UBS Q3 results exceed expectations

Despite the London trader fraud which cost the bank SFr1.8 billion ($2 billion), UBS has posted a pre-tax profit of SFr980 million for the third quarter of 2011.

The Zurich-based banking giant indicated at the beginning of this month that a “modest net profit” was in store for the Q3 results but Tuesday’s figures well exceed analysts’ expectations.

In a statement, UBS revealed that the SFr980 million result included the SFr1.849 billion trading income loss “resulting from the unauthorised trading incident” and an own credit gain of SFr1.765 billion.

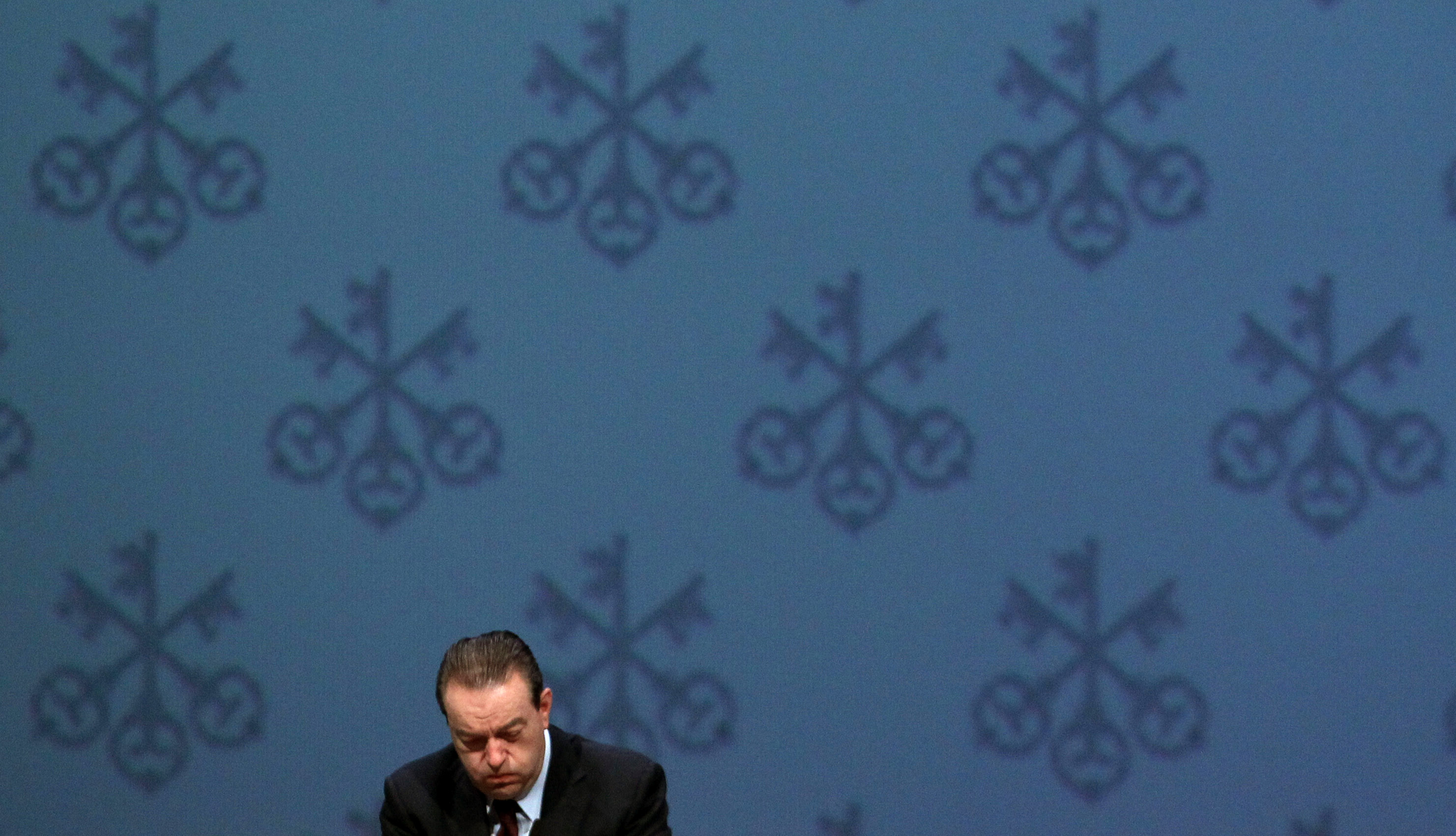

September’s rogue trading scandal, now before the courts in London, threw UBS into turmoil and led to the resignation of chief executive Oswald Grübel, brought in two years ago to turn the bank’s fortunes around after massive subprime losses and a damaging US tax evasion case.

Also in Tuesday’s results, UBS Investment Bank made a pre-tax loss of SFr650 million, after making a profit of SFr376 million in the previous quarter.

Net new money inflows were SFr3.8 billion compared with Sfr5.6 billion in the previous quarter.

“Solid”

The net profit attributable to UBS shareholders was SFr1.018 billion compared to SFr1.66 billion for the same period last year and SFr1.015 billion for the second quarter of 2011.

For the nine month period January to September 2011, the net profit attributable to shareholders amounted to SFr3.84 billion. The 2010 equivalent was SFr5.87 billion.

UBS reiterated that its SFr2 billion cost reduction programme was on track with total restructuring charges in the third quarter of SFr387 million and operating costs down 2 per cent.

Commenting on the latest results, interim chief executive Sergio Ermotti said: “UBS clients and shareholders can rest assured that our financial, capital and funding positions remain unquestionably solid.”

Switzerland’s biggest bank was flying high in 2007, announcing record quarterly profits of SFr5.6 billion in the second quarter of that year.

This figure was achieved despite the collapse of its Dillon Read Capital Management hedge fund. However the figures hid problems that only started to come to light after the sudden departure of chief executive Peter Wuffli in July of that year.

The profits turned into a SFr726 million loss in the third quarter as the bank started writing down subprime mortgage and debt security trades. The bank eventually lost some SFr50 billion in the financial crisis.

In 2008, the situation had become so bad that the Swiss National Bank was forced to bail out UBS with a SFr6 billion loan and by taking over bad debt.

UBS also admitted to aiding and abetting US tax evaders and was forced to pay a $780 million fine in 2008. It later had to release the names of 4,450 clients to the US authorities, denting its own reputation and Swiss banking secrecy laws.

Share prices fell from a high of SFr70 in 2006 to under SFr10 in 2009.

Former Credit Suisse boss Oswald Grübel took over as CEO in 2009 with a mandate to turn UBS around. The bank was back into the black for the full year in 2010 to the tune of SFr7.2 billion.

But a rogue trader scandal, that cost the bank $2 billion, forced Grübel’s resignation in September.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.