Swiss expat group turns up heat on banks

Swiss banks’ restrictive policy towards the Swiss abroad has been a major concern for nearly a decade. First steps have been taken to tackle the issue, but more progress is needed, says Remo Gysin, president of the Organisation of the Swiss Abroad (OSA).

Many expatriate Swiss have complained about losing access to Swiss banking services and about unfair conditions, notably what they consider to be excessive fees.

Parliament has discussed several proposals to improve the situation without agreeing on any political measures.

Gysin does not mince his words criticising both the banking sector as well as the government. He also pledges to take a critical look at the strategy used in the parliamentary process over the past few years before the organisation decides on the next steps.

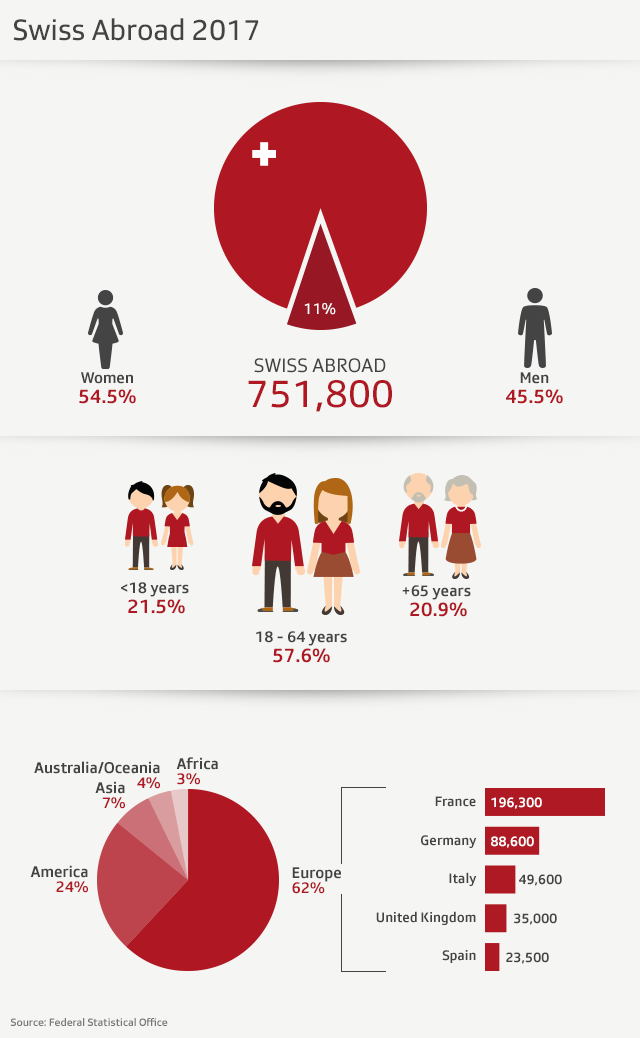

The OSA representsExternal link the interests of the more than 750,000-strong Swiss Abroad community living mainly in neighbouring European countries – France, Germany and Italy – but also in North America.

The annual Congress of the Swiss Abroad is scheduled to take place in mid-August.

swissinfo.ch: As president of the OSA, are you pleased with the results achieved in parliament over the past few years to improve banking services for Swiss expatriates?

Remo Gysin: We did make progress but the overall situation is by no means satisfactory.

We’re facing problems about opening new bank accounts, banking fees and minimum deposits. The Swiss Abroad community has been subject to a discriminatory policy by the banks in all three areas as Swiss expatriates are not given the same treatment as domestic Swiss clients.

swissinfo.ch: Why was progress at a parliamentary level very limited? Some proposals won approval in one of the chambers, but were ultimately thrown out after discussion in the second chamber.

R.G.: Our lobbying efforts were considerable in parliament, I’d say. There is a parliamentary group of about 100 members, we regularly talk to the relevant committees and the leading members of our organisation in parliament – Senator Filippo Lombardi and Laurent Wehrli in the House of Representatives, as well as other parliamentarians – did a good job.

But in the end, the result was rather modest. Firstly, because legal amendments take a long time, as they have to win approval by both parliamentary chambers. It didn’t help that the government came out against our proposals. It does not want to get involved because it prefers to leave it up to the free market economy to find a solution.

Then were sudden also ‘mood swings’ in parliament which are hard to explain. Some motions were passed in one chamber and fell through in the other.

swissinfo.ch: Was it possibly due to the successful lobbying by the banking industry which scuppered your plans?

R.G.: Indeed. I know that the two main banks, UBS and Credit Suisse, the state-owned PostFinance, as well as banking associations and financial sector lobbying groups were up in arms about it.

I don’t quite understand why they are opposed to any kind of progress. This became very clear in negotiations with big and smaller banks, private and public institutes, as well as with banking industry associations.

It’s not easy to move ahead under such circumstances. Having said that, we did make progress not least because of public and parliamentary pressure. It helped raise awareness at a political level, both in parliament and the government, as well as in society, which puts the onus on the banks.

It seems that we have to keep up and even increase pressure in the near future.

We may have failed in bringing about a legal amendment, but the difficulties faced by the Swiss Abroad community over access to banking services are now widely known.

swissinfo.ch: Away from parliament and at a more institutional level, the OSA successfully concluded negotiations with the Geneva Cantonal Bank which agreed to offer Swiss clients abroad the same conditions as those residents in Switzerland provided they comply with all the legal requirements. Where do we stand after the first few months?

R.G.: The deal that was signed offers good conditions and we have great hopes that the situation will improve. The first results are encouraging, but it remains to be seen if the bank can really deliver on its promises.

swissinfo.ch: In what way could the treaty with the Geneva Cantonal Bank serve as a model for others?

R.G.: The deal has created a precedent. From now on it will be harder for any other cantonal bank or for their umbrella association to argue that it is not feasible to find a solution.

In the past we were told they were aware of the difficulties but it was unfortunately impossible to do anything about it.

From now an answer like that means: there is no willingness to come to an agreement.

The Geneva Cantonal Bank says the feedback from the Swiss Abroad community has been very positive. The bank has set up a special programmeExternal link, XpatBking.

“It enables expatriates to maintain their banking base in Switzerland, whether it concerns the financing of a second home, a pension plan or asset management,” says spokesman Gregory Jaquet.

The bank says it is drawing on its experience stemming from the specific nature of Geneva’s economic fabric and the proximity of international organisations.

swissinfo.ch: How quickly can we expect a deal with another cantonal bank?

R.G.: It is a long and sometimes arduous process and it’s taken us ten years to get to this point. Progress is visible but problems remain.

There’s still a long way to go before we reach a satisfactory solution, I’m afraid.

swissinfo.ch: What are the next steps for the OSA?

R.G.: It’s time to take stock after an intense phase in parliament. We will also take a critical look at our tactical approach. The next steps will follow on from our discussions within the OSA. I think we have to step up pressure on the banks both in public and at a political level in parliament.

But at the same time, we would like to negotiate directly with individual banks to try and find solutions.

The Swiss Abroad Council plans to put e-voting and Switzerland’s EU policy on its agenda, as well as a proposal for a memorial for Swiss expatriate victims of the Holocaust era.

The assembly is due to hold its regular meeting ahead of the annual Congress of the Swiss Abroad in Visp, scheduled for August 11/12.

The Congress of the Swiss AbroadExternal link is focusing on Switzerland’s future bilateral ties with the European Union.

By communicating clearly with the Swiss Abroad community and talking to the public in Switzerland about the situation, we can show how unfair and discriminatory the banks are.

The Zurich Cantonal Bank is a perfect case in point. It demands a minimum deposit of CHF100,000 ($104,000) from potential Swiss expat clients, while domestic customers are exempted from it. Such a discriminatory policy can’t be justified by additional costs for administration but confirms a general trend in the banking sector. Banks only want rich customers while ordinary clients apparently don’t count any more.

swissinfo.ch: Critics could argue this too much of a sweeping attack against all banks…

R.G.: The OSA strategy distinguishes between big banks, public banks and private banks and we differentiate between individual institutes and umbrella organisations.

PostFinance has been relatively forthcoming, but we could not get parliamentary approval for a proposal to guarantee members of the expat community the right to a credit card.

Bank Cler also made concessions. In other cases, we know of striking differences within the same bank depending on the regional subsidiary or even the individual client advisor.

The two main banks, UBS and Credit Suisse, have taken an extremely tough stance. Their opposition and unwillingness to find solutions is hard for me to understand.

I strongly recommend expat clients contact the banking ombudsman directly if they have problems with Swiss banks.

swissinfo.ch: Comments on the OSA platform, swisscommunity.orgExternal link, illustrate the difficulties and some of our readers regularly complain about incapable and passive politicians, greedy and arrogant banks. What’s your message to those Swiss expatriates who get increasingly impatient with the banks and the politicians?

R.G.: No doubt the banking industry can take its share of the blame, but the government is also at fault with its free-market policy approach. The business community has not offered much support to alleviate the problems either.

This shows the unequal power relations in Switzerland.

I appeal to all those who are about to lose patience: please don’t forget that the first steps have been taken to tackle the issue of having fair banking services for Swiss overseas clients. The general public and politicians are fully aware of the problems. It will still take some time to find a viable solution.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.