Navigating health insurance plans as a Swiss abroad

What type of health care coverage should you take out when moving to a new country? In this installment of our series, we offer a few tips for those contemplating an extended or indefinite stay outside Switzerland.

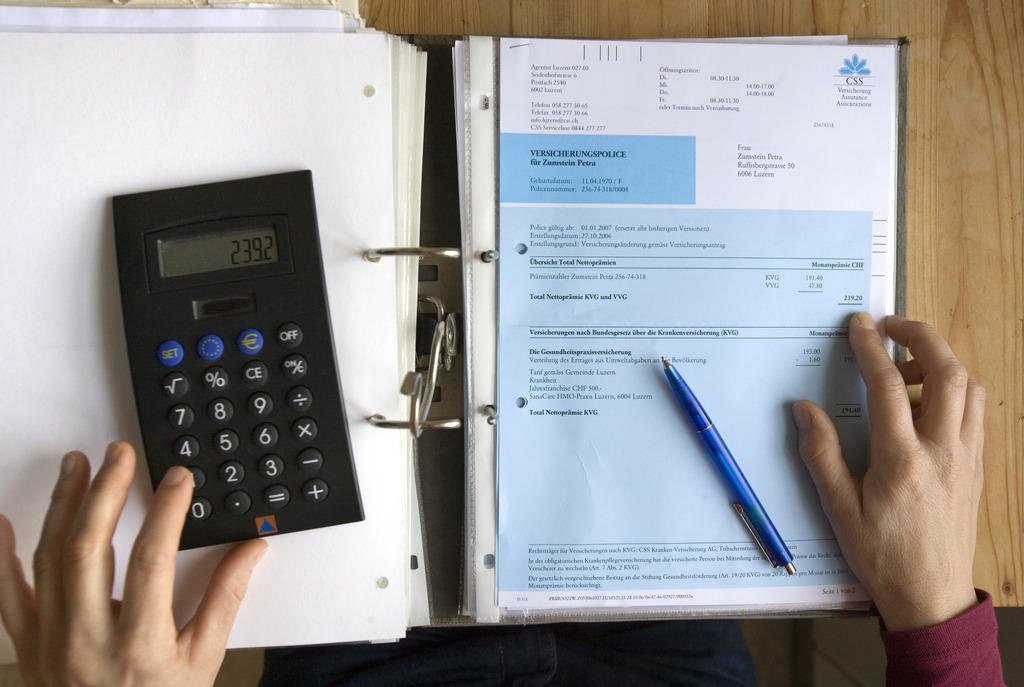

People who move their permanent residence to another country are no longer obligatedExternal link to take out basic health insurance in Switzerland, although there are exceptions to this rule. Those moving on a temporary basis and holding on to Swiss residency, however, can continue with their Swiss health coverage. To illustrate these basic rules, let’s look at a couple of cases sent in by our readers, along with coverage options for those moving to the United States.

A Swiss pensioner

Someone receiving a state pension who moves to a country outside the European Union or European Free Trade Agreement (EFTA) zone falls under the category of people no longer subject to Swiss health insurance law. So they must obtain coverage in their new country of residenceExternal link.

Pensioners setting up house in an EU/EFTA country are a case apart: they must continue to hold basic health insurance with a Swiss provider for themselves and their dependents. But an exception exists for pensioners living in a country with which Switzerland has special agreements (e.g., Germany, France and Spain) and those drawing a pension from their newly adopted home, so they can take out insurance in their place of residence.

A Swiss student

Those who opt to study abroad can keep their Swiss health insuranceExternal link, so long as they also keep their permanent residence in Switzerland. But the coverage they’re entitled to varies depending on where they’re studying.

Within the EU/EFTA zone, holders of Swiss basic health insurance can expect to receive reimbursements for essential medical servicesExternal link (in cases of illness, accident and maternity) in accordance with the law in that country. They can also choose to receive treatment in Switzerland.

The picture is slightly different for students in non-EU/EFTA countries. They receive reimbursements for emergency treatmentExternal link up to twice the amount the same treatment would have cost in Switzerland, and up to 90% of hospitalization costs. So in places like the United States, where medical care can be particularly expensive, it may make sense to take out additional travel or complementary health insurance.

Regardless of their situation, anyone planning to be away for an extended or indefinite period should check coverage options with their current provider. A small number of Swiss insurers actually offer plans specifically for people moving abroadExternal link who are no longer entitled to compulsory basic insurance, and which can be signed as private contracts under Swiss law. Some also have international health insurance policiesExternal link.

Moving to the US

For foreign nationals in the US, health insurance access depends a lot on why they’re in the country, and their legal statusExternal link. If a Swiss citizen is an employee of a company, then the company will likely provide a health insurance plan that can be purchased through premiums. These policies often kick in for eligible employees at the start of the month following the start of the position, though policies differ. Even though there is an ‘individual mandate’ for people in the US to have insurance under the Affordable Care Act, or Obamacare, not all foreign nationals can buy insurance through the marketplaces. Dual citizens can, as can those with Green Cards (or lawful permanent residents), and those with some work permitsExternal link.

A reader’s experience

Swiss-born Daniel Fritschi left eastern Switzerland with his American wife and young daughter in 2015. Since they switched their permanent residence to their new home in the US state of Michigan, the family was no longer entitled to Swiss compulsory health insurance. Finding health care coverage in the marketplace for their first month in the US was “almost impossible” and involved multiple phone calls over several days, Fritschi recalls. “We had a small infant and definitely did not want to take the risk of not having insurance.”

They finally managed to get a health insurance planExternal link for two adults and one child at a rate of $780 (CHF772) – for a single month. Once Fritschi began working, they were able to switch their coverage to a more affordable plan through his employer. The family’s insurance bills are now lower than they would have been in Switzerland, but treatment costs are much higher: about twice the cost when it comes to maternity, by Fritschi’s own accounting after his second child was born in the US.

For those who can’t buy insurance through the marketplace, or exchanges, then buying insurance through a private provider is still possibleExternal link, but might be expensive. And depending on the length of stay, some travel medical insurance plans through private providers may be enough to cover you in case of emergency, but again, shopping around for a good price may be worth the effort.

Students travelling to the US often must have health insurance External linkthrough the university or exchange program, or show proof of other coverage. These policies are often not too expensive for students, however. And for some exchange programsExternal link the insurance is part of the comprehensive package.

Once foreign nationals are in the US, access to medical careExternal link will also depend on whether or not you have insurance, and how serious the situation is. With employer-sponsored plans and private insurance, medical care is typically arranged through a family doctor and health care network. But there are also urgent care clinics, charitable groups, or community health centers, which offer treatment regardless of a patient’s insurance or legal status. As we mentioned in a previous article, there is also a federal requirement that emergency rooms stabilize patients without concern for payment, but that will not serve minor medical needs or lingering conditions.

The key thing to remember is that health insurance is not free, and is not a given for foreign nationals in the US. Private insurance is available, but may not be cheap. There are options for care without insurance, but the quality and cost can vary greatly.

Ask a question about the Swiss and US health care systems and we may cover it in this series:

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.