Giving businesses early warning on corruption

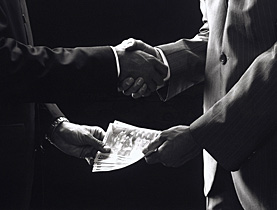

The rising tide of anti-corruption legislation and the growing cost of reputational damage are forcing companies to be more careful about who they do business with.

Steering clear of laundered money, organised crime, bribery and trading sanctions is a priority. One enterprise, formed to help Swiss banks comply with money laundering rules, specialises in keeping firms out of hot water.

Despite their best efforts, many multinationals still sometimes find themselves on the wrong side of the law. This year, Swiss firm ABB was fined after a bribery probe while Credit Suisse was also forced to pay up for dealings with countries subject to United States sanctions.

Even Swiss state telecoms provider Swisscom has been unwittingly drawn into a money laundering probe with mafia links after buying an Italian company.

Doing business on a global scale has turned into a minefield and the rising costs of negotiating a safe path have spawned a new industry that allows companies to outsource some of the expensive research.

World Check is one such enterprise that provides companies with intelligence on the more shady characters to avoid doing business with. Its database of Politically Exposed Persons (PEPs), as they are quaintly referred to in industry jargon, is now indispensible reading for bankers, mining firms, lawyers, casinos and 200 government agencies in 90 countries.

Information available

Uncovering the hidden bad guys is far removed from the world of subterfuge, phone tapping and wading through rubbish bins. In reality, it involves the more mundane task of sifting through reams of publicly available information – known as open-source intelligence.

“Our sources might range from an Interpol arrest warrant, the UN sanctions list, BBC news reports or academic research,” World Check founder and executive chairman David Leppan told swissinfo.ch.

“When we started, I would never have believed that we could in the public domain be able to uncover on people what we have been able to uncover.”

He added: “We have a more and more transparent world where it is nigh impossible to control the flow of information on the Web. You can hide for a certain period of time, but the moment you entrust information to somebody there is a bigger risk that it will get into the open.”

Having obtained the pieces of information, World Check then sets about assembling the pieces of the jigsaw until the breakthrough is achieved.

“You might be dealing with a guy who is crystal clean, but two steps away you have a problematic individual. It just takes one little piece of information that helps join the dots and suddenly everything just jumps out at you,” Leppan said.

Terror attack

World Check formed ten years ago to help Swiss private bankers avoid money launderers. But the client list expanded rapidly after the September 11 terrorist attacks, when it was discovered that the perpetrators had used normal high street banks to hide their assets.

The company then branched out into helping clients avoid corrupt officials in other countries and to steer clear of breaking trading sanctions placed on nations. It now employs 500 staff, including a convicted former money launderer, to service some 4,600 companies in 160 countries, generating an annual turnover of $70 million (SFr67 million).

World Check is one of the global leaders in the sector, according to anti-corruption watchdog Transparency International.

“It has become difficult for any large bank to explain how they could do without such a database of PEPs,” Transparency spokesman Daniel Thelesklaf told swissinfo.ch.

But organised criminals always seem to be one step ahead of the enforcement agencies and legislators, he warned. The most common loopholes to detection are to open trust funds, move assets to less transparent jurisdictions or to start up fake cash-generating businesses, such as motor dealerships, casinos and fashion boutiques.

Lack of resources

Perhaps more surprising is that Leppan agrees that the fight against money laundering is practically a lost cause.

“Organised crime is as successful today as it has ever been,” he told swissinfo.ch. “It still continues to generate and embed billions of dollars every year right under our noses. We are clearly all failing hopelessly.”

World Check’s task is to defend its clients against corrupt practices, not to stop them from taking place. The biggest hurdles to stamping out money laundering is the limited resources of police agencies, and particularly, financial regulators.

“Regulators are often trying to do this with a skeleton staff, massively under-resourced and with outdated technology,” he said.

“Governments fall short by asking business communities to comply and then not backing it up by giving regulators the means to action the mass of suspicious transaction reports.”

Money laundering, the act of concealing the ill-gotten gains of criminal activity, is by its shady nature hard to calculate.

In 1996, the International Monetary Fund declared that laundered money equalled some 2-5% of total global gross domestic product. This would equate to $590 billion-$1.5 trillion (SFr566 billion-SFr1.44 trillion).

However, Transparency International does not believe there are any credible figures available to accurately reflect the true state of affairs.

Several pieces of legislation have been enacted to make it harder for criminals to hide their assets. Much of the global legislation was triggered by the 9/11 terrorist attacks in the US.

However, the Swiss Federal Law on Combating Money Laundering in the Financial Sector has been in force since 1998.

Under the “Know Your Customer” principle, banks and financial institutions are obliged to conduct due diligence to verify the identity of the owner of deposited assets.

In Switzerland, any deposit or transaction over SFr25,000 must be checked.

The US Patriot Act of 2001 beefed up regulations for financial institutions in the US to prevent money laundering and to identify the owner of assets.

The United Nations Security Council resolution 1373 of 2001 called on all countries to “prevent and suppress the financing of terrorist acts”.

The European Union launched a second Money laundering Directive in 2001 followed by a third in 2006.

Many other countries have introduced their own legislative responses to money laundering.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.