Job cuts prompt economic soul-searching

Amid a stream of job cuts by Swiss firms, all eyes are fixed on the two potential temporary solutions – a weaker Swiss franc and the government’s rescue package.

The government expects to start dipping into its SFr500 million ($550 million) unemployment benefit fund by the end of the year.

Meanwhile, export businesses and trade unions are pressuring the central bank to again intervene against the strong Swiss franc – a move economists say would be a big mistake.

Since September, barely a week has passed without another Swiss company announcing restructuring plans.

More than 14,000 jobs were slashed in the last three months alone by around 30 firms ranging from the country’s biggest banks to small textile makers. Some firms, like pharma giant Novartis, are moving some production abroad to protect their earnings.

The government’s rescue package, agreed in September, is no more than a feel-good measure for industry, according to Thomas Daum, director of the Swiss employers association.

“The problem of the strong franc is more or less the basis of all the [current] problems,” he told swissinfo.ch, adding that many issues would become “less severe” with a weaker franc.

Faced with the franc’s near parity with the euro in August, the Swiss National Bank (SNB) set a new minimum exchange rate of SFr1.20 in September – the first time it has done so in three decades. But in light of the gloomy economic outlook businesses and unions have been calling for it to be upped to between SFr1.30 and SFr1.40.

“All exporting enterprises would love to see that,” Swiss Business Federation, economiesuisse, chief economist Rudolf Minsch told swissinfo.ch. But these are “illusory targets”, he said, adding, a limit of SFr1.25 was a “maybe.”

“Difficult” times ahead

Raising the floor might help for a couple days, but it’s just not “economically relevant because the higher the value is fixed the more likely it will be problematic to defend in times of crisis”, Minsch said.

Quarterly statistics point to slowed economic growth, with demand falling substantially, and the government expecting 0.9 per cent growth next year.

This week Economics Minister Johann Schneider-Ammann forecast “difficult” months ahead. He has said around 40,000 jobs could go because of the strong franc. But he has ruled out talk of a second government aid package until the first had been rolled out.

The largest chunk of Switzerland’s SFr870 million rescue package will go to the state unemployment benefits plan, with most of that being used to subsidise the wages of workers who have had their hours and pay compulsorily reduced – the “partially unemployed”.

Another SFr212.5 million will go to a research and innovation programme to improving business acumen. Around SFr100 million will go towards tourism.

The government has received numerous requests by companies wanting to access the funds – around 130 in the last two weeks alone. Applications are first being reviewed by cantons and a working group is expected to process most of them by the end of the year.

For the Swiss employers association however, the package is “80 per cent psychological”. “It’s a signal to employers not to carry out layoffs straight away but to try shortening working times and to try taking advantage of [other] possibilities,” said Daum.

In the absence of measures to introduce a weaker franc, companies were having to make do, Daum said. “It’s up to the companies, it’s up to the employers, it’s up to the employees, with a lot of flexibility, with a lot of innovation, to struggle for less.”

“There are more and more companies who can’t afford to go ahead with the same structure they had until now, so we are seeing all this restructuring.”

Looking long term

Minsch, of economiesuisse, said he did not expect the Swiss National Bank to cave in to outside pressure.

In his eyes, September’s intervention had prevented much more dramatic job cuts from taking place. “Part of the job losses are also simply some restructuring effects, which are necessary from time to time, especially in bigger enterprises,” he said.

Were there any other measures that could be taken to improve the situation in the short term?

“You can do close to nothing,” said Minsch. Direct subsidies to export businesses are not allowed under World Trade Organization agreements. What has been done – and rightly so – is to ensure there is flexibility in the government’s unemployment benefits programme, allowing for partial unemployment payouts, he noted.

“What has been done is to really focus on long term perspectives. There we see the most influence you can have is to provide a better business environment, cutting taxes, adding free trade agreements with China and other countries, and also investing a lot in research and development.”

Meanwhile, the State Secretariat for Economic Affairs (Seco) told swissinfo.ch: “The respective departments would look at other measures depending on how the economy and financial markets act”.

The Swiss National Bank said this week it expected the franc to weaken over time, with vice-president Thomas Jordan telling one newspaper that the central bank was prepared to raise the exchange rate limit if economic forecasts and a risk of deflation so required.

Having racked up massive losses during past interventions in 2009 and 2010, the SNB’s books are so far looking much healthier this time around. But the fear is that a complete breakdown of the European debt crisis could spark a concerted run on the euro, forcing the central bank to spend billions keeping the franc down.

The SNB’s next quarterly meeting is in December.

Major job cuts announced in the past three months:

Alpiq 450

Bobst 420

Swiss Federal Railways Cargo 200

Credit Suisse 3,500

EFG International 250

Huntsman 580

Jet Aviation 300

Julius Bär 150

Kudelski 270

Novartis 2,000

Schindler 1,800

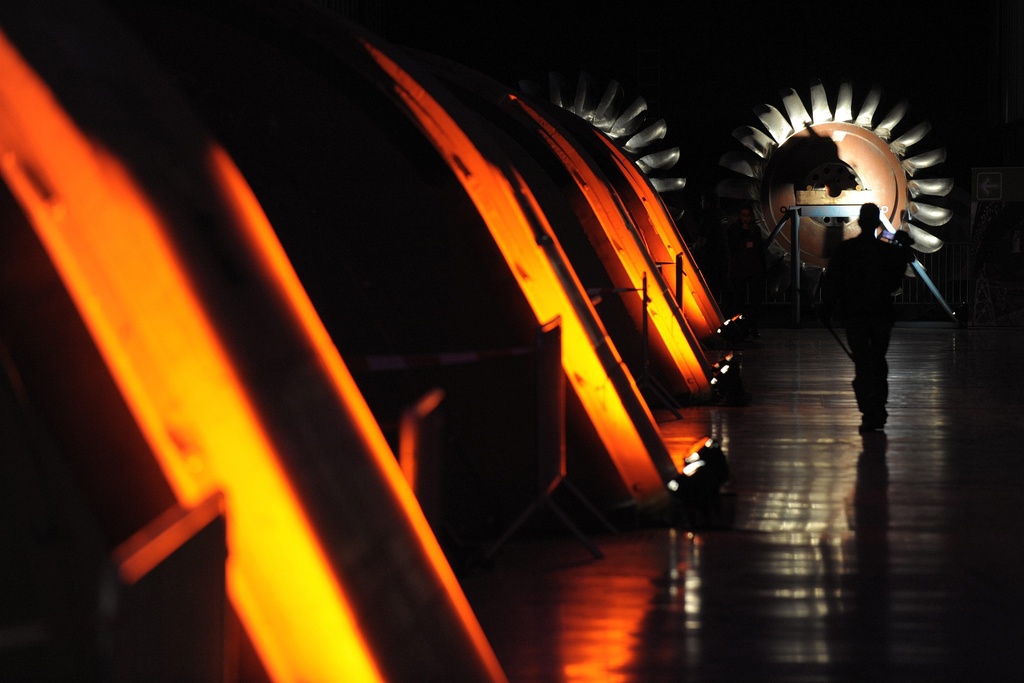

SR Technics 250

Swissmetal 180

Swissprinters 247

UBS 3,500

At the end of October 2011 there were 115,178 people unemployed. It was a 3,834 rise on September and took the jobless rate from 2.8% to 2.9%.

But it was still 17.4% less than the same month last year.

Among those unemployed were 17,710 people under the age of 24. In August 2,514 people took partial unemployment benefit, 299 more than in July.

Swiss figures do not include the long term unemployed (over two years out of work). If Swiss and European figures were harmonised, the Swiss jobless rate would be more like 4%.

Switzerland’s unemployment rate is still one of the best in the world. European Union figures show a 9.7% rate for the zone.

The Swiss franc is a so-called “safe haven” currency, which means that investors and speculators buy it when other currencies, including the euro and the dollar, are under pressure.

The Swiss National Bank has emphasised that it does not pursue an exchange rate target, but consistently bases its monetary policy on its legal mandate.

This mandate stipulates that “the SNB is required to ensure price stability, while taking due account of economic developments”.

Starting in March 2009 the SNB intervened in currency markets. But after pumping in 15 per cent of GDP in May 2010 to little effect as the Swiss franc surged during the first round of the Greek debt crisis, it dropped the plan June 2010.

These forays led it to a loss of SFr21 billion last year, its biggest ever.

The SNB further intervened in the markets this year before announcing a floor exchange rate of SFr1.20 against the euro in September.

Since then, the franc has hovered above that mark thanks to the SNB’s pledge to buy unlimited amounts of foreign reserves.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.