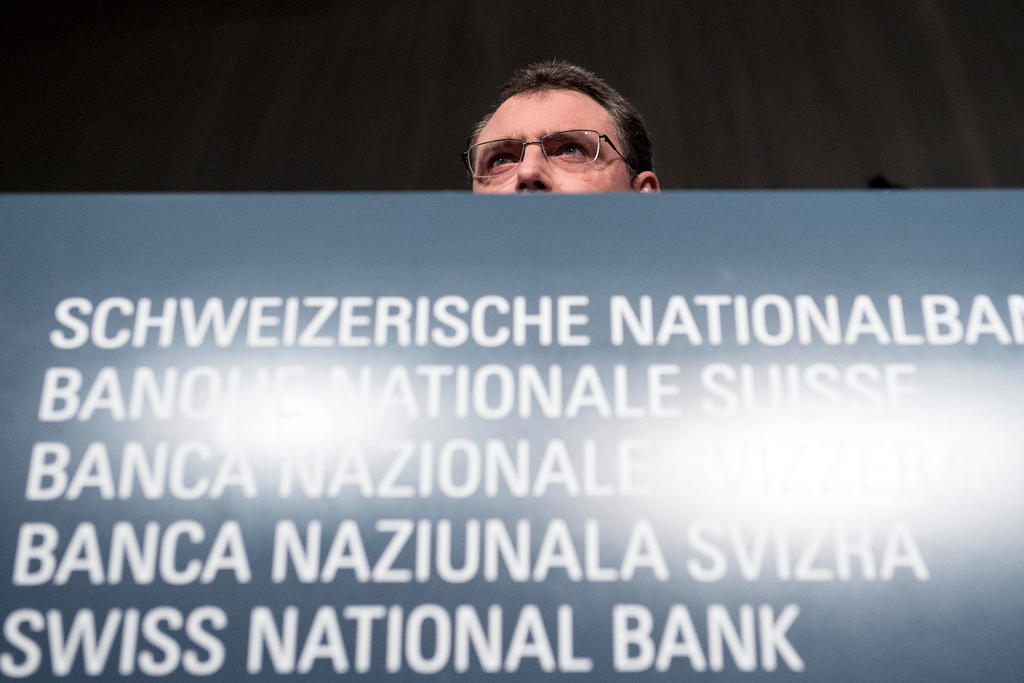

Still room to intervene: SNB president

Switzerland’s central bank still has room left on its balance sheet to intervene in the currency markets and tamp down the strength of the Swiss franc, the bank’s president said on Monday.

Thomas Jordan, the president of the Swiss National Bank (SNB)External link, told a central bank conference in Bali, Indonesia, that the leeway to intervene exists despite the franc’s overvaluation and the negative inflation rate.

“The current approach is right, an expansionary monetary policy and being ready to respond,” said Jordan.

“The balance sheet is big but we still have room to intervene,” he said. “We look at the costs and benefits of intervention. There is no limit to the balance sheet.”

The SNB wants to prevent more strengthening against the euro, which has hurt Swiss exports and tourism.

Accelerated intervention

In June, the SNB posted the first data on how it has been intervening to contain the post-Brexit fallout on the franc caused by Britain’s June vote to leave the European Union. Sight deposits – assets parked at the central bank by domestic banks – broke the CHF500 billion ($513 billion) mark for the first time.

More

Swiss central bank accelerates intervention

The SNB confirmed it was printing more money to buy up other currencies in order to stop the safe haven franc from appreciating too much. Investors value the country’s stability and reliability, particularly amid financial-market tumult.

To prevent monetary tightening, the SNB also could cut the deposit rate – which at minus 0.75% already represents a record low – if the central banks of Europe or England ease their policies.

Jordan said it “clearly absolutely necessary to have negative interest rates”, because of factors including the strong Swiss franc and negative inflation. The SNB projects an inflation rate of minus 0.4% this year.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.