Colibrys navigates funding and aerospace systems

Intel Capital, along with four co-investors, has invested SFr15 million in Colibrys in a second round of financing for the two-year-old CSEM spinoff in Neuchatel.

The new capital will fund expansion into the United States.

Colibrys employs some 120 people and had revenues of SFr22 million in 2001. It will report an increase in turnover this year. Sean Neylon, the company’s chief executive officer, is not yet certain about the US location, but said it would likely be on the West Coast, where most of its customers are located.

Its ability to grow and develop its market in a very new area of technology is what convinced existing investors to back the company for the next phase. Nevertheless, the negotiation of the venture capital funding took six months, due more to the economic situation than the company’s performance.

First round investors, Intel Capital, Banexi Bank, TAT Investments, and Banque Cantonal Vaudoise, were joined by a new investor to the syndicate, Credit Suisse’s venture capital arm in Zurich.

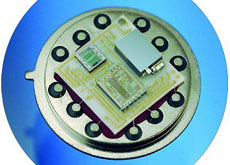

Colibrys owns a brand new facility in Neuchatel, built specifically to fabricate micro-electro mechanical systems (MEMS) in volume. MEMS are electronic devices that are fabricated using many of the techniques used in the semiconductor industry. Colibrys makes standard and custom products.

Important product line

It supplies components to the industrial, printing and scanning equipment market (about 50 per cent of revenues). Optical MEMS devices (about ten per cent), typically found in scanners, fiber optic, and optical recognition systems, are also an important product line.

“Production runs are still relatively small at the Swiss company, but like other new MEMS players coming into the market, it hopes the niches it targets will turn into large markets,” says Eric Gulliksen, manager of the embedded hardware group at Venture Development Corp., a market research firm.

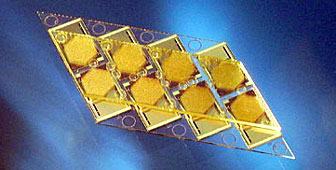

Its fastest growing market at the moment, representing 30 per cent of revenues, is aerospace and military customers who are acquiring inertial navigation systems and accelerometers, which have to been tested to a very high level or reliability and quality. They are robust enough to withstand the shock of a missile launch, but sensitive enough to do the job once the system is in flight.

This market is growing at a rate of 100 per cent, according to Neylon.

Military buildup

“The munitions sector is showing strong demand at this point in time. It is one of the few ‘solid’ high tech business areas these days. It declined somewhat when the Cold War ended, but has picked up again recently with a munitions buildup in the US and Europe following September 11 and the ensuing Afghanistan military operations,” says Gulliksen who believes that the defense demand may create the kind of mass market Colibrys needs in order to thrive.

Inertial sensors can deliver information on speed, distance, and direction back to military personnel or computer systems that respond with corrective information to reach targets more accurately. A guidance computer may even be built into a missile or bomb itself.

“For high-speed ‘smart’ bombs, or tactical missiles, inertial navigation sensors may provide faster feedback than GPS or laser tracking,” says Gulliksen. He is referring to “limited tactical missiles”, which are small bombs, with precision guidance and low yield with “only enough blasting power to take out a car, not a village.”

Colibrys cannot name the companies buying the military oriented sensors because of nondisclosure agreements. Its customers are fiercely competitive, but he does say they are among the top US and European vendors in the sector.

A startup with a past

Colibrys was a division of CSEM, a non-profit institute that balances basic and applied research, before being spun out in 2001. That background gives it a foundation and know-how in fabricating products for a range of applications.

It is this breadth of experience, as well as its process and design know-how, that attracted Intel Capital, according to Michael Dierks, Intel’s director of strategic investment.

“Eventually, Intel could be a customer of Colibrys,” said Dierks. It already is indirectly, according to Dierks, because Intel uses equipment from ASML Holding NV, the Dutch lithography, track and thermal systems vendor. ASML uses micro-optical devices (diffractive elements) from Colibrys in its lithographic steppers.

Unlike other semiconductor vendors, such as STMicroelectronics or Analog Devices, Intel is not selling any MEMS products – yet. But Dierks said that Intel Capital has a MEMS strategy – funding R&D in-house and in academia.

Colibrys’ expertise fits with two of the long-range visions of Intel executives, such as Radio Free Intel,” says Dierks, referring to Intel’s ambitious R&D effort into the radio-frequency (RF), software-defined radio, and related wireless sectors. The vision sees all computer processors eventually integrated with high-speed wireless access – on a single chip.

Colibrys recently beat competitors in the United States, France and the Far East to win business from up and coming GalayOr Networks (Lod, Israel), because of its ability to handle complex designs.

Other MEMS foundries with a business model similar to Colibrys are Sensonor (Horten, Norway) and Applied MEMS (Stafford, Texas). But they are differentiated at the moment and targeting different applications, according to Kees Eijkel, technical commercial director of the MESAplus institute, a large MEMS research at the University of Twente.

Valerie Thompson

Intel Capital, with four co-investers, have invested SFr15 million in Colibrys.

The new capital will fund expansion into the US.

Colibrys makes micro-electrical mechanical systems (MEMS).

Its fastest growing market is aerospace and military equipment.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.