Neuchâtel tax vote seen as just the beginning

Cantons are under pressure to follow the example set by Neuchâtel whose voters on Sunday approved plans to end corporate tax breaks and harmonise company tax rates.

With 77 per cent in favour, voters in Neuchâtel backed the government’s plan to cut the corporate profit tax rate from ten to five per cent by 2016 and reduce taxes on holding companies. The plan will see companies taxed at the same rates.

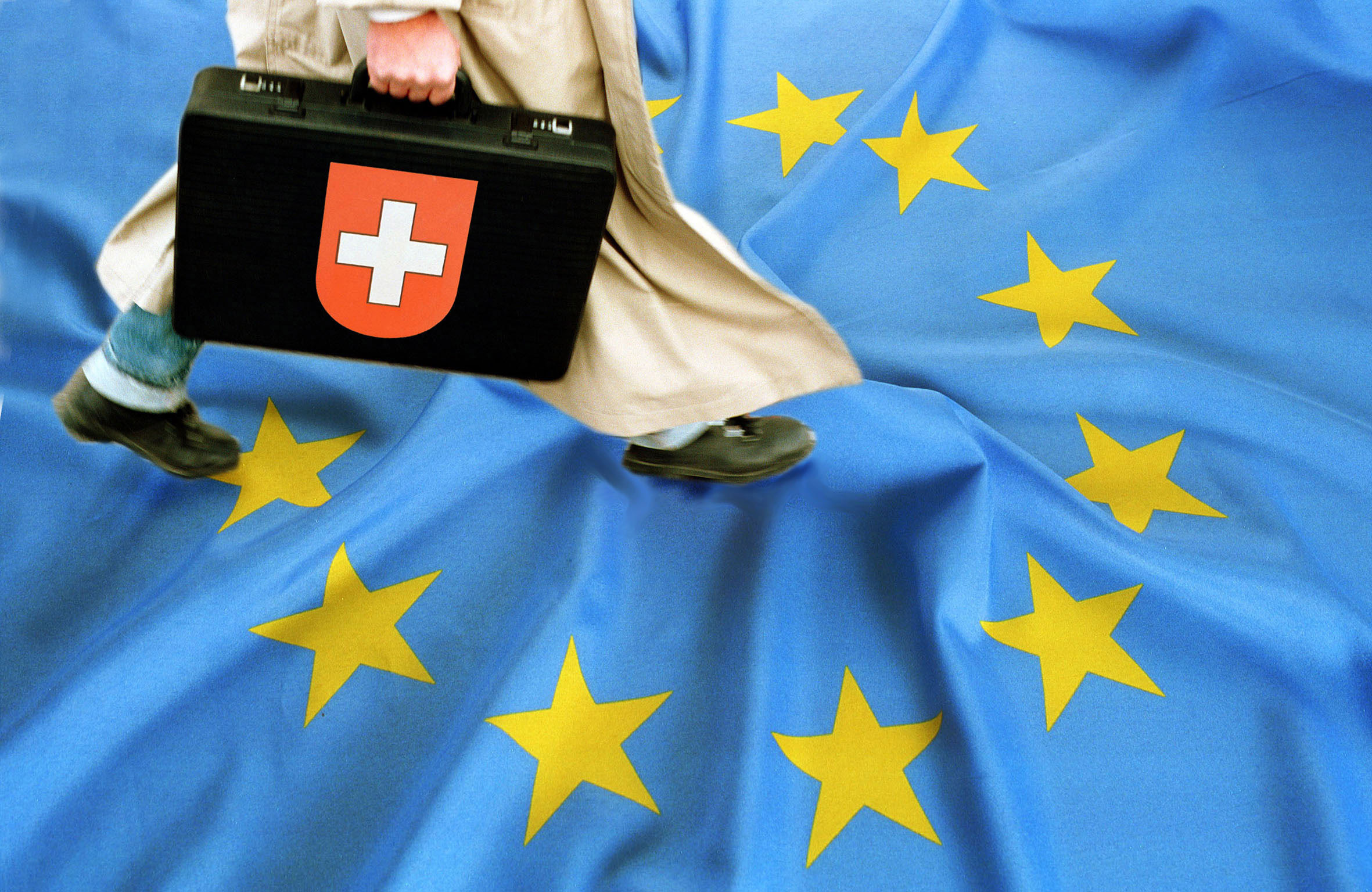

The Neuchâtel vote brings the canton in line with the wishes of the European Union and the Organisation for Economic Co-operation and Development (OECD) which have been pressuring Switzerland to abolish individual cantonal tax regimes.

Whether Neuchatel was influenced in its reforms by outside pressure is “difficult to say”, professor of public finances at Fribourg University Bernard Dafflon told swissinfo.ch.

But Dafflon says the vote will “unleash a virtual epidemic” of tax reform in neighbouring cantons and predicts special tax deals for foreign companies will disappear entirely within ten years.

“Between the Neuchâtel example and outside pressure, the cantons won’t have a choice. Until now, Switzerland has used the argument of cantonal sovereignty in its negotiations with the OECD and the European Union. Today, that is no longer valid,” Dafflon said.

“The strong ‘yes’ of the people of Neuchâtel in effect gives all those who have been applying pressure on Switzerland a fantastic argument. From now on they can say to the Swiss authorities: Given that it’s possible to win a popular vote in a canton like Neuchâtel, don’t come and say to us that it’s impossible in the other 25 cantons.”

Pressure

The EU has criticised cantonal tax practices for giving unfair advantage to foreign companies, and to foreign holding companies in particular.

The Neuchâtel vote will put an end to the use of the “Bonny Decree”, implemented in the late 1970s, which granted firms tax breaks in an effort to stimulate employment. At present, only half of Neuchâtel companies pay corporate taxes.

The reform plan will lower average total company taxes on profits – which include council, cantonal and federal taxes – from 22.18 per cent to 15.6 per cent. Revenue generated from the new system will be used to finance planned income tax reforms.

Roland Godel, spokesman for Geneva Finance Minister David Hiler, described EU pressure to reform company tax regimes as “strong”.

“In the medium term, Switzerland will be forced to adapt,” Godel told the Swiss News Agency, adding that in such a context, the Neuchâtel vote would help to rebalance the political debate on taxation, which is “quite a good thing”.

Geneva has been examining possibilities for making its taxation system “Eurocompatible” for several months and expects to outline its plans before the end of the year, Godel said.

A model for all?

A working group comprised of federal and cantonal financial representatives has been established to examine the Neuchâtel plan and determine if the model can be applied more broadly.

But Mario Tuor, spokesman at the state secretariat for international financial matters, told the Swiss News Agency the Neuchâtel model could not be applied to all cantons.

Tuor said that in certain cantons, including some large ones, the model would create too big a hole in public finances as lower tax revenues collected from Swiss companies would not be offset by the increased revenues from foreign companies.

Were Geneva to follow Neuchâtel’s example, the canton could lose some SFr300 million ($356 million) in revenue, Godel said.

“In our canton, a lower uniform rate would inevitably lead to losses,” said Godel.

Dafflon said the Neuchâtel model could be applied to all cantons, although he conceded that some cantons, particularly those with a higher proportion of holding companies, would suffer revenue losses if they lowered taxes to the same level as Neuchâtel.

“Removing tax breaks given to certain companies allows you to lower the middle tax rate of all companies,” said Dafflon.

Softly, softly

Finance minister for canton Fribourg, Claude Lässer, said the need to achieve reform and harmonise tax rates must be balanced with the need to keep the cantonal books in the black.

The canton has commenced reform of its taxation practices but is doing so “gradually”, Lässer told the Swiss News Agency.

“We have cut our corporate tax rates by more than 20 per cent in three years and we will continue,” said Lässer.

“However, our canton intends to harmonise rates over time to maintain a balance, that is to say, to avoid going into deficit and the need to borrow.”

Referendum: The law was accepted by a large majority (99 votes to 10) by the parliament of Neuchâtel but a group of citizens had called for the issue to be put to a popular referendum. A political party on the extreme left felt the plan would be too generous to owners of capital.

Measures: The reforms will reduce the company tax rate on profit from ten to five per cent by 2016 and the rate on holdings from 0.5 per thousand to 0.005 per thousand.

End of privileges: Tax exemptions for foreign companies in the context of economic stimulus will be removed, with some exceptions. Currently, half of all profits generated by companies in Neuchâtel go untaxed.

Tax hell: The total tax rate (local, cantonal, national) will stand at 15.6 per cent, placing Neuchâtel 7th on the ranking of attractiveness of Swiss cantons. Often considered a “tax hell”, the canton plans to reform its individual income tax system in 2013.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.