Pressure builds on banks to offer Swiss crypto start-ups accounts

Switzerland’s drive to become a “Crypto Nation” has hit a road block: Swiss banks are unwilling to offer accounts to many blockchain start-ups. Following a personal intervention by Swiss finance minister, the Swiss Bankers Association (SBA) is now addressing the impasse.

The bottleneck has become acute thanks to the extraordinary rise of cryptocurrencies and the initial coin offering (ICO) crowdfunding craze that attracted $1.46 billion (CHF1.45 billion) to Switzerland last year.

Companies seeking ICO funds typically issue tokens in exchange for cryptocurrencies, which they use as start-up capital. The ‘wild west’ ICO market has been peppered with high profile cases of fraud, scams and Ponzi schemes – one reason that practically all Swiss banks steer clear of this business.

More

“Law change would kill Swiss crypto industry”

Having been stung by a calamitous tax evasion fight with the United States, Swiss banks are also now alarmed by what they see as money laundering risks associated with bitcoin and other digital tokens that grant users anonymity. A recent survey of 50 Swiss banks by audit firm KPMG saw 60% name bitcoin & co as the mostly likely source of increased financial fraud.

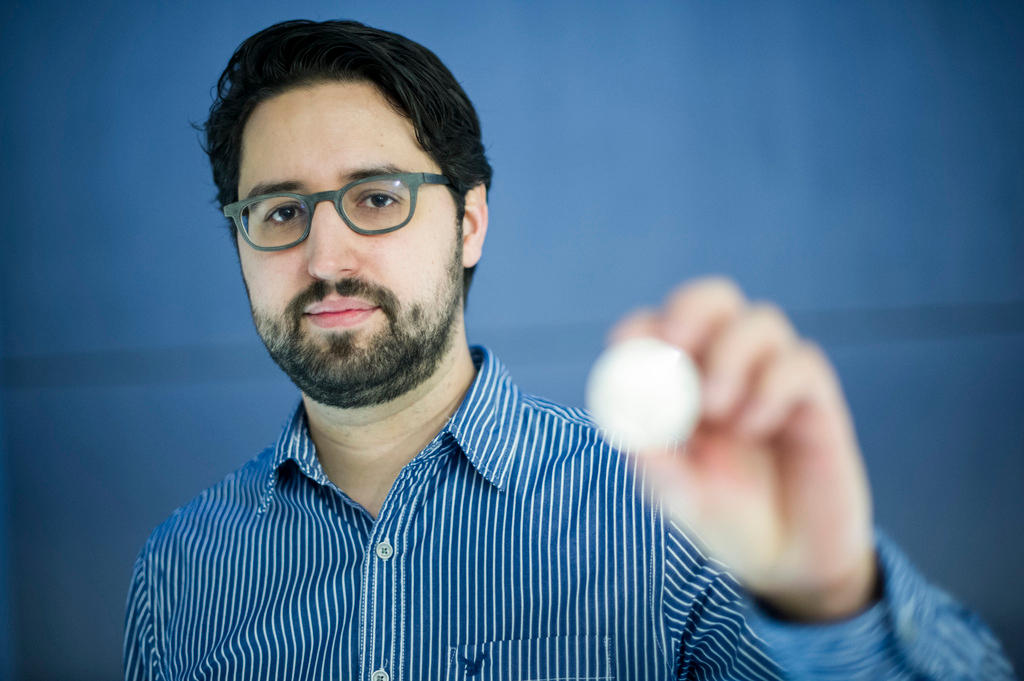

Blockchain and cryptocurrency expert Guido Schmitz-Krummacher is a former director of the Tezos foundation and has advised other blockchain projects like Cardano. Starving start-ups of bank accounts is akin to killing the goose that laid the golden egg, he fears.

Image bashing

“Canton Zug has invested a lot of effort into building its reputation as a ‘Crypto Valley’ global blockchain hub,” he told swissinfo.ch. “If banks fail to provide a reliable environment for start-ups to pay their bills then this image will take a severe hit.”

“I am already seeing projects choose Singapore, Malta and Gibraltar because they can’t get a bank account in Switzerland. They will be followed by projects already established in Switzerland unless the banks and politicians address this topic.”

Similar pleas from the industry have found the ears of government ministers. In January, Economics Minister Johann Schneider-Ammann stated his vision for “Crypto Nation” Switzerland. Finance Minister Maurer, also a big fan of blockchain, recently gathered together a workforce comprising the SBA, the financial regulator, the central bank and other big hitters.

The SBA in turn has set up its own taskforce, acknowledging that “business accounts are an important infrastructure service.” “Banks are currently hesitant to open business accounts for companies with particular touchpoints to ICOs and cryptocurrencies due to risks such as fraud or money laundering,” the banking umbrella group wrote in an emailed statement to swissinfo.ch.

The SBA wants to establish a set of minimum standards for ICO-funded start-ups to “simplify the account opening process”.

Cross-pollination

Such a plan would probably need to address fraudulent ICOs and the requirement for banks to fulfil anti-money laundering obligations by identifying the owners of cryptoassets. This might require some compromise from the crypto sector that seeks to reduce the influence of commercial and central banks in the financial sector.

The SBA would not go into specifics, but added in its statement: “Both we as an association and the banks have an interest in business relations in this growth area. Banks see the potential that the blockchain technology offers for their industry and Switzerland as a financial and technology hub.”

The Zug-based Crypto Valley Association welcomed the development. “Thanks to Switzerland’s best-in-class environment for ICOs, the level of demand for banking services for ICO-funded projects is high and growing,” Mattia Rattaggi, head of the CVA Policy & Regulation Working Group told swissinfo.ch in an emailed statement.

“While other countries have moved quickly to fill the niche, there is growing political and regulatory support for measures to support the development of ‘Crypto Nation’ Switzerland. On the whole, we anticipate a progressive broadening of offerings by a number of Swiss banks, both old and new.”

As the banking sector as a whole works out how to cross-pollinate the worlds of crypto and traditional finance, a handful are prepared to offer services to a select group of crypto firms. These include the Neuchâtel Cantonal Bank, Neue Helvetische Bank and more recently the Hypothekarbank Lenzburg.

In the meantime, many of the some 200 blockchain firms in Zug alone have to seek bank accounts beyond Swiss borders, in countries such as Liechtenstein where banks Frick and Alpinum have been more accommodating.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.