“Glenstrata” fusion approved by shareholders

Xstrata shareholders have rubber-stamped the takeover of the mining group by commodities trader Glencore to create a $70 billion (SFr66 billion) industry giant.

Glencore and Xstrata shareholders approved the transaction at two separate meetings in Zug on Tuesday. Completion of the deal is still subject to approvals by regulators including the European Commission.

The merger will create an international powerhouse company that will control both the extraction of many raw materials – particularly minerals – and their distribution around the globe.

This fusion has been viewed as a commercial masterstroke, allowing the combined firm to ramp up revenues while reducing costs.

Commodities trader Joseph Di Virgilio, who has extensive experience of the burgeoning Swiss market, believes that more copycat mergers may be on the way.

“The long-term outlook for commodities is quite strong given the exponential growth of the Earth’s population and the ever growing emerging market story related to food, water, raw materials and energy in general,” he told swissinfo.ch.

“This will spur more entities in wanting a bigger market share via acquisitions and mergers.”

But the fusion is seen in other quarters as a danger to developing countries with the potential to inflate commodity prices.

Concerns

Campaigning group Berne Declaration has consistently highlighted environmental abuses and dangerous working conditions allegedly carried out by both companies in the developing world. Furthermore, the group accuses canton Zug-based Glencore in particular of aggressive tax avoidance in poorer countries.

The volatility of commodity prices has caused concern on a governmental level across the world. Berne Declaration believes that the Glenstrata merger, monopolising some commodity sectors, could raise these fears to a new level.

“The prospect of market dominance by Glencore and Xstrata has caused worries from representatives of the German steel industry to members of the European parliament,” Berne Declaration spokesman Andreas Missbach told swissinfo.ch.

“In general both the mining and the commodity trading sector are dominated by a few big players. The influence of those oligopolies on commodity prices needs to be carefully monitored.”

Stumbling blocks

The merger of the two companies was first mooted more than a year ago, when privately controlled Glencore emerged from the shadows with a public listing in London and Hong Kong.

The listing attracted enough money from outside sources to make the purchase of Xstrata possible, but ironically the introduction of shareholders nearly brought the sale to a grinding halt.

Major shareholders in Qatar, Norway and the United States objected to an initial deal proposed by the two companies because it came with an over-generous compensation package for Xstrata executives.

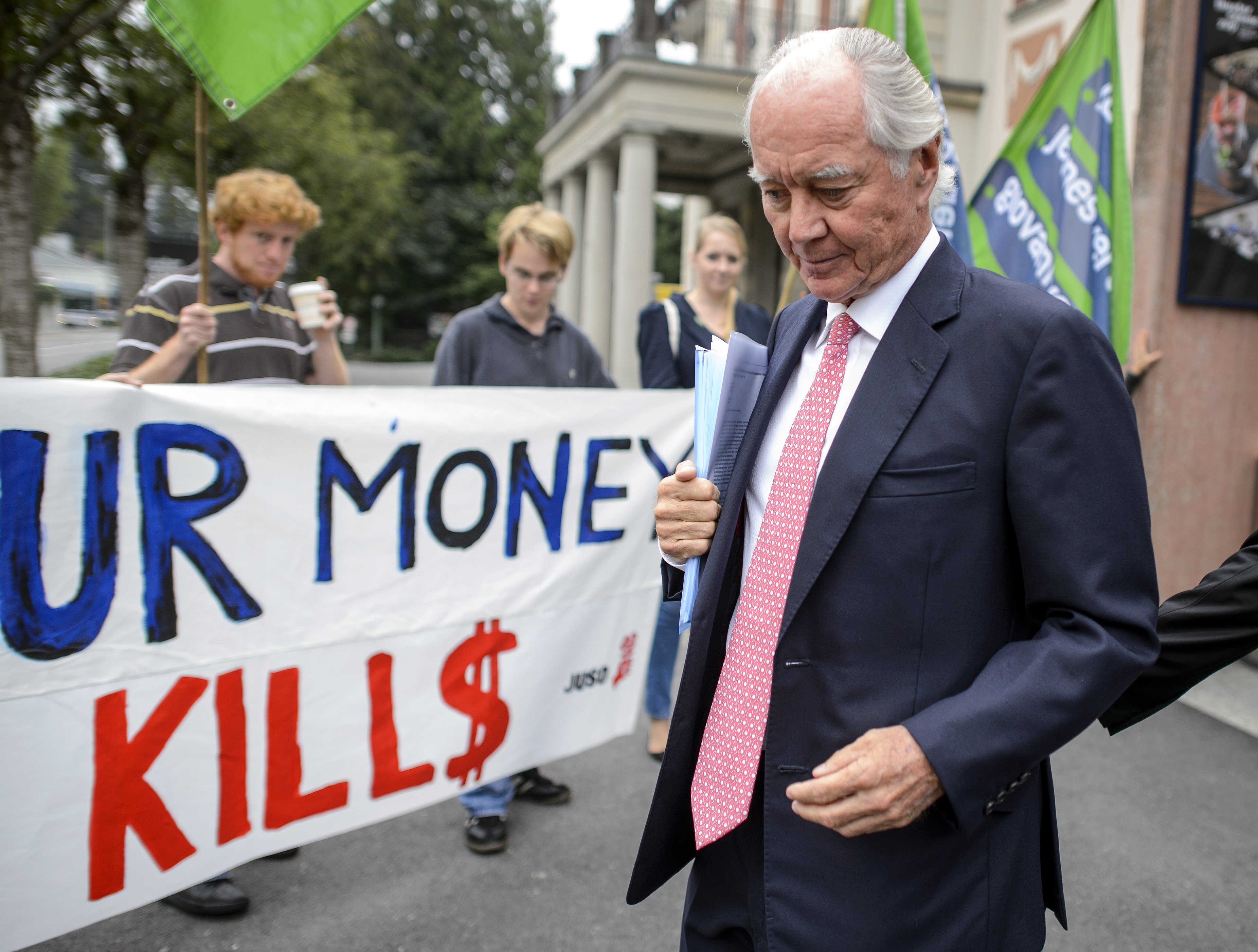

Xstrata shareholders voted Tuesday against a controversial incentive programme for managers. The snub prompted Xstrata’s current chairman, John Bond, who would also be chairman of the combined group, to announce he would step down once a replacement is found.

The merger between Glencore and Xstrata has created a Swiss-headquartered company with assets and projects in 33 countries, and around 130,000 employees.

Glencore Xstrata’s mining assets will include more than 100 mines, 30 concentrators, 25 base metals smelters, eight copper solvent extraction plants, four copper electro-winning plants, eight base metals refineries and precious metals refineries.

Other assets:

A global network of warehouses with 1.5 million tons of concentrate and metal storage capacity and access to 100 tank farms/oil terminals worldwide.

Glencore Xstrata’s agricultural assets will include 270,000 hectares of leased/owned farmland.

Over 200 vessels owned, leased or commercially managed for the oil business.

Access to and ownership of many ports.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.