FINMA chief warns Swiss banks to cooperate

The head of Switzerland’s banking regulatory body has issued a last-minute plea for Swiss banks to participate in a United States programme to reveal undeclared assets from American clients. But a prominent lawyer says many may not sign up.

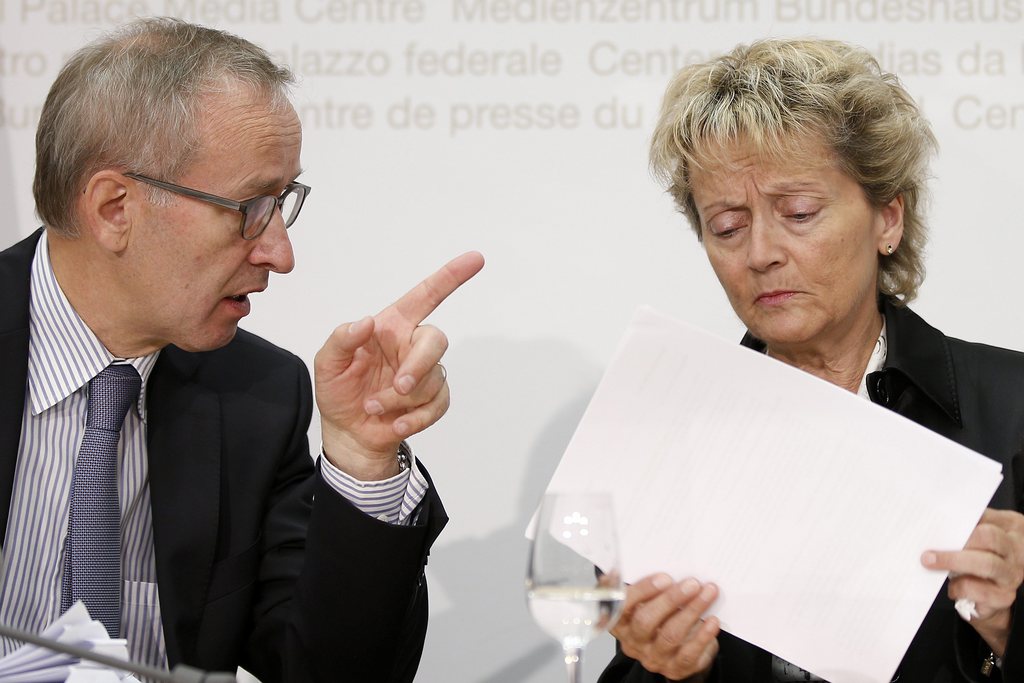

In the Friday edition of the prestigious Neue Zürcher Zeitung newspaper, Patrick Raaflaub, director of the Swiss Financial Market Supervisory Authority (FINMA), said if a bank had any doubt it had run afoul of US law, it should sign up to the scheme and tell FINMA before December 9. Banks have until the end of 2013 to inform the US authorities.

Raaflaub admitted cooperation would be expensive for participating institutions – with fines up to 50% of the value of assets involved – and that the deal offered no 100% assurances that they would face no future lawsuits.

Any bank failing to cooperate “must expect to be involved in a conflict dragged out over years”, he warned, “and the fear of further sanctions from the US authorities.”

But there is a possibility that several banks may refuse the deal.

“The situation is very worrying and many banks are now seriously considering the possibility of not participating in the programme,” Geneva-based lawyer Shelby du Pasquier told the French-speaking Le Temps newspaper on Friday.

The Swiss government, with the backing of the financial sector, signed an agreement with the US on September 3 which aims to end a long-standing dispute over tax dodging.

On Friday, the government said it had cleared the first batch of banks to cooperate with US authorities under a deal to stem tax evasion. However, the finance ministry said in a statement that it wouldn’t give information on the number of banks involved or name them.

Categories

On paper the deal separates banks into different categories. Fourteen banks are in category one and therefore excluded from the programme as they continue to be under criminal investigation. Among them are UBS, Credit Suisse, at least two state-backed cantonal banks as well as private banks Julius Baer, Pictet and the Swiss arm of Britain’s HSBC.

The remaining 300 banks are divided into three other categories. Category two includes Swiss banks not currently under investigation that will provide accountholder information, pay fines, or both, in exchange for deferred prosecution or non-prosecution agreements from the US. Category three are Swiss banks that can prove that they did not aid US taxpayers in tax evasion and category four are local Swiss banks not subject to the American Foreign Account Tax Compliance Act (FATCA).

The institutions have until the end of this year to apply to the programme, then reveal the size of assets involved and the date that accounts were opened.

For accounts already in existence by August 1, 2008, banks would pay a fine equivalent to 20% of the assets held in that account.

Accounts opened between August 1, 2008, and February 28, 2009, would attract a 30% levy. A fine of 50% would apply to accounts opened after February 28, 2009.

In 2009, Switzerland’s biggest wealth manager, UBS, was fined $780 million after admitting to aiding and abetting US tax dodgers.

The following year, the Swiss government handed over nearly 4,500 names of UBS clients to the US authorities, effectively ending Swiss banking secrecy.

The US continued to target other Swiss banks suspected of helping tax cheats and of poaching UBS’s US clients.

In January 2012, Switzerland’s oldest private bank, Wegelin, was forced to sell off its non-US wealth management business as it succumbed to a US criminal investigation.

A year later, the 272-year-old bank effectively ceased to function, with its partners facing massive fines.

In April 2012, the Swiss government authorised a handful of banks to hand over details of US business dealings to the US authorities.

In June of this year the Swiss parliament rejected a government plan to extend the data transfer to other banks, including new information such as the leaver lists.

On July 3, 2013, the Swiss government nevertheless approved the new data transfer deal.

On September 3 the Swiss government, with the backing of the financial sector, signed an agreement with the US which aims to end the long-standing dispute over tax dodging.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.