Family tax breaks lose ground ahead of March vote

Opposition to a proposal to grant tax breaks to families in Switzerland has grown considerably ahead of a nationwide vote next month. Pollsters blame the political and economic context for a likely rejection of the initiative.

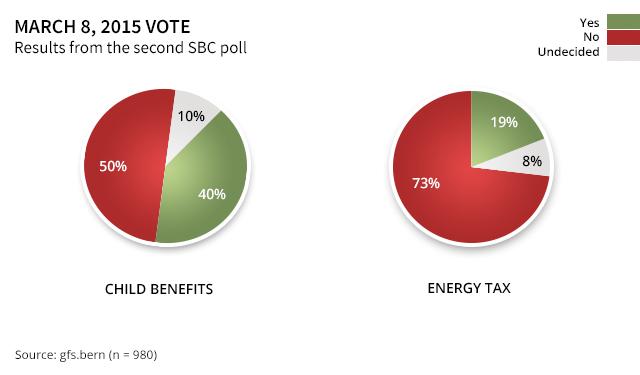

The proposal by the centrist Christian Democratic Party to make child allowances and education costs tax deductible, was supported by 40% of respondents in an opinion poll conducted a week ago.

Compared with a first poll in January, support has dropped by 12%, while opponents gained an additional 17%.

Some 10% of respondents are still undecided according to a survey by the leading research and polling institute GfS Bern on behalf of the Swiss Broadcasting Corporation. (For details see graphic)

The overall trend applies to all parties, says GfS Bern political scientist Martina Imfeld. The initiative only has a majority among the grassroots of the Christian Democrats as well as families with children.

Imfeld says the campaign failed to gather pace despite a good start and has not really convinced citizens or other parties.

Despite a widespread feeling that families are under financial pressure and deserved a boost, many respondents said would reject the initiative.

“Ultimately the majority of citizens have selfish reasons. They do not stand to benefit from the tax breaks,” Imfeld says. “Clearly there are also party political considerations.”

The left has its own plans to ease the financial burden of families and the right only gave a lukewarm support to the initiative.

The Christian Democrats for their part, were hoping to use their initiative as a campaign tool for the parliamentary elections in October.

Economy

Adverse economic conditions, including concerns over the negative impact of the strong Swiss franc and the announcement of the first state deficit in almost ten years, have also had an impact, according to Claude Longchamp, director of the polling institute.

“Voters tend to keep risks to a minimum and reject any privileges for a certain group of the population in times like this,” he says.

Supporters of the initiative argue about one million, mainly middle-class, families would benefit from the tax reform.

Opponents, including the government, parliament and the 26 largely autonomous cantons have come out against the initiative.

They say the expected CHF1 billion ($1.1 billion) drop in revenue would inevitably trigger spending cuts in other areas. The political left has also pointed out that the tax breaks were unfair as poor families would not have more cash available due to the intricacies of the current tax system.

The GfS Bern research and polling institute interviewed 1,416 Swiss citizens from all language regions across the country for the second of two nationwide surveys ahead of the March 8 vote.

Swiss expatriates are not be included in the poll.

The telephone interviews took place between February 16-21.

The margin of error is 2.7%.

The survey was commissioned by the Swiss Broadcasting Corporation, swissinfo’s parent company, and carried out by the leading GfS Bern research and polling institute.

Running empty

The fate of another proposal to come to a vote on March 8 appears literally sealed.

Support for the initiative by the centrist Liberal Green Party to replace value added tax by a tax on non-renewable energy has dwindled to just 19% in the opinion poll.

Political scientist Longchamp sees no chance for the proposed reform of winning more than 20 to 30% in the vote. “It is over now.”

He says the small party did not succeed in winning the backing of environmentalists in a low-profile campaign.

“It was impossible for the campaigners to launch a real controversy with a polarising conflict pattern,” he says. “Hence there has been no swing of opinion.”

The initiative lost more than 10% of its initial support while opponents gained ground by an additional 15%.

Barring unforeseen events over the next few days, the initiative is likely to suffer a crushing defeat – possibly even scoring one of the poorest results in recent years.

Turnout on March 8 is likely to reach around 50%, slightly below last year’s level but above the long-term average.

Imfeld says both issues are of general interest to Swiss citizens.

“But the campaigns failed to reach out beyond the followers of the two parties behind the initiatives.“

Two separate fiscal issues, promoted by two centrist political parties, are at stake.

A proposal by the Christian Democratic Party to make child allowances and education benefits tax deductible.

An initiative by the Liberal Green Party to replace value added tax by an energy tax.

It is the first of two sets of nationwide votes this year.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.