concessions and had enlisted a task force of legal experts, bankers, economists and people with diplomatic expertise to offer recommendations for the future.

“Uncooperative”

Merz said previously the government was willing to improve international cooperation to combat tax offences.

He said Switzerland could be affected by Liechtenstein’s decision on Thursday to conform to the standards set by the OECD in reporting tax offences. Andorra also announced on Thursday that it was now willing to conform to OECD requirements.

A French newspaper reported earlier in the week that the OECD had submitted a list of “uncooperative” countries, including Switzerland, to the G20 group of the world’s strongest economies.

The countries concerned – which also include Liechtenstein, Austria, Andorra, Monaco and Luxembourg – could then be placed on an official blacklist. If this happens, companies doing business with them could be subject to additional withholding taxes and stifling auditing and reporting requirements.

A G20 summit meeting is scheduled for April 2, where ministers are expected to discuss how to force alleged tax havens into being more transparent with sharing client data.

The Swiss finance ministry said an expert group had been set up last Friday to look for solutions to the dispute over bank secrecy.

A spokesman said that reports of Switzerland’s possible inclusion on a blacklist showed that the country did not have much time to find concrete proposals.

swissinfo

Banking secrecy is far from being a simply Swiss phenomenon. The European Commission is also targeting Belgium, Luxembourg and Austria. The Organisation for Economic Cooperation and Development also considers that Andorra and Monaco are non-cooperative tax havens, whereas Liechtenstein has cooperated with the EU since last year.

Banking secrecy is limited in Britain and the US but the two countries do have territories where it is less restrictive. Singapore has drafted plans in the general direction of the OECD. But when it comes to Hong Kong, China is deaf to EU demands for more transparency.

People wishing to dodge paying taxes on their assets can do so by three means: avoidance, evasion and fraud.

Avoidance is the legitimate means of structuring finances so they don’t fall under the scope of taxable assets. This can be done, for example, by setting up a trust fund or by changing country residence or nationality.

Evasion is the deliberate concealing the true state of assets from the tax authorities – in other words, lying about the extent of your assets. This is a civil offence in Switzerland and some other countries, such as Austria and Liechtenstein, but criminal in most states.

The main distinction between evasion and fraud is that the perpetrator tells lies on official documentation. Unless tax fraud can be proved, Swiss banks are not obliged to hand over details of client assets to investigators. In some cases this information is needed before fraud can be established in the first place.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.