Job losses loom as ABB plunges into red

Switzerland's beleaguered engineering giant, ABB, says it has no choice but to axe more jobs and sell assets, after posting a third-quarter net loss of $183 million.

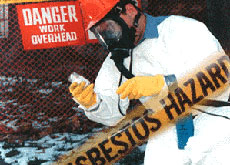

The Swiss-Swedish group is battling to cut a $5.5 billion (SFr8.3 billion) debt mountain, amid ongoing fears of huge asbestos liabilities in the US.

Delivering its third-quarter results on Thursday, ABB said earnings before interest and taxes (EBIT) fell 44 per cent to $405 million for the first nine months of 2002.

ABB hopes to cut costs by a further $800 million over the next 18 months, a move that would likely lead to thousands of job losses.

“The situation at ABB is very discouraging… this is certainly not fat that ABB is cutting,” Andres Gujan, from Zurich’s Vontobel Bank, told swissinfo. I’m sure thousands of well qualified employees will be targeted by this restructuring.”

Unions warned that up to 20,000 ABB workers around the world could lose their jobs as a consequence of the restructuring.

Sell off

The company has also announced plans to sell off its oil, gas and petrochemicals division (OGP) and to restructure its core businesses in a bid to restore market confidence in the battered group.

The sale of OGP – a profitable division that employs some 12,000 people and turns an annual profit of between $150 million to $200 million – would significantly reduce ABB’s overall size.

Gujan says the sale – due within 12 months – should yield some $1.5 billion, enabling ABB to retire some of the $3.7 billion in debts that will fall due in the coming year.

“It’s an important division. It’s one of the profitable ones,” he says.

Jörgen Dormann, ABB’s chief executive and chairman, announced the drastic overhaul just days after warning that the company would miss its financial targets for this year.

“We are expecting difficult times,” says Dormann.

ABB is also considering bankruptcy protection for its US subsidiary, Combustion Engineering (CE) – currently facing a $1 billion asbestos bill that outstrips the units’ book value.

Fears that the liability could be extended by the US courts to ABB itself have cast a long shadow over the company’s future prospects.

Share rout

ABB’s run of bad news has pushed shares in the former powerhouse to record lows – further undermining its already shaky equity-to-debt ratios.

After two harrowing days on the Swiss stock market – ABB shares fell by over 60 per cent on Tuesday, and another 20 per cent on Wednesday – Thursday saw its stocks recover from an all-time-low of SFr1.41 to around SFr 1.88.

In addition, the company’s bonds have fallen to near junk grade, reflecting the fact that many investors have lost confidence in the company’s ability to honour future debt payments.

Dormann blamed ABB’s nine-month operating loss on an eight per cent downturn in orders to $16.6 billion, while sales slipped two per cent to $16.04 billion.

ABB plans to reorganise itself from five divisions to three – Power Technologies, Automation Technologies and OGP.

“The risk of failure is high… emergency disposals are required to try to keep the company afloat,” says Fabrice Theveneau, at Société Générale.

Dismay

Some of Switzerland’s ABB workers echoed the sentiment, expressing disbelief at the company’s collapsing share price.

“The shares are virtually free. You have to ask yourself whether there is anything of substance left. The whole thing is very unsettling,” says one.

One mechanic, already pensioned off, said he felt sorry for younger workers. “There may not be much left for them,” he says.

Yet despite the gloom, some Swiss commentators maintain that ABB remains a dynamic company, with new ideas and some of the world’s best people.

The Zurich-based Neue Zürcher Zeitung insisted on Thursday that the company’s intrinsic worth far outstripped its current market capitalisation.

“Why has the price and value of ABB fallen so far apart?” asked the newspaper, blaming overly bleak market assessments for the share rout.

Optimism misplaced

But Gujan, from Vontobel bank, says bankruptcy remains a real possibility.

“It’s certainly tempting to buy ABB shares now, because the market capitalisation is only SFr2 billion, compared to sales of SFr30 billion. It’s very cheap,” says Gujan.

“But the investor should be aware that he can lose even this. It may be that ABB will see much higher share price levels, but it could also be the whole group will be dissolved into bankruptcy.”

swissinfo

Earnings before interest and taxes (EBIT) fell 44 per cent to $405 million for the first nine months.

ABB warned on Monday that it would miss its financial targets for the year, sending its stock plummeting.

The company plans to save $800 million in 18 months through restructuring.

It gave no details about possible job cuts – 12,000 have already gone out of a workforce of 150,000.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.