Novartis sustains growth as patents expire

Basel-based pharmaceutical giant Novartis slightly increased sales in 2013 to $57.9 billion (CHF52 billion) but saw profits dip 1% as expiring patent protection and currency variations had an impact on the bottom line.

Chief executive Joseph Jimenez said on Wednesday that Novartis delivered a strong performance in 2013, with net sales and core operating income in constant currencies increasing while absorbing patent expirations.

Jimenez earned CHF13.23 million for running the company last year. Between them, the 11 members of Novartis’ executive committee received remuneration packages totalling CHF67.7 million in 2013.

Currency variations weighed on sales results though, equivalent to 2%. This was mainly due to the weakened Japanese yen and emerging currencies losing ground against the dollar according to Novartis.

At constant currency rates, sales progressed 4% and profits rose 7%.

Full-year net profit fell to $9.175 billion, down from $9.27 billion in 2012. The company said however it would pay a dividend of CHF2.45 per share for 2013, compared to the CHF2.30 it paid out for the previous year.

Outlook

The company confirmed its outlook for 2014 sales growth is in the low to mid-single digits, a slightly less confident forecast than last year, when it told investors to expect growth of at least mid-single digits this year and next.

Novartis said it still expected core earnings to grow ahead of sales, helped by productivity measures.

The drugmaker lost its patent rights for blood-pressure drug Diovan in the United States at the end of 2012, but has been spared some of the pain from cheaper, copycat drugs since Ranbaxy Laboratories faced regulatory delays for its generic version.

However, the company cautioned the delay would push the hit into 2014 and it expected generic competition to knock as much as $3 billion off sales this year, compared to the $2.2 billion impact in 2013.

Overall, Diovan sales still dropped one fifth to $3.52 billion as patent protection expired in the European Union, the United States and Canada.

Refocus

So-called growth products launched after 2008 or still benefiting from patent protection for the next few years helped prop up the bottom line, contributing $18.1 billion or 31% of Novartis’ net sales, up from 28% in 2012.

The company’s Galvus diabetes treatment notably reached blockbuster status with sales of $1.2 billion last year.

Novartis is also seeking to boost productivity and refocus its activities. The firm wants its units to be big enough to compete worldwide, with the criteria being annual revenue of around $10 billion and a position among the top two market leaders.

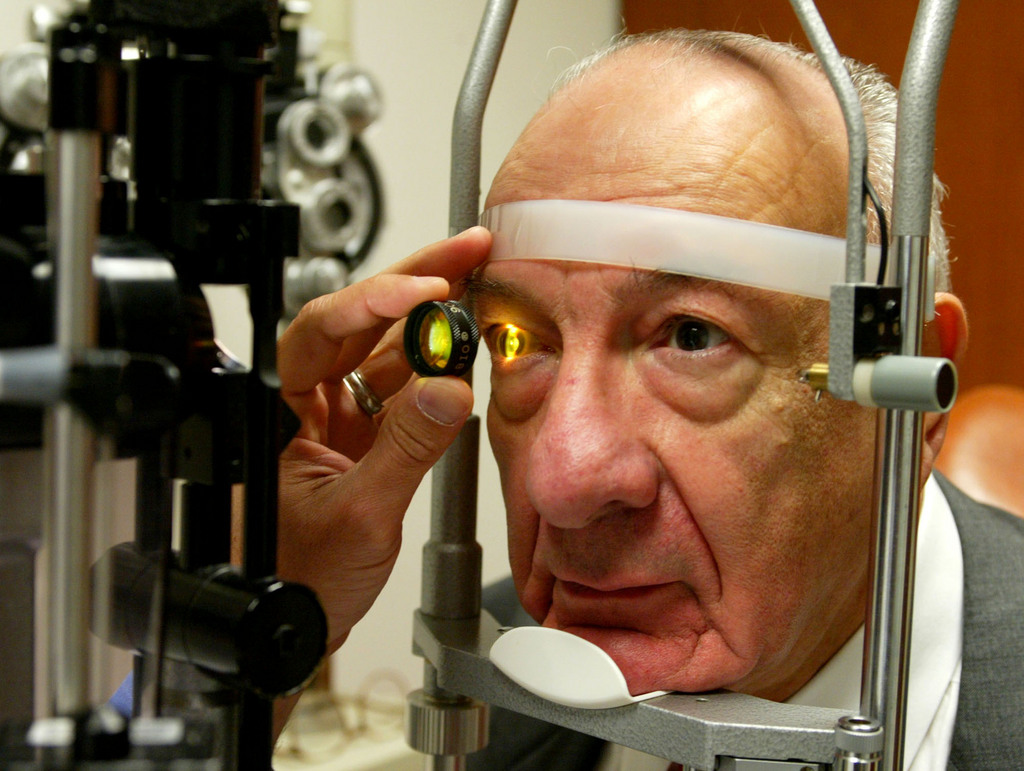

Jiminez has previously said Novartis has three global businesses – pharmaceuticals, eye care and generics – it was focusing on, but was looking at options for its three subscale businesses, vaccines and diagnostics, over-the-counter (OTC) and animal health.

The company recently sold its blood transfusion diagnostics unit to Spain’s Grifols for $1.68 billion. It is also redeploying staff, announcing earlier this month for example that it was cutting 500 jobs in Basel, a move it said was necessary to bolster the launch of new drugs, notably for the treatment of respiratory, heart and skin diseases.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.