New attempt to fill looming pension fund gap

Voters will have the final say next weekend on a proposal to prop up the ailing old age pension system with profits of the Swiss National Bank.

The plan by the centre-left Social Democrats and the trade unions has been somewhat pushed into the background as the electorate also decides on the controversial tightening of asylum and immigration rules.

All but SFr1 billion ($0.8 billion) – which are destined for the cantons – of the central bank’s annual profits are to go towards old age benefits according to the proponents of the initiative.

Currently the country’s 26 cantons receive two thirds of the bank’s surplus, while the federal authorities pick up the remainder. Under an agreement the bank is to distribute SFr2.5 billion annually up to 2012.

“The National Bank makes an average annual profit of more than SFr3 billion and has a further SFr16.5 billion set aside,” the proponents say.

“The pension scheme needs an injection of more funds in the middle-term,” says Hans-Jürg Fehr, parliamentarian and president of the Social Democratic Party.

“There are few other options to gain more revenue and they include raising Value Added Tax (VAT) or higher contributions from employees.”

Supporters argue that approval of their proposal would help ensure the financial future of the scheme and rule out in increase of VAT.

Old age benefits are the most important pillar of the Swiss welfare system, they say.

More

People’s initiative

Warning

Opponents –including the government, the National Bank, the cantons and three of the four main political parties – have dismissed the profit margins as unrealistic and warned of undermining the bank’s independence.

Finance Minister Hans-Rudolf Merz warned that the federal authorities would face a considerable shortfall in revenue which would hit research and education in particular.

“The bank would be under pressure to make bigger profits and could no longer properly act as guardian of monetary policy,” Merz added.

He said the pension scheme required structural changes to be discussed in parliament.

Cantonal authorities have expressed concern that they would be deprived of much needed subsidies from the federal state, pushing the cantons, which enjoy a large degree of autonomy, deeper into debt.

“It’s a waste of time to shift funds from one place to another. The initiative is based on unrealistic profit estimates,” said Hans Kaufmann, parliamentarian of the rightwing Swiss People’s Party.

Previous attempts

Instead the government and a majority in parliament have agreed to use about SFr7 billion – part of the proceeds from the sale of the bank’s excess gold reserves – to shore up the pension scheme.

In 2002 voters threw out a plan to use the proceeds to finance a special charity to fight poverty. Two years later they also rejected a government proposal for a slight rise in the rate of VAT in order to provide additional funds for the pension scheme.

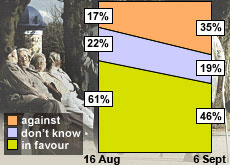

The latest opinion poll shows that supporters of the new funding proposal are ahead of their opponents. But it is uncertain whether the initiative will also manage to win the necessary majority of cantons to pass.

swissinfo, Urs Geiser

The state old age pension scheme is a central pillar of the country’s social security system. It is aimed at providing minimum coverage for all people over the age of 65 (men) and 64 (women), surviving dependents and those who need constant care.

Employers and employees, as well as the state, fund the system through mandatory contributions.

The scheme which was set up in 1948 risks running into financial trouble as a result of demographic changes.The number of contributors has been dropping amid a growing list of beneficiaries and an increase in life expectancy.

Proposals to prop up the scheme include raising the retirement age, cuts in old age benefits and raising VAT.

In 2002 voters turned down a proposal to use the proceeds from the sale of the National Bank’s excess gold reserves for poverty reduction.

National Bank profits: 2006 (first-half figure): SFr1.96 billion ; 2005: SFr12.8 billion; 2004: SFr400 million

At the beginning of 2006 there were over 1.8 million people – of the total population of 7.4 million – drawing a state pension.

On average a single monthly benefit is SFr1,860 for individual beneficiaries, and SFr3,098 for couples.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.