Credit Suisse devalues assets in surprise move

A week after presenting what it considered good financial figures for 2007, Credit Suisse says it's written off $2.85 billion (SFr3.12 billion).

An unexpected announcement on Tuesday sent the share price of Switzerland’s second-largest financial institution down by 6.6 per cent at the end of trading on the Swiss stock exchange.

Credit Suisse said an internal review had found traders had overpriced some of its assets. Chief executive Brady Dougan said an unspecified number of them had been suspended.

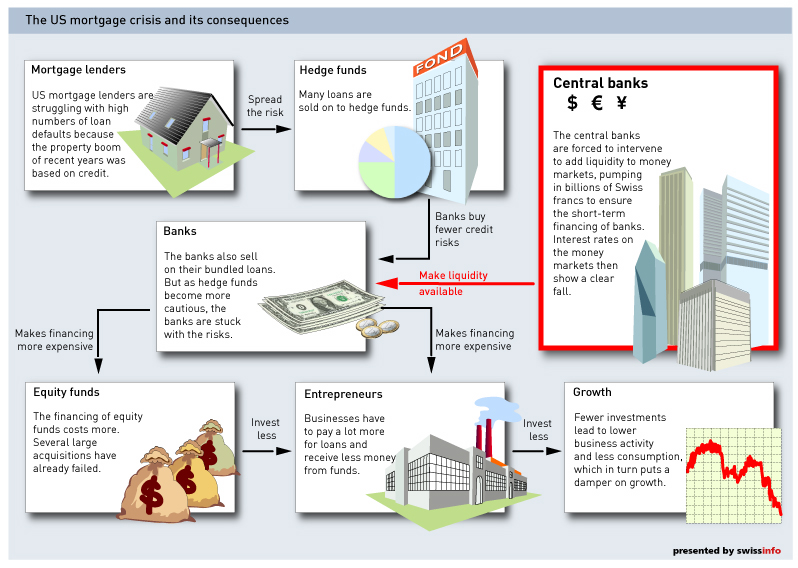

The writedown was the latest in a string of shock announcements by global banks and follows revelations of huge new subprime mortgage-related exposures at rival UBS and a trading scandal exposed last month at Société Générale in France.

The bank said the writedowns would wipe $1 billion from its first-quarter net income, but it still expected to stay in profit in the quarter despite the charge.

It added that the final determination of the reductions would depend on further results of its review and market conditions.

“We will also assess whether any portion of these reductions could affect 2007 results,” the bank said.

A Credit Suisse spokesman said he was unable to quantify the impact of the errors on the size of the writedowns.

“Disaster”

Analysts said they were stunned by the announcement by the CS Group, which until now had been practically unblemished by the subprime crisis.

“This is a disaster. This could be the tip of the iceberg,” said Helvea analyst Peter Thorne.

“It’s pretty shocking, but I think they can absorb it,” an analyst at a US investment bank told Reuters. “But from a sentiment point of view, it is very bad.”

The announcement was triggered by disclosure requirements relating to the listing by Credit Suisse of a $2 billion bond, which closed on Tuesday.

In another reaction, the Swiss Federal Banking Commission said the situation of the bank’s own resources was “very good” and it had not intervened.

swissinfo with agencies

Credit Suisse on February 12 reported net income for 2007 of SFr8.549 billion, down by 25% from a record SFr11.327 billion in 2006.

At the same time it said that fourth-quarter net profit had dropped 72% to SFr1.33 billion owing to writedowns for investment banking and money-market funds.

Net loss of SFr4.38 billion (SFr12.26 profit in 2006)

Operating expenses SFr8.59 billion (SFr8.65 billion 2006)

Employees: 83,560 (78,140 in 2006 and 83,814 in September 2007)

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.