Swisscom caught up in Italian tax scam probe

An Italian subsidiary of Swiss telecommunications firm Swisscom has been caught up in a tax fraud and money laundering investigation with alleged mafia links.

The probe into former and present Fastweb employees has already caused reputational damage to the firm, which could translate into serious business implications for mother company Swisscom.

The international investigation has also focused on banks in Lugano, in the southern Swiss canton of Ticino. The financial centre has frequently been accused of hiding the assets of tax evaders and is still reeling from the effects of an Italian tax amnesty last year.

Italian prosecutors suspect Fastweb and a division of Telecom Italia, called Sparkle, of being involved in a criminal operation to defraud the tax collector of nearly €2 billion (SFr2.9 billion) between 2003 and 2006.

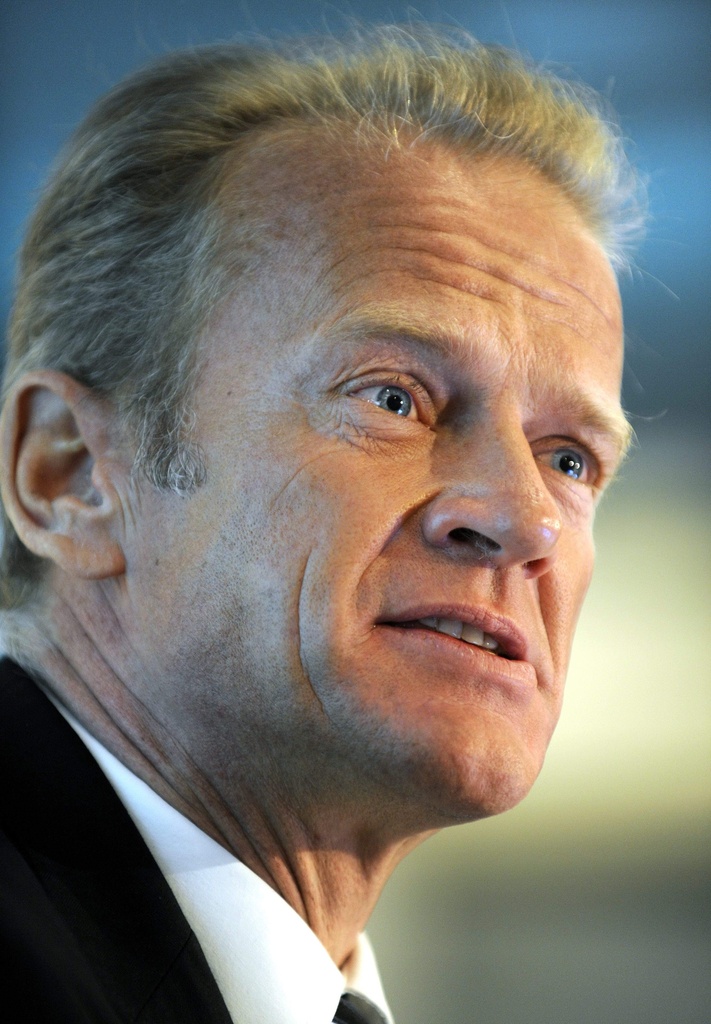

Fastweb founder, Silvio Scaglia, and other former employees are among 56 people who were the subject of arrest warrants this week. Current chief executive Stefano Parisi and other current staff may also face questions in connection with the scam.

“I can assure you that Fastweb is an healthy company, run by people who will be able to prove their honesty,” Parisi told swissinfo.ch. “I repeat that Swisscom did an excellent deal.”

Parisi admits that being associated with international organised crime batters the company’s image imensely. He denies that Scaglia knew what justice authorities would find and decided to sell the company in 2007 to make a big profit. Parisi said the idea of a sale came up before then and that the Swisscom deal was transparent.

“We gave Swisscom all the necessary elements and informed them about the investigations,” he said, adding that he had no intention of resigning.

Scaglia turned himself over to the Italian police upon his arrival in Rome early on Friday. The Fastweb founder, who has denied any wrongdoing, was returning from a business trip to the Caribbean.

Swisscom, Fastweb and all the parties under suspicion have denied they did anything wrong. Swisscom added in a statement that the investigation would not threaten Fastweb’s business activities.

Financial consequences

But the damage has already started, according to Bank Vontobel telecoms analyst Pangiotis Spiliopoulos.

“The longer these allegations last, the more difficult it will be to maintain a solid operating business,” he told swissinfo.ch. “Unless this situation is cleared up it is very unlikely that Fastweb will gain customers, and more likely that it will lose them.”

Swisscom bought Fastweb for €3.1 billion in 2007 (SFr5.2 billion at the exchange rate of the time). Part of that outlay covered a premium, or so-called goodwill payment, associated with expectations of how the firm would perform in future.

If Fastweb’s performance drops below those expectations, then this would make the transaction more expensive for Swisscom and could adversely affect its bottom line this year.

Poor takeover history

Fastweb had appeared to be a winning acquisition following a chequered decade of takeover activity for Swisscom. Previous ventures into Germany, India, Malaysia and the Czech Republic had resulted in embarrassing losses for Switzerland’s dominant telecoms player.

The poor strategy had led to the government, that holds a 62 per cent stake in the company, to block proposed foreign takeovers in 2005, leading to the departure of former CEO Jens Alder. But Fastweb provided Swisscom with much need revenue growth in 2009 compared to bad news in the domestic market.

“Domestic telecoms markets across Western Europe are in structural decline with eroding revenue bases and prices,” Spiliopoulos told swissinfo.ch. “Fastweb had been the compensating element for the group’s results.”

Swiss politicians have expressed anger that Swisscom knew about suspected irregularities when it undertook due diligence on its target in the lead-up to the takeover. But the company said it had been advised by two independent consultancies that Fastweb had done nothing wrong.

Banks in dog house again

Swisscom added that it was “surprised” by the latest developments and that it would fully cooperate with the Italian authorities.

However, the suspected fraud ring does not end with Fastweb and Telecom Italia. Prosecutors have talked about a string of fictional companies and law firms being set in numerous countries and the involvement of Swiss banks in laundering the ill-gotten gains.

Once again, Italian eyes have settled on the banking centre of Lugano as playing a part in the elaborate sting – even if it was perhaps an unintentional role.

Italian Finance Minister Giulio Tremonti spoke of “bleeding dry” Lugano’s banks during an aggressive tax amnesty last year.

Matthew Allen, swissinfo.ch (With input from Aldo Sofia in Milan)

Fastweb is the second largest internet services provider in Italy.

The company was founded by Italian entrepreneur Silvio Scale and financier Francisco Michelin in 1999.

In 2007, Swisscom bought an 82% stake in Fastweb in a deal worth €3.1 billion (SFr4.54 billion) while agreeing to take on €1.1 billion of debt.

In the past few years, Fastweb has become Italy’s leader in the field of fibre optic communications, particularly for internet connections and fixed line telephones.

Fastweb also offers television services and has a line in mobile telephones.

It has a 13% market share in broadband internet connections and its services reach 90% of the Italian market.

Between 2008 and 2009, Fastweb broadband connections increased 9.7% from 1.48 million to 1.64 million (out of a total 12 million connections in Italy).

Italian prosecutors suspect Fastweb of being part of a wide-ranging, highly complex and international fraud scheme, engineered by the mafia.

The so-called carousel sting involves the creation of sham companies within the European Union and the trading of fictitious services between them.

The name of the game, according to the allegations, was to defraud the Italian tax authorities out of VAT.

In such carousel schemes, the criminals typically take advantage of VAT exemptions on trade between EU member states.

Fastweb and Telecom Italia – that owns Sparkle – say they were not involved in the fraud but were the victims. The Italian tax authority is not so sure and has withheld VAT credits.

Fastweb is accused of being responsible for around €40 million of the €2 billion gains of the alleged fraud.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.