Money matters dominate old age pension reform

The debate over a proposal to offer early retirement under the state-run old age pension scheme has been focusing on financial matters.

But critics say discussions ahead of the nationwide vote on November 30 do not take into account the contribution made by experienced workers and the role of the older generation in society.

The proposal – launched by trade unions and supported by the centre-left Social Democrats and the Greens – is aimed at granting early retirement at the age of 62 to all those who earn less than SFr120,000 ($103,400) a year and wish to give up gainful employment.

“Flexible retirement must no longer be the privilege of high income earners,” said Paul Rechsteiner, president of the Trade Union Federation.

He said those who needed the possibility more than many others – employees in the health sector, people working in hotels and restaurants, shop assistants and craftsmen – could not at present afford to stop working.

The union proposal was also a way of putting pressure on the government which had promised to introduce a flexible retirement age back in 1995, said former Interior Minister Ruth Dreifuss.

The unions have vehemently dismissed allegations that the latest reform would cost too much. They argue that opponents have for the past 60 years always put forward financial reasons, but history has proved them wrong.

“The old age pension system is unique and has been a success story. Contributions are linked to income, and for more than 30 years the funding rate remained unchanged, ” said Otto Piller, who headed the Federal Social Security Office until 2003.

Cost of dignity

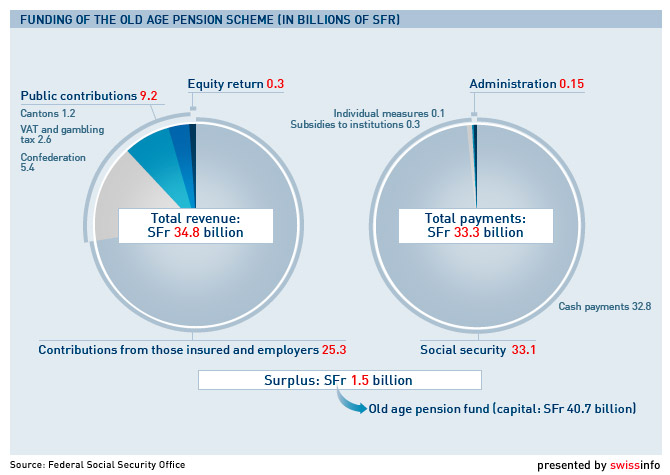

The main argument in the run-up to the vote is likely to be the long-term funding of the pension scheme.

“The decisive factor is whether the costs or the possibility for individual and dignified retirement are considered more important,” says Claude Longchamp of the gfs Bern polling and research institute.

But it is not possible to say precisely what impact the global financial crisis has had at the initial stage of the campaign ahead of the ballot. In a first opinion poll 52 per cent of those interviewed came out in favour of the union proposal.

Proposals to boost social security traditionally receive more support in the French- and Italian-language region than they do in the majority German-speaking part of Switzerland, according to Longchamp.

However, it is very rare that people’s initiatives win the necessary majority at the ballot box.

Bucking European trend

The government as well as the main centre-right and rightwing parties are opposed to the trade union plan saying it is a misnomer, costs too much and goes against the general trend.

“The initiative aims for the retirement age to be lowered to 62 across the board. No other government in Europe is doing that,” said Interior Minister Pascal Couchepin.

The number of people taking early retirement has increased to 20 per cent over the past year, but the quota is still relatively low compared with other countries.

“Those who have health problems can stop working and take early retirement under the current system,” argued Radical Party Senator Christine Egerszegi.

Switzerland’s pension scheme is based on a state allowance, occupational pensions and individual savings.

There are concerns that it would be impossible to check whether old age pensioners who move abroad are complying with the rules, including a ban on paid professional activities post retirement.

More

Pensions (Three Pillar system)

More than money

Ruedi Winkler, an employment consultant, says it is regrettable that the pension reform is limited to financing issues.

“Instead, more should be done to encourage older employees to stay at work and give them the recognition they deserve,” said the former head of Zurich City’s labour department.

Winkler says it is a fact that many employees aged around 50 often feel unwanted and are demotivated.

But it is not only about a lack of incentives.

“The older generation also has a responsibility towards society. Never before in the history of humanity have so many people grown so old and remained healthy.”

He says one way of returning something to the general public could also be to do voluntary work of some sort.

swissinfo, Urs Geiser

Regular retirement age: 65 for men, 64 for women. At present early retirement is possible two years beforehand, but with a reduced pension.

Estimations of the financial costs of the new early retirement system vary between SFr500 million and SFr1.46 billion. It would have to be funded through an increase in VAT or higher salary deductions.

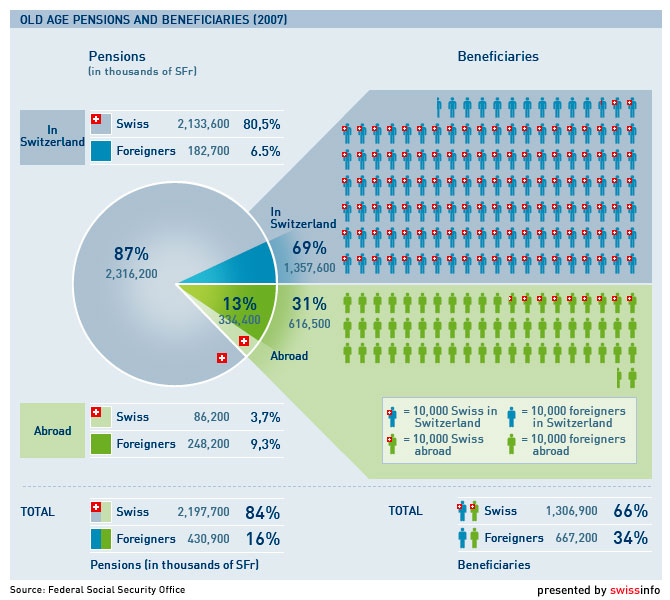

About 70,000 people a year would benefit from the early retirement system – 30,000 of them living outside Switzerland.

In 2003 the building sector introduced an early retirement scheme from age 60.

The pension system is based on three pillars, including state pension, the occupational pension and personal savings.

The state-run old age pension scheme was introduced in 1948. Discussions are underway in parliament for another reform, including ways to ensure the financial stability of the system.

It is the 17th time in Swiss history since 1925 that voters have been asked to decide on the old age pension scheme at the ballot box.

In 2004 the electorate threw out a plan to raise the retirement age for women to 65.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.