“Rich ghetto” building scheme sparks protest

Plans by the central canton of Obwalden to reserve sections of land for its wealthier inhabitants to build homes have been condemned as a form of "apartheid".

The canton’s authorities have hit back at the mounting criticism, saying the rich provide valuable income for everyone. Obwalden has actively courted well-heeled newcomers since it revamped its tax system in 2006.

The decision on April 30 to grant building rights in prime locations only to those who could afford to pay more has rekindled arguments that the drive by jurisdictions in Switzerland to seduce millionaires is going too far.

Several cantons offer low corporate and income tax rates to persuade large companies and wealthy individuals to settle inside their borders – often from abroad.

Obwalden raised the bar in 2006 by voting for a regressive income tax that obliged low earners to pay a higher rate of tax than those who brought home fabulous salaries. This system was outlawed by the Swiss Federal Court 18 months later as being unconstitutional and was replaced with a flat-rate tax model.

Apartheid accusation

The latest move to make millionaires feel right at home has drawn fresh protests, largely from left-leaning political groups. Obwalden’s Green Party has lodged a protest against fields being concreted over and the centre-left Social Democrats want a referendum on the grounds the policy is anti-social.

Swiss Environment Minister Moritz Leuenberger, a Social Democrat, has waded into the argument by publicly likening the planning policy to apartheid. His department denies giving Obwalden the green light to adopt the strategy.

Several legal experts have predicted a possible return to the Federal Court if objections gather pace.

The canton has responded sharply to certain criticism, saying Leuenberger’s remarks were “unacceptable”. On Wednesday, it issued a statement defending its right to make its own decisions.

“Canton Obwalden wants to provide an appropriate lifestyle, economic and recreational environment for its own inhabitants and for the welcome newcomers from other countries,” the statement read.

Cantonal authorities pointed out that they had relied on state subsidies to survive and were losing large numbers of people to cities before they enacted the policy to attract the wealthy in 2002. The number of companies in Obwalden had risen from 2,000 in 2005 to 3,153 by the end of 2008, while population numbers had also increased.

Social inequity?

Patrik Schellenbauer from think tank Avenir Suisse told swissinfo that the novel method of boosting finances in cantons including Zug, Schwyz and Valais, in addition to Obwalden, had raised serious issues.

“It is easy to understand the strategy [of tax reductions] but there is a danger that it could lead to a race to the bottom,” he said.

However, Schellenbauer was less impressed by arguments that Obwalden’s segregated planning system would create social inequity.

“If you look at countries like the United States or Britain, you will find rich people living in one area and poorer people living in others. It does not take a specific planning strategy to create these disparities in living areas.”

Matthew Allen, swissinfo.ch

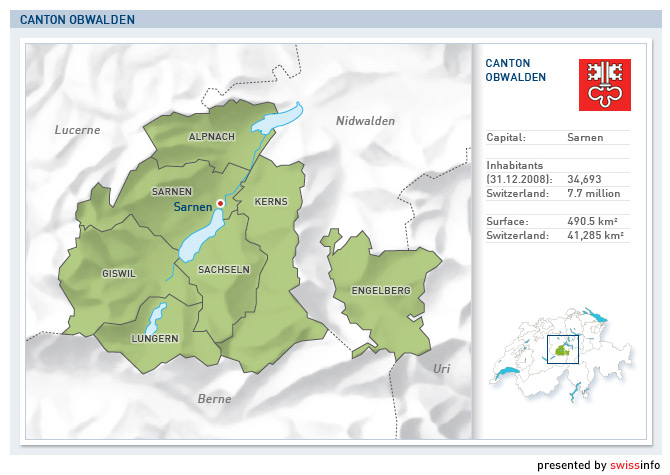

Obwalden has a population of nearly 34,000 with a third living in the capital of Sarnen.

Statistics from 2000 reveal that only 16.6% of the workforce had higher education qualifications, well below the national average. Some 14% were employed in agriculture, nearly three times more than the Swiss population as a whole.

After years of struggling to meet its budgetary requirements, the canton voted with a majority of 86% to introduce sharp tax cuts for corporations and a regressive income tax model that came into force on January 1, 2006.

The idea was to attract the wealthy with a lower rate of income tax compared to lower earners. Millionaires would fill up the cantonal tax coffers and stimulate the economy.

However, the Swiss federal court ruled the system as unconstitutional 18 months after it was introduced. In December 2007, nine out of 10 citizens voted for a flat rate of income tax.

The current global recession, sparked by the financial crisis, appears to have reversed some public opinion on attracting the wealthy to Switzerland.

Canton Zug is set to follow in the footsteps of Zurich with a referendum calling for an abolition of tax breaks for the wealthy. Canton Zurich voted to overturn the perks in February.

Several cantons attract the fabulously rich from abroad by cutting special tax deals, based on the rental value of their property, if they live and spend their money in Switzerland. Zug is one of the most famous tax paradise cantons.

The canton’s centre-left Social Democrat party will gather signatures for its motion to end these tax privileges that would trigger a vote if enough people support it.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.