History bites back at Swiss private banking

Dating back more than 250 years, Swiss private banking traces its roots to the cross border trade in goods. Some of Switzerland’s most enduring private banking symbols originated from in-house financial specialists at trading firms.

But as the industry developed from humble beginnings, and grew into an international leader, it picked up many black marks along the way that still hang over today’s private banking players.

“Originally all the banking houses across Europe were trading companies,” Youssef Cassis, professor of economic history at the European University Institute in Tuscany. “They started to specialise in trade finance and then split off as banking became a separate profession.”

Basel’s La Roche (founded in 1787) and Dreyfus (1815) were offshoots from larger companies while Wegelin (1741) and Rahn & Bodmer (1750) were established on the back of the St Gallen textiles industry.

Geneva’s Pictet private bank, that started off life as Banque de Candolle Mallet & Co in 1805, stated its original purpose was to “trade in goods and articles of all types, collect annuities and undertake speculation in commodities”.

But early on in its history, the bank realised that profit was to be gained from advising wealthy merchants and families in how to manage their assets.

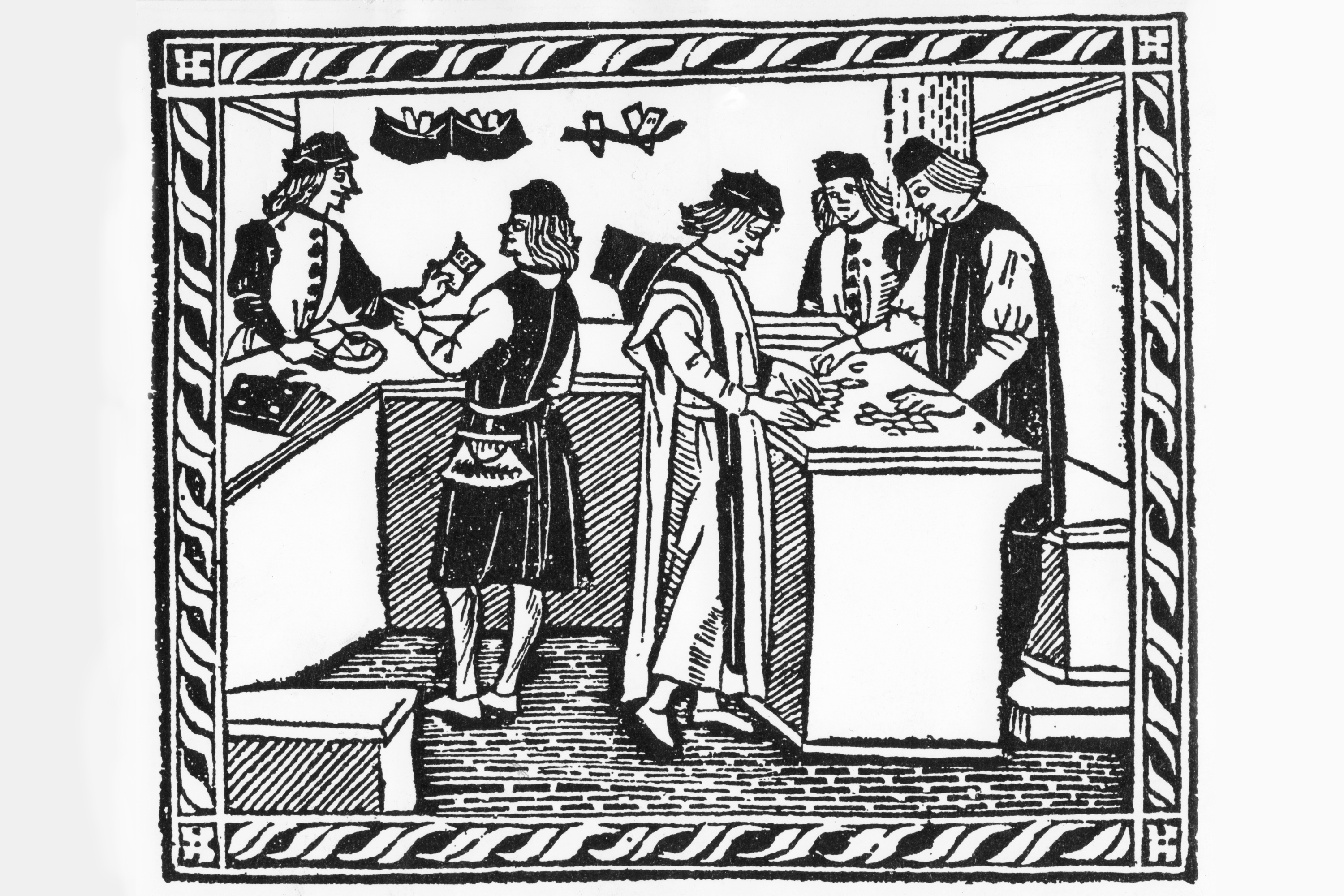

13th century: the first recorded appearance of Jewish and Lombardian money exchangers arrive in Switzerland from around Europe.

14th century: In 1387 Bishop Adhemar Fabri allows Genevan bankers to charge interest on loans.

15th century: The Geneva trade fairs attract merchants and financiers the city, who soon spread to Basel.

16th century: John Calvin further loosens Catholic usury restrictions and creates a safe haven for European Protestant refugees.

Trading wealth

Located at the heart of Europe, commanding access to important alpine passes, sharing borders with many countries and bordering the Rhine, Switzerland gained importance as a trading hub in medieval times.

Religious reformer John Calvin, who helped shape the Protestant Church from his base in Geneva in the 16th century, further boosted banking by applying a liberal interpretation of the Catholic ban on usury – or gaining interest on loans.

At this time the booming Geneva trade fairs – an important part of the medieval European commercial scene in the 15th century – attracted foreign financiers. “Switzerland was very much dependent on foreign merchants and financial specialists to get its banking industry off the ground,” Cassis told swissinfo.ch.

Switzerland’s status as an important refuge for Protestant refugees from Catholic neighbours in the 17th century also helped build up the banking industry. This influx of émigrés brought not only watch makers to western Switzerland, but also bank specialists.

18th century: enduring Swiss banking icons, such as Lombard Odier Darier Hentsch, start to appear on the landscape.

In 1713 the Great Council of Geneva bans banks from revealing client information – the foundations of banking secrecy.

19th century: Switzerland’s neutrality and the emergence of the modern federal state provides political and economic stability.

20th century: Two world wars, the Great Depression and exchange rate volatility cement Switzerland’s position as a leading wealth management centre.

But the Nazi gold, Holocaust era bank account, money laundering, dictators’ assets and tax evasion scandals haul Swiss private banking back to earth.

Stability attracts assets

As companies in Geneva, Basel and later the textiles giants in St Gallen grew bigger, they required financial experts to handle credit, exchange and early derivatives that offset trading risks.

Some of the biggest names in today’s Swiss private banking scene were later founded on the back of this success: Lombard Odier Darier Hentsch (1796), Pictet (1805), Mirabaud (1819) and Bordier (1844).

Switzerland’s political neutrality, recognised in 1815, and the creation of the modern federal state following the 1847 civil war laid the foundations for a strong wealth management industry.

“Surrounded by old-fashioned reactionary monarchies, Switzerland became a safe haven for political refugees, and provided an ideal political and economic environment for the safe-keeping of assets,” Swiss economic historian Robert Vogler told swissinfo.ch.

Storm oasis

However, it was the extreme political and economic turmoil of the 20th century that cemented Switzerland’s place at the head table of international private banking. Two world wars, a cold war, financial crashes and the instability of many other currencies drew assets to Switzerland like a magnet.

“Until 1914, Brussels was a more important financial centre than Switzerland,” Cassis told swissinfo.ch. “And it was not until after the Second World War that Switzerland gained its current reputation as one of the world’s leading banking hubs.”

The enshrining of banking secrecy into national law between the world wars, and the attraction of Switzerland for vast sums of money illicitly escaping European restrictions on currency movements between countries, also provided a boost for wealth management.

The stability and convertibility of the Swiss franc into other currencies during times of global economic volatility have also added to Switzerland’s attraction as a centre for wealth management.

Facing the music

But the boom times for Swiss private banking also attracted unethical practices that became widespread. A string of scandals, that have been uncovered in the last 20 years, have not only damaged Switzerland’s reputation and that of its private banking industry.

Switzerland was an eager recipient of Nazi assets looted during the Second World war. To compound matters, Swiss banks then denied the ascendants of Holocaust victims access to family accounts.

Money laundering, accepting assets looted from developing countries by dictators and now tax evasion have been added to a growing list of scandals to sully the name of Swiss private banking.

The private banking industry has outgrown the traditional world of private bankers – defined as privately-owned partnerships that assume unlimited liability for losses. UBS and Credit Suisse now head a list of larger players dominating the industry.

History has given Swiss private banking a leading role in international wealth management, but it now faces an uncertain future.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.