National Bank defends interest-rate decision

The president of the Swiss National Bank (SNB) has defended his decision not to raise interest rates, saying the economy has “lost some momentum”.

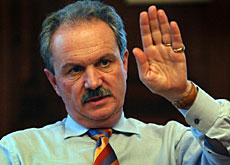

In an interview with swissinfo, Jean-Pierre Roth said the economic recovery was not proving to be as dynamic as expected.

Businessmen and economists have welcomed the decision to leave the rate unchanged after two successive rises earlier this year.

The Swiss Business Federation, economiesuisse, which warned last week that the Swiss economic recovery was now too “fragile” to support a further rate hike, described the announcement as “the right decision”.

Swissmem, the umbrella organisation of the country’s machine industry, said a further rise – and a resulting increase in the exchange rate of the franc – would have put further pressure on members’ ability to compete in international markets.

Serge Gaillard, chief economist at the Swiss trade union federation, said the central bank had “taken account” of changing economic circumstances, while a housing association representative described the decision as a “Christmas present for homeowners”.

However, economists at leading Swiss banks UBS and Credit Suisse gave a more guarded response, saying a further quarter point rise would have sent a more positive signal without in any way endangering economic growth.

swissinfo: Does this decision mean the economic recovery in Switzerland is over before it even began?

Jean-Pierre Roth: No, that is not the case. We still expect the economic recovery to continue in 2005, but what we see is that it has lost some momentum. That is the reason why we decided not to raise interest rates again now. We started to raise rates in June and did so again in September as part of the process of “normalising” [tightening] monetary policy, because we were then in a phase of normalisation of the economic situation. Now we see that it will take longer for the economy to fully recover, so it will probably take [correspondingly] more time for monetary policy to be adjusted.

swissinfo: What is the main message that you are sending with this decision?

J-P.R.: The main message is that the recovery is there and will continue, but the level of dynamism of the recovery is not exactly what we thought earlier this year. However, we do expect 2006 to bring more dynamism.

swissinfo: So what exactly has changed in the last few months?

J-P.R.: On the one hand, the oil price situation and, on the other hand, the weakness of the dollar. Taken together, these have a very strong impact on the European economic situation and we now have forecasts for Europe as a whole that are not much better than, or even less favourable than, those for Switzerland. We are still very much dependent on what happens in Europe, so the weakness of the European economy does have an impact on us.

swissinfo: In retrospect, do you regret the decision to raise interest rates twice in a row this year?

J-P.R.: Not at all. The first two corrections were absolutely necessary and provide us today with a better base for our latest decision to wait before making any further change. If we hadn’t raised interest rates in June and September, we would be in a very difficult position today. However, having already raised rates twice, we can now afford the luxury of waiting a while before making any further change.

swissinfo: The United States doesn’t seem to be suffering so much. Does this mean that Switzerland – and the rest of Europe – are paying the price for the huge US deficits and the resulting slide in the dollar?

J-P.R.: That is true in so far as European currencies are appreciating against the US dollar, while most Asian currencies are linked to the US dollar and therefore do not change value [comparatively]. This is disequilibrium in the international monetary system and would need to be corrected over time. However, it will take a very long time to find a solution because it would require much more flexibility in Asia, and that is not something I see happening tomorrow.

swissinfo: The dollar aside, what do you see as the main risks or dangers facing the Swiss – and world – economy today?

J-P.R.: We still have geopolitical uncertainty and it could prove very difficult for us if we were to have a further geopolitical crisis interfere with the current worldwide economic recovery. The world economy needs more confidence, because we are very much dependent on investment in Switzerland. We produce investment goods and as soon as investors begin to have doubts about the future, this has a very strong impact on the Swiss economy.

swissinfo–interview: Chris Lewis

The SNB left its target range for the key three-month Libor interest rate unchanged at 0.25 to 1.25%.

It said economic growth in Switzerland had lost momentum in recent months and predicted economic growth of 1.5 to 2% for 2005.

The SNB said longer-term inflationary pressures had eased and forecast inflation of 1.1% next year and 1.3% in 2006.

SNB president Roth says the decision not to raise interest rates again was driven largely by high oil prices and the ever-sliding dollar.

He says economic growth in Switzerland has slowed, but remains confident that this year’s recovery will continue.

Roth adds that Switzerland is particularly vulnerable to any drop in investor “confidence”.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.