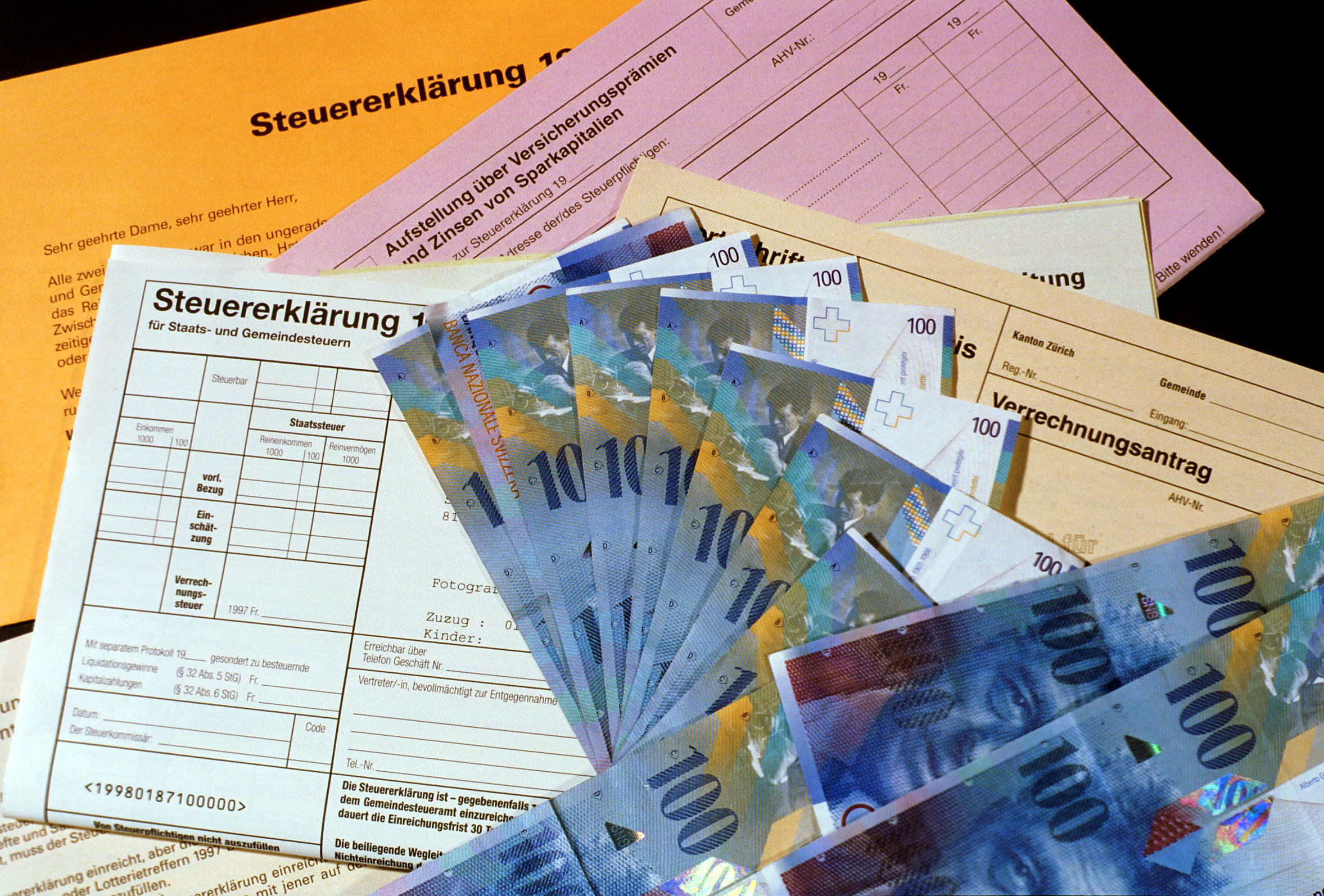

Billions surface from fledgling programme

Tax authorities say a new programme has brought in CHF24.7 billion ($25.9 billion) owed to local, cantonal and federal coffers, exceeding expectations.

The money came to light on Thursday in surveys that the Swiss Federal Tax Administration (FTA) provided to parliament.

Since 2010, a Swiss law has offered tax evaders the one-time possibility of revealing undeclared assets without having to pay penalties.

But those who take advantage of the offer do have to pay all the back taxes and interest.

Data exchange

The amount of money uncovered so far by the amnesty programme comes from 22,000 voluntary disclosures as of the spring of 2016, FTA said, but some details are being withheld to maintain confidentiality.

The information was provided to a parliamentary finance committee.

Until two years ago, only CHF8.6 billion had been uncovered from 5,100 voluntary disclosures.

But as Switzerland’s new tax accords bring it closer to automatic exchanges with foreign authorities, the pace of non-punishable voluntary disclosures has picked up.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.