Government works toward transparency

The government has announced further planned measures to crack down on money laundering in order to meet new standards set by the Paris-based Financial Action Task Force (FATF), the main international body combating money laundering,

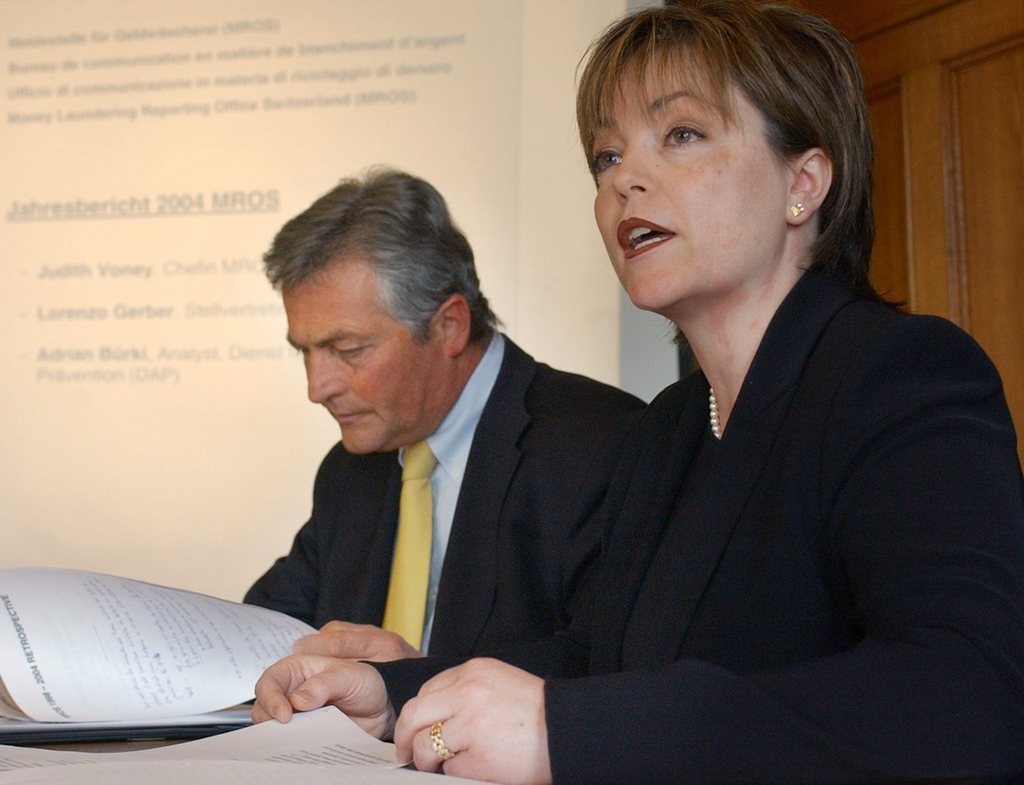

Finance Minister Eveline Widmer-Schlumpf told journalists on Friday that the main changes to be submitted to parliament for discussion had to do with tax offences.

She explained that under the FATF rules these had to be regarded as so-called predicate offences to money laundering – in other words, ones committed in order to lay the ground for subsequent offences.

She said tax offences would now count as a predicate offence for money laundering if tax fraud exceeding CHF200,000 ($225,000) per tax period had been committed, and included the use of forged documents. The government realises that the new regulations will give the banks considerably more work to do, but the aim is to keep untaxed money out of the Swiss financial system, which in the long run will benefit them.

In a set of measures proposed in February 2013 the government had suggested that the level should be set at CHF600,000.

Interested parties had been given until June 15 to submit feedback to the government’s initial proposals.

The changes announced on Friday took this feedback into account as well as the FATF demands.

They include an expansion and tightening up of the definition of tax and smuggling offences.

The government is suggesting different ways to meet a demand by the FATF for more transparency with bearer shares – shares which do not record changes of ownership, and which are widely regarded as tax avoidance instruments. For example, shareholders are to be allowed to report their identity to a financial intermediary who is subject to the money laundering law, and it will be made easier to change a bearer share into a registered share.

A permanent working group consisting of members of various departments is to be created to coordinate the fight against money laundering, in particular in relation to terrorism financing.

Swiss Bankers react

Responding to the government announcement, the Swiss Bankers Association stated that although it supports the adoption of international standards such as those recommended by the FATF, the current draft qualifying tax offences as a predicate offence for money laundering “is only partially implementable for banks”.

It points out that banks cannot know clients’ future tax obligations and untaxed amounts. It wants the threshold to be set at CHF600,000 rather than CHF200,000, and calls for a further qualifying criterion, namely multiple offences.

However, it says the banks are generally in favour of the elimination of bearer shares “as these unnecessarily expose Switzerland to international criticism”.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.