Exporters pick path through economic minefield

Swiss exports are moving inexorably east to diversify risk and tap new consumers, but companies are not entirely burning their bridges with established markets.

The trend is being driven as much by new opportunities in rapidly expanding emerging economies as by a flight from unfavourable exchange rates in Europe and the United States.

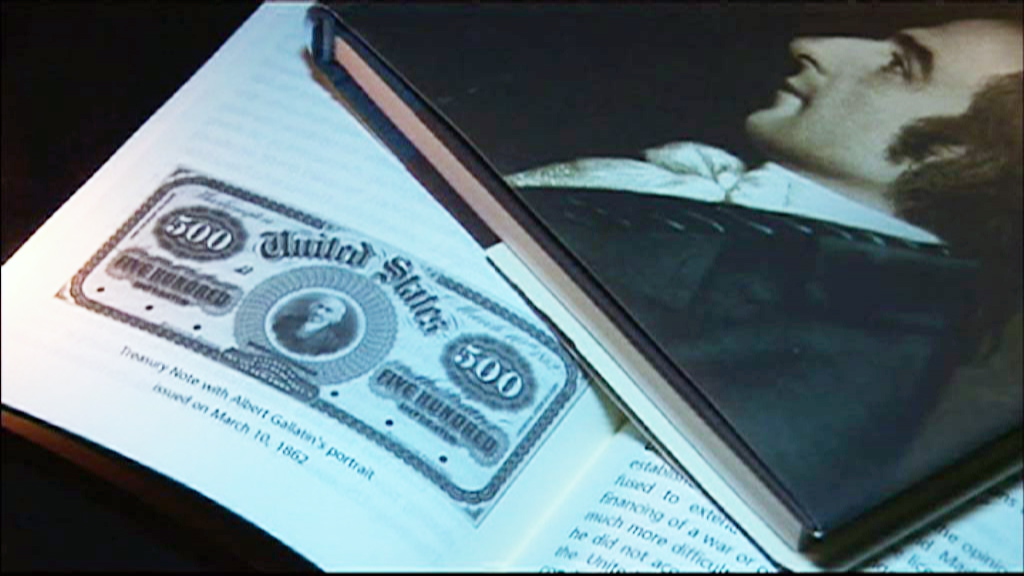

Customs figures released in February revealed a 19 per cent rise in Swiss exports to China and the same hike in Hong Kong last year. The Indian market absorbed 15 per cent more Swiss goods and services while Russia saw a 13 per cent increase.

The European Union’s share of Swiss exports has sunk from two thirds to 60 per cent within a couple of years while the Bric countries (Brazil, Russia, India and China) accounted for 8.4 per cent of total Swiss exports last year compared with 7.6 per cent in 2010.

The strong franc has weakened Swiss export sales in Europe and has been largely blamed for Swiss companies having to cut prices by an average of 5.5 per cent last year to prevent orders drying up.

No panacea

But the strong franc and deteriorating economic conditions in Europe were not the only reason that Baumot, a Swiss firm specialising in vehicle exhaust filters, entered the Chinese market for the first time 18 months ago.

Baumot recognised pollution as one of the biggest challenges in the world’s fastest growing economy and expects China to contribute nearly a third of the firm’s revenues in future as the country cracks down on emissions.

But Baumot chief executive Marcus Hausser warns against viewing China as the magic cure for Swiss exporters.

“Our biggest market is still Europe because all important technology trends in our industry are driven from there,” Hausser told swissinfo.ch.

“China is big and it is important to be there,” he added. “But companies that rely on China as their only future core revenue driver might run into severe problems if there is an economic hiccup.”

Filling trust gap

While admitting that the speed of the franc’s recent appreciation against the euro and the dollar has caused headaches, Hausser said Swiss firms are used to competing with the handicap of a strong domestic currency.

“If the only advantage of your product is that you sell it out of a region with a weak currency, you had better go back and think about your strategy,” said Hausser as he likened the currency impediment for Swiss firms to training for a marathon by running up hills.

Hochdorf, a company based in the town of the same name in canton Lucerne, also saw a largely untapped market potential for its products in China.

The nutrition group that supplies milk and cereal products for baby food believes it can provide Chinese consumers with a trusted alternative to local products that have been tainted by melamine scandals.

“Many families have learned not to trust local milk products,” Hochdorf regional manager for Asia, Edith Koch, told swissinfo.ch. “Swiss-made products have an excellent reputation for high quality and we produce to such high standards. This gives us a good chance of gaining greater access to the market.”

Having set up in the country in 2009, around a third of Hochdorf’s total global infant powdered formula exports are now to China.

Low hanging fruit

But Asia is not all things to all Swiss exporters. The rise in Swiss exports to China and Asia have been somewhat distorted by the massive increase in watch sales in this region.

Exports unsurprisingly dried up last year in Europe’s most debt laden countries (notably Greece and Portugal) but also to stronger economies such as Britain and the Netherlands.

Germany, which has traditionally been the largest single market for Swiss firms, absorbed six per cent more exports in 2011. Germany also accounted for half of the SFr4 billion ($4.4 billion) hike in exports in terms of value.

Germany’s own export industry blossomed last year, hitting the €1 trillion (SFr1.2 trillion) mark for the first time, dwarfing Switzerland’s SFr197.6 billion in exports trade.

But the economic success of Switzerland’s large neighbour also helped improve the fortunes of many Swiss firms. As German manufacturers churned out goods in record volumes last year, Swiss companies were on hand to supply supporting equipment and innovation.

Diversify, diversify, diversify

Another recently maligned market, the United States, provided Swiss exporters with a stable level of business last year. Exports to the US rose 2.4 per cent in 2011, cementing its position as the second biggest market for Swiss firms.

The government agency Osec that helps Swiss firms break into foreign markets nevertheless said its recent advice to companies was to diversify risk and reward away from traditional regions.

“Sustainable export strategies should not be too dependent on the euro and dollar zones,” he told swissinfo.ch. “There are increasing export opportunities for Swiss companies in emerging economies, particularly Asia.”

“There are 600 million consumers in the ASEAN [South East Asia] region. Countries such as Indonesia, Vietnam, Thailand and the Philippines are becoming increasingly important for export driven Swiss companies.”

“But a successful export strategy should have a long-term focus. It is extremely difficult to realign strategies to emerging markets in a few months if, for example, 80 per cent of a company’s exports go to the eurozone.”

Swiss exports increased 2.1% last year to reach a value of SFr197.6 billion, but remained almost SFr9 billion below the 2008 level.

The slight increase in exports in 2011 came at a cost to many companies which had to decrease prices by 5.5% — the biggest annual slump since records began.

The watch industry was untroubled by the global economic turbulence, racking up an impressive 19% increase in exports – including a 48% rise in China.

The only other sectors to record a 2011 export increase were the metals industry (+2.2%), machinery and electronic engineering (+1.2%) and Food, beverages and tobacco (+0.6%).

Exports in paper and graphic arts fell 12.5%, textiles by 6.5% and clothing by 3.8% – representing the biggest losers by industrial group.

Exports to Asia rose by 9.6%, led by China (+19.2%), Hong Kong (+18.8%) and India (+15.2%).

Exports retreated significantly from Europe’s most debt-laden markets (i.e. Greece and Portugal) but also fell back 9% in Britain and 10.7% in the Netherlands. Exports to the European Union shrank 0.7%.

But Switzerland’s two largest export market countries, Germany and the United States saw gains. Exports to Germany rose 5.5%, accounting for half of the global export growth by sales volumes, and by 2.4% in the US.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.