ICO craze also benefits home-grown Swiss fintech firms

Last year Switzerland made a name for itself as a global hub for the new craze of initial coin offerings (ICO) – a new means of raising cash for start-ups that involves selling tokens that can eventually be used to utilize (or take part in) the new technology (hence the term utility tokens).

Of the $5 billion raised worldwide, it is estimated that around a quarter of these funds ended up in purpose built Swiss foundations. But this can hardly be categorised as “Made in Switzerland”. These crypto piggy banks could best be summed up as “funds held in Switzerland until they leak out to coders developing the projects elsewhere in the world”.

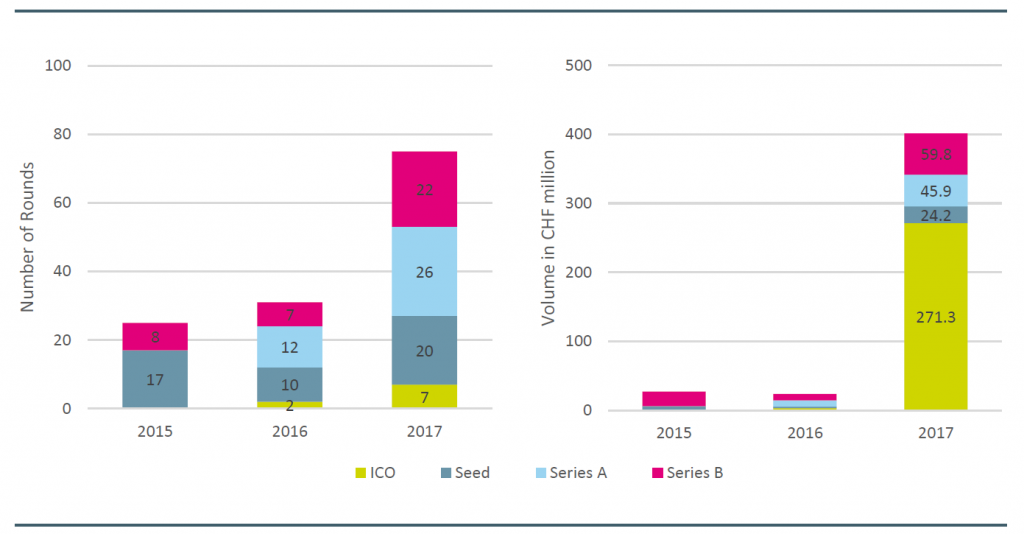

But Swiss start-ups have also benefited from the craze, according to Lucerne’s University of Applied Sciences and ArtsExternal link (HSLU). Researchers estimate that some CHF271 million of ICO funds actually ended up in home-grown Swiss fintech companies.

That represents around 5% of the total ICO funds raised globally. Not quite as impressive as 25%, but still a useful new addition to start-up capital flowing into Swiss firms. On top of that, HSLU estimates that traditional venture capital investments in Swiss fintech went through the roof last year, adding an extra CHF130 million in funding.

That’s combined funding for Swiss fintech of CHF400 million, compared to well under CHF50 million in 2016. This created 16% more Swiss fintech firms, which now number 220, HSLU states.

In January, StartuptickerExternal link also noted a meteoric rise in fintech VC funding. In 2016, fintechs received a few crumbs from the VC table, but the CHF76 million last year put the fintech sector on a par with the established medtech start-up industry.

Obviously, there are some rather large discrepancies between the absolute figures measured by Startupticker and HSLU (perhaps due to different ways of categorising fintech). But they both show the same upward trend.

It will be interesting to see how the latest guidelinesExternal link issued by the Swiss financial market regulator FINMA impact on ICO funding in Switzerland this year. FINMA appears to have taken exception to start-ups raising ICO capital to fund their projects before anything concrete has even been produced.

As of this year, these tokens will be classified as securities, FINMA states. This could dampen the hundreds of millions rolling into Swiss foundations set up to fund nascent (virtually non-existent) overseas projects. But real enterprises, with concrete operational models, could still benefit – providing they clear regulatory hurdles first.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.