Cantons battle to save rich tax

A concerted attack against tax breaks for wealthy foreigners has forced some cantons to increase controversial lump-sum levies rather than lose them altogether.

Anxious to avoid the fate of Zurich, that saw lump-sum taxes abolished in a public vote in 2009, other cantons are promising that they will charge rich foreign residents more, and exclude many current beneficiaries in future.

The tactic worked in canton Thurgau last weekend, where voters rejected an initiative to abolish lump-sum taxation. Instead, they approved a counter-proposal from the authorities to increase the average annual tax burden for such individuals from SFr67,000 ($86,000) to SFr150,000 ($170,000).

The issue is less sensitive in canton Glarus where a mere five wealthy residents contribute SFr320,000 to public coffers, compared with the SFr11 million paid by 127 lump-sum tax payers in Thurgau.

As a result, voters in Glarus decided to retain the lump-sum taxes in a May 1 vote without the need for the authorities to tighten up the system.

Stars arrive

Lump-sum taxes have been a feature in Switzerland since 1920, allowing cantons to ignore the wealth and income of wealthy foreign residents as long as this has been earned abroad. Instead, cantons levy a charge typically based on five times the rental value of the resident’s property.

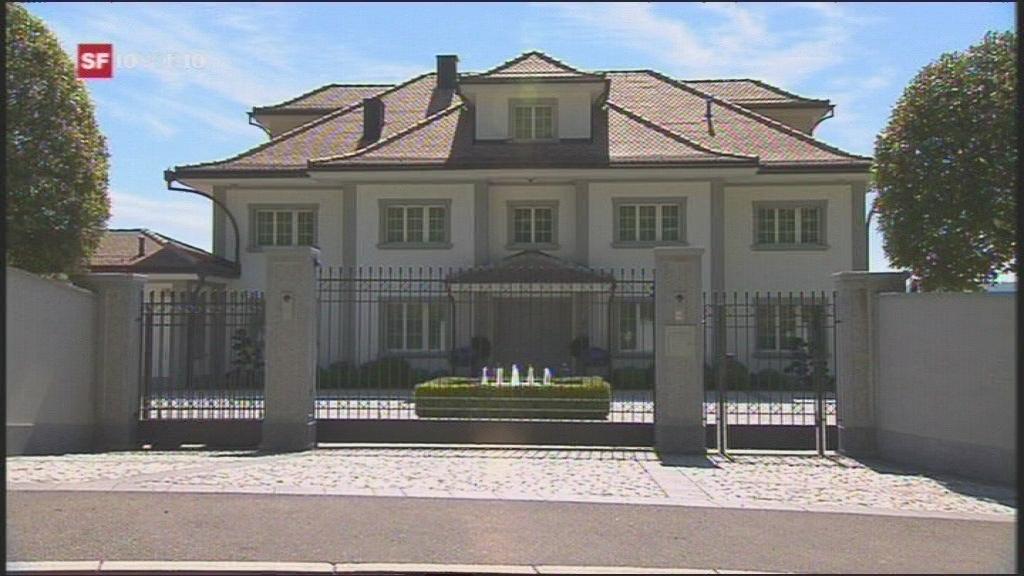

The practice has drawn withering criticism from neighbouring countries for poaching their wealthy citizens and their tax revenues. High profile celebrities, such as Phil Collins, Tina Turner and Michael Schumacher have moved to Switzerland to take advantage of the deal.

Proponents of lump-sum taxation, notably the cantonal finance chiefs, argue that the system generates some SFr600 million ($680 million) in extra revenues each year from more than 4,000 lump-sum beneficiaries.

But since the financial crisis there has been a growing popular backlash in Switzerland against “fat cat” foreigners paying proportionally less tax than ordinary citizens who both live and work in the country.

Communities, which had previously put up with the disparities in tax treatment because the revenues of rich people had boosted public coffers, are now feeling less well disposed to their cosseted neighbours, according to Christian Keuschnigg, a professor of public finance at St Gallen University.

“People are now looking over the fence with a sense of injustice that their neighbour is paying ten per cent in taxes and they are paying 30 per cent,” he told swissinfo.ch. “The issue has become highly politicised and people are losing their appetite for the lump-sum system.”

Cantons strike back

Furthermore, there is a growing feeling of unease that wealthy people are exempt from paying taxes on their incomes, he added. Income, wherever it is generated in the world, is taxed at the country of residence, but the lump-sum system ignores overseas earnings.

“These people are not being fully taxed on their global income anywhere in the world,” he said.

The Social Democrats have long been critical of lump-sum taxes and have recently launched a number of cantonal initiatives, often combining forces with other left leaning political parties.

Zurich was the first canton to feel the force of the popular backlash when voters backed such an initiative to abolish lump-sum taxes from January 1, 2010.

In addition, the leftwing Alternative Left Party is gathering signatures on an initiative that it hopes will spark a nationwide vote.

In response, the government has recommended that lump-sum taxes should be raised to seven times the rental value of properties while only people with an income of at least SFr400,000 would qualify for the tax break.

Voters in Lucerne, St Gallen and Basel City will have their say on the issue in the coming months.

Lucerne and St Gallen have issued counter-proposals to the initiatives calling for the system to be scrapped in those cantons. They have promised to go further than the government guidelines, by both raising charges to seven times the rental property value and imposing a minimum qualifying threshold of SFr600,000.

Revenue hole

The effects on Zurich of having lost its ability to offer lump-sum deals are unclear. Several of the 137 wealthy foreign individuals that had benefited from the system have already left for neighbouring cantons.

But the media have reported that their houses were swiftly filled by regular tax payers while the lump-sum revenues in Zurich are calculated to have represented just 0.3 per cent of total tax income.

However, Zurich clearly felt that the loss of lump-sum tax breaks had helped put it at a competitive disadvantage to other cantons.

To make up for this setback, Zurich put a new financial strategy to voters last weekend that would have given tax breaks to both the highest and lowest earners, plus extra relief for families.

Cantonal politicians argued that the initial SFr400 million in tax revenue losses this plan would have incurred would have been made up in future years by attracting new tax payers. However, voters rejected the plan on Sunday.

In 1862 Vaud became the first canton to introduce separate measures to tax foreigners living, but not working, in Switzerland.

The federal authorities later created a separate tax category for people who came to Switzerland for health reasons and not to work.

Lump-sum taxation is regulated by the Tax Harmonisation Act, brought into force in 2001 to compel cantons to follow the same guidelines when setting individual rates.

Beneficiaries of this system must live at least six months and one day in the canton, have their principal residence in Switzerland or have been absent from their home country for at least 10 years and not be employed within Switzerland.

Tax consultants KPMG conducted a survey in 2007 to compare the numbers of lump-sum beneficiaries in Switzerland in 2003 and 2006.

They found the numbers had shot up from 2,394 in 2003 to 4,175 three years later. This figure has since climbed above 5,000, according to the Swiss government.

Canton Vaud had the most lump-sum tax residents in the KPMG report (1,100 in 2006, 260 in 2003), followed by Valais (860, 647), Geneva (600, 555), Ticino (477, 410) and Graubünden (250, 168).

Canton Zurich occupied sixth place on the list (150, 38) but scrapped the lump-sum tax system at the start of 2010

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.