Swiss to help Indian tax-dodging investigation

The Swiss Federal Tax Administration has been given the go-ahead to cooperate with Indian authorities in their investigation of data stolen from the Geneva branch of HSBC bank by whistle-blower Hervé Falciani.

The decision was reached on Thursday by the Federal Administrative Court in St Gallen, which rejected an appeal by two Indian citizens and two companies that are subject to requests by the Indian taxman following up on data included in the Falciani files.

The concerned parties had opposed a previous decision by the court to allow the transfer of information surrounding their banking activities between April 2011 and March 2014, when they held HSBC trust accounts in the Virgin Islands.

For them, the request for assistance by Indian authorities was based on evidence of stolen data, which does not amount to valid grounds for further investigation.

However, referring to another recent Federal Court ruling from March, which stated that Indian authorities had never raised the question of using data obtained by methods illegal in Switzerland, the court said the request did not infringe international public law.

Besides, the Indian authorities did not receive the data directly from Falciani, it said, but indirectly from the French tax body.

Whistle-blower or opportunist

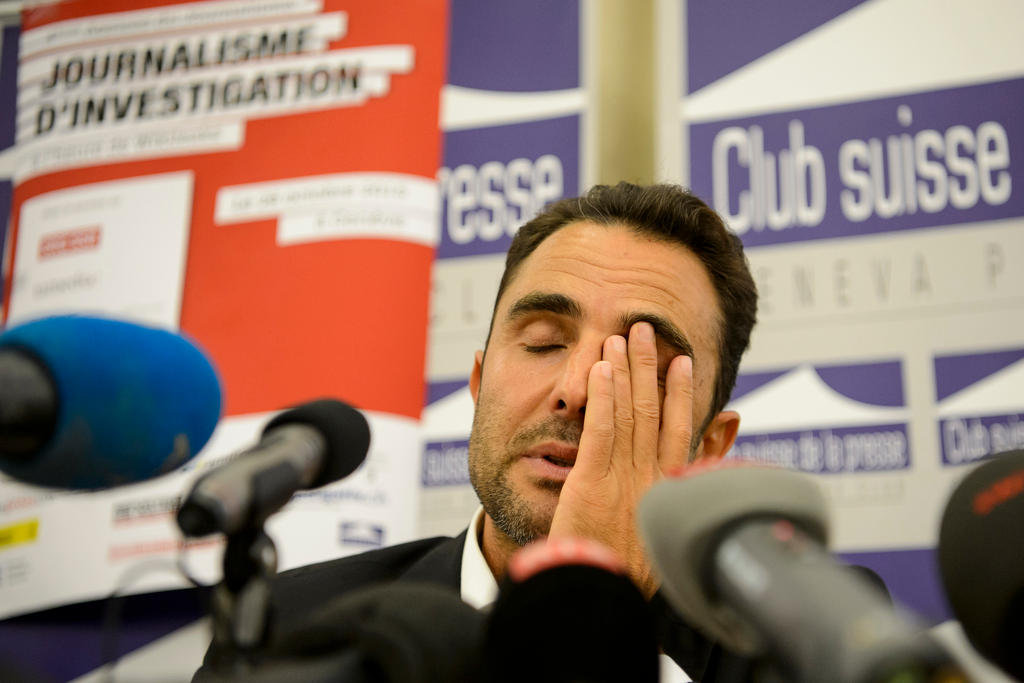

The case marks the latest turn in the story which began in 2006, when Hervé Falciani, an IT employee of HSBC bank in Geneva, absconded with stashes of sensitive client data.

After several unsuccessful attempts to sell the data in Lebanon, Falciani gave the data to French authorities – where they acquired the moniker of the “Lagarde list”, after the then-finance minister – who used the data to chase down thousands of tax dodgers.

Following increased international interest in the number of companies and individuals holding offshore accounts in Switzerland, the Swiss authorities were forced to adapt several laws on secrecy and the sharing of information.

Battling a reputation for opaque regulations, it received a “largely compliant” rating in a 2016 Organisation for Economic Co-operation and Development (OECD) tax evaluation, which stated that “Switzerland’s approach to exchange of information for tax purposes has changed significantly over the past three years”.

In 2016, Falciani was sentenced in absentia by a Swiss court to a five-year jail term, but he continues to live in France where he is protected from extradition by his French citizenship.

swissinfo.ch with agencies/dos

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.