Cat-and-mouse dance in tax evasion struggle

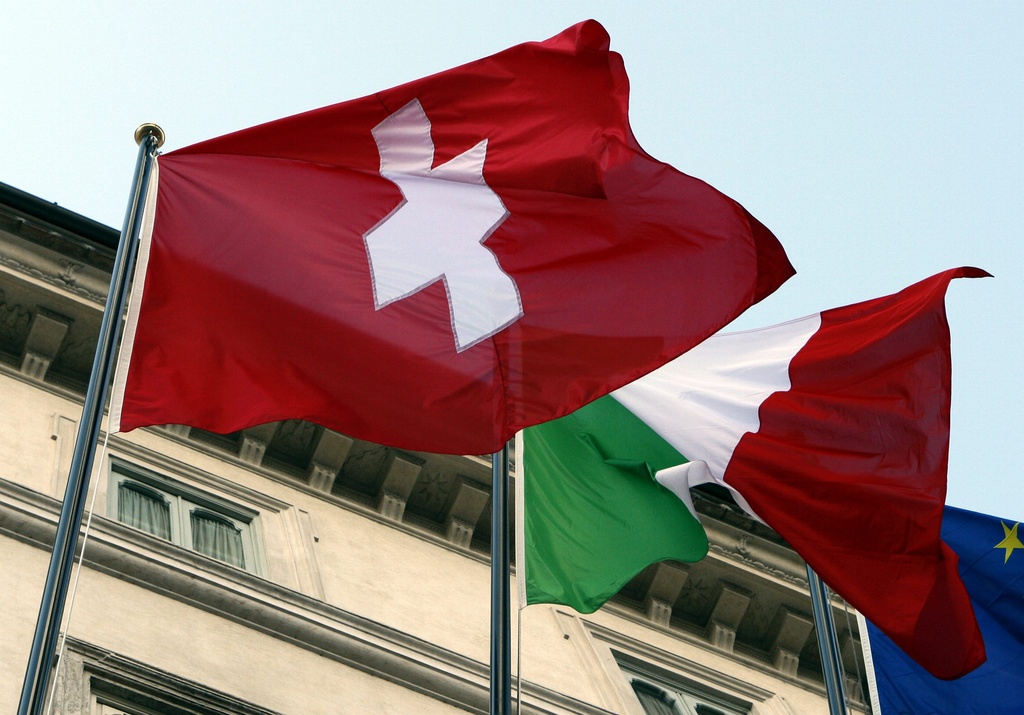

Switzerland’s bid to rid itself of the tax haven mantle has resulted in a delicate game of strategy with the European Union and individual EU member states.

At stake is Swiss banking secrecy, Switzerland’s sovereignty as a bilateral EU partner, countless billions of assets parked in Swiss banks and the multiple millions this wealth should be contributing to the tax coffers of other countries.

The Swiss authorities are attempting to cut individual withholding tax deals with powerful EU member states Germany and Britain, with Italy crying foul from the sidelines and the European Commission observing in the middle.

Added to the heady mix are EU members Austria and Luxembourg which are – alongside Switzerland – resisting the Commission’s wish to introduce an automatic exchange of information in suspected cases of cross-border tax evasion.

The central plank of Switzerland’s strategy is to negotiate deals with Germany and Britain to pay withholding taxes on assets placed in Swiss banks by citizens of those two countries.

Clash looming?

The settlements, which Switzerland hope to conclude by the end of this year, would cough up a retrospective tax on assets held by Swiss banks in the past ten years and continue to pay withholding duties on future deposits.

Mario Tuor, spokesman at the state secretariat for international financial matters, told swissinfo.ch that the deals would boost Switzerland’s argument that withholding taxes are the best way forward.

“We hope to demonstrate to the EU that we have an effective model that does not require the automatic exchange of information,” he said.

For Thomas Cottier, professor for European and international economic law at Bern University, it should be relatively simple to arrange back payments, but a deal relating to future taxes could tread on the EC’s toes.

“I’m not sure Britain and Germany would have the authority to negotiate future withholding taxes because this involves EU law and the related issue of the exchange of information,” he told swissinfo.ch.

“This legal angle could be the weak point in Switzerland’s strategy.”

Incensed Italy

Cottier also fears that such preferential deals could artificially boost Switzerland’s access to the financial markets of Britain and Germany in contrast to other EU states, thus contravening global trade regulations.

And while Switzerland has been making progress with Germany and Britain, its relationship with Italy has gone rapidly into reverse over the issue of taxes.

Italy has retained Switzerland on its own black list of tax havens despite the OECD (Organisation for Economic Co-operation and Development) having cleared the Swiss 18 months ago. As a result, Italy has increased the amount of red tape for Swiss companies, making it harder for them to do cross-border business.

Italian Finance Minister Giulio Tremonti also took the gloves off with some fighting talk at an EU meeting in Brussels on Tuesday.

Tremonti rejected a suggestion to tighten up an existing treaty that allows Swiss banks to pay withholding taxes on the assets deposited by citizens of EU member states. He called the deal a “paper tiger” and a “toothless instrument”.

“Switzerland is not a member of the EU – the EU has become a member of Switzerland,” he added.

Breathing space

The treaty he was referring to – the EU Taxation of Savings Directive – has proved of limited value since it was introduced in 2005. It yielded only SFr401 million ($457 million) to EU countries last year, with Italy receiving just SFr123 million despite Italians holding tens of billions of francs in Swiss banks.

The EC is committed to tightening the various loopholes in the directive that, for example, fail to recognise earnings made from many complex financial instruments.

Swiss bankers have also championed a beefed-up system of paying withholding taxes on client assets that could be utilised around the globe.

For the time being, negotiations between the various parties have reached a finely balanced stage.

Austria and Luxembourg have given their Alpine neighbour breathing space by rejecting EU talk of an automatic exchange of information. Switzerland, in the meantime, is pinning much of its hopes on the proposed deals with Germany and Britain.

It remains to be seen how these deals will look in the final version, whether they would be accepted by the EC and whether they would be strong enough to keep more vociferous critics, such as Italy, at bay.

In 2009, Switzerland bowed to international pressure by agreeing to provide administrative assistance to other countries in cases of tax evasion. Previously, Swiss assistance had only been given when there was evidence of tax fraud.

To take this change into account, Switzerland embarked on renegotiating double taxation agreements (DTAs) with many countries.

The Swiss have renegotiated around 30 new DTAs since it agreed to comply with OECD rules on cross-border assistance in 2009. But Switzerland has resisted pressure from the European Union and the OECD to agree to an automatic exchange of information.

Instead, it has offered to lower its criteria of evidence before giving administrative assistance.

The Swiss authorities have traditionally only responded to calls for assistance when a name of a tax fraud suspect could be produced. Given the strict nature of Swiss banking secrecy, it is often difficult to obtain this information. But Switzerland is likely to lower the threshold for identification by accepting numbers of bank accounts.

1961: Seven countries, including Switzerland, sign the treaty creating the European Free Trade Association.

1963: Switzerland joins the Council of Europe.

1992: The Swiss government requests the opening of negotiations on European Union membership. The application is still on ice.

1992: Swiss voters decide by 50.3% not to apply for membership of the European Economic Area.

2006: A government report on European integration clearly explains that Switzerland’s policy towards the European Union should be based on bilateral relations.

Since 1972 Switzerland and the EU have signed nearly120 accords.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.