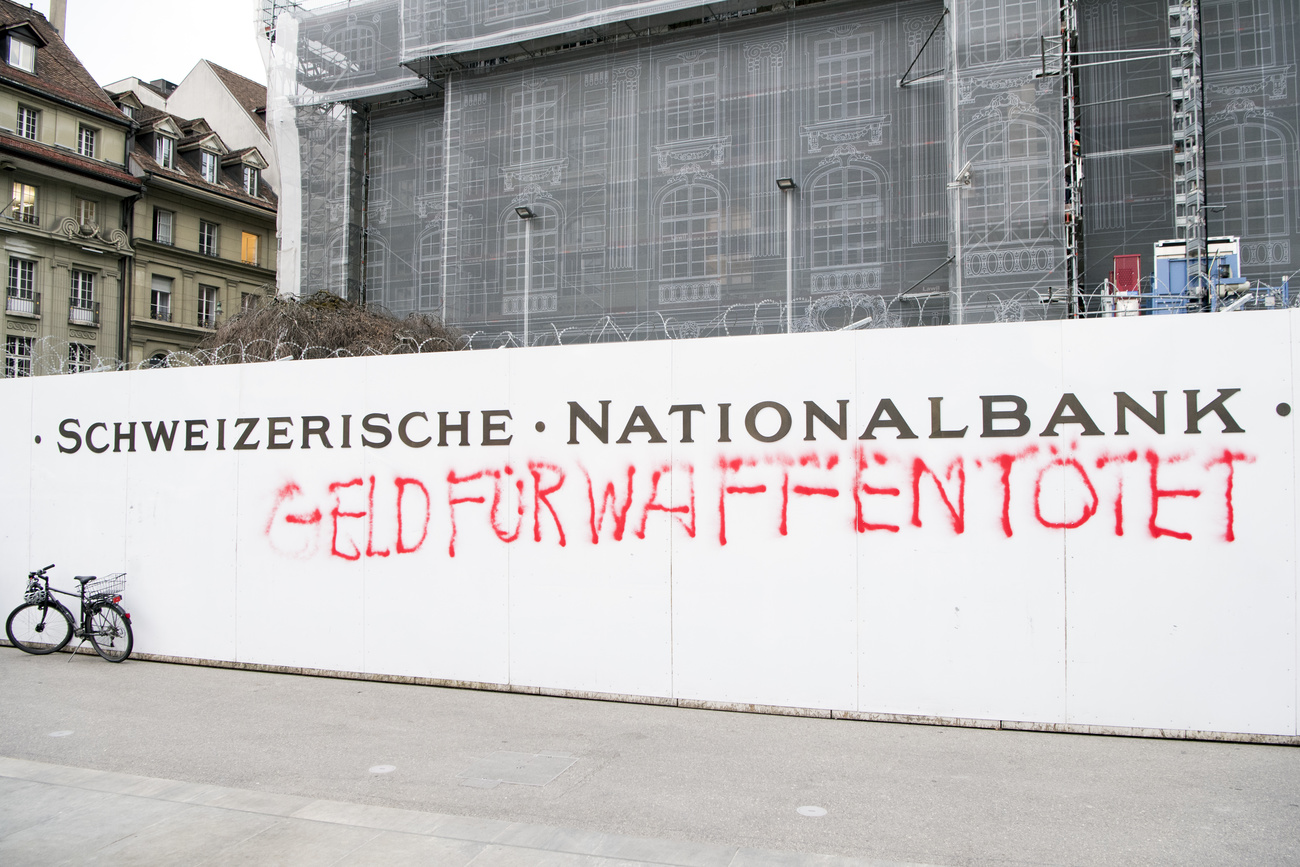

Major Swiss banks invest billions in weapons manufacturers

Switzerland’s largest financial institutions invest billions of dollars in the global weapons industry. In the United States alone, Switzerland’s central bank has invested more than $2 billion (CHF1.8 billion). On November 29, Swiss voters will have their say on whether they want to put a stop to these activities.

In 2017 and 2018, Switzerland’s largest financial institutions invested more than $9 billion in companies which manufacture nuclear weapons. The figure was revealed in June 2019, in the latest Don’t Bank on the BombExternal link report by Dutch pacifist NGO Pax and the International Campaign to Abolish Nuclear Weapons (ICAN).

More

Initiative aims to impose ethical investment rules

According to this “non-exhaustive” report (see box below for methodology), nine of the world’s biggest groups involved in nuclear weapons received investments from four Swiss financial institutions: UBS, Credit Suisse, the central bank (Swiss National Bank, SNB) and wealth management group Fisch Asset Management.

Shares and/or bonds make up most of these investments, and all of those by the SNB and Fisch Asset Management. For Credit Suisse and UBS, their investments also included loans (CHF507 million and CHF145 million respectively), Susi Snyder, one of the report’s authors, told SWI swissinfo.ch.

The Don’t Bank on the Bomb report outlines the investments made by the world’s financial institutions in the 18 major nuclear weapons companies. Groups that derive income from such activities, regardless of the share of turnover they represent, are considered to be producers of nuclear weapons.

Only the financial institutions with substantial investments (at least 0.5% of the total of securities issued by listed companies) are taken into account. The report’s authors say they limit themselves to official information available in the public domain. “There is always a notable lack of information” on the subject, they explain. The figures provided in the report are therefore “a cautious estimate of the total global investment” in the industry.

On November 29, Swiss citizens will vote on the popular initiative “against the war trade”. For supporters of the reform, the figures provided by Pax show that current Swiss legislation, which does not formally ban the direct financing of internationally prohibited weapons (see box), is insufficient.

The text wants to ban all forms of financing for international manufacturers of weapons – including conventional weapons – by the SNB, foundations, and pension funds.

More

Proposed investment ban targets armament industry

Concretely, they will be prohibited from providing loans to weapons manufacturers but also from owning shares and financial products associated with such companies. The initiative does not directly target the banks but calls for the government to commit to making similar rules apply to them.

Since 2013, the Swiss Federal Act on War MaterialExternal link (WMA) has banned “directly financing the development, manufacture or acquisition of war materials prohibited” internationally. It covers nuclear, biological, and chemical weapons, anti-personnel mines, and cluster munitions. By “direct financing”, the law designates “providing direct credits, loans, donations or comparable financial advantages” destined to cover or advance the costs of these activities.

Participation in companies engaged in these activities or the purchase of investment products they issue (described by the law as “indirect financing”) are not restricted unless “the intended aim is to get around the ban on direct financing”, something which is difficult to demonstrate. The restriction does not apply to financing other activities of these companies that are not linked to prohibited war materials, and none of the provisions apply to conventional weapons.

Contacted by SWI swissinfo.ch, the SNB refused to comment on the detail or the total amount of its investments in armaments.

But the US Securities and Exchange Commission (SEC), the American stock market supervisory authority, releases an overview of the SNB’s American equity portfolioExternal link each quarter. According to its Q2 2020 publication, the range of the SNB’s positions in the US alone appears much larger than the PAX report shows.

As of the end of June, the bank held shares in 29 of the 48 largest US armaments and defence businesses listed by the Stockholm International Peace Research Institute External link(including nine considered by PAX to be active in nuclear weapons) for an amount of nearly $2.4 billion.

On its website, the institution, which is opposed to the initiative, indicates that if the text is accepted, it would exclude “more than 300 businesses from its equity portfolio, which corresponds to roughly 11% of the portfolio’s market value”. According to an estimate by the Neue Zürcher Zeitung newspaper, this would mean that at the global level, the SNB has holdings worth around CHF20 billion in the wider arms trade.

The banks defence

The SNB says that it “already refrains entirely from investing in any firms that produce internationally condemned weapons” and “generally does not engage in any direct financing of specific projects or products”.

Without commenting on the detail of the PAX report, the other banks mentioned also oppose the November 29 initiative, and reaffirm that they are not making investments that would violate the Federal Act on War Material.

They note that for several of the groups mentioned in the report, nuclear weapons are one activity, among others. “[These businesses] are for the most part large conglomerates principally active in areas which are not contested such as aircraft manufacturing or electronics,” Credit Suisse told SWI swissinfo.ch.

More

Pension funds curb arms investments, but oppose an outright ban

For UBS, “the approach chosen by the critics is very questionable, because it demands that financial companies do not even finance businesses which are important to the civil economy such as Boeing and Airbus”.

Even if less is known about it, the production of nuclear missiles remains an activity of these groups, insists the NGO Pax, which defends its approach. “It is impossible to stop a group from reallocating capital internally [to its different entities]”, and therefore guarantee that “the financial services provided to a business will not ultimately be used to manufacture nuclear weapons or key components,” it says.

Swiss investments “in the low range”

Credit Suisse also claims to be situated “at the bottom of the range of global banks in relation to the volume of financing of these conglomerates”. In fact, the $9 billion invested by the four Swiss institutions represents just 1.2% of the global total of investments in nuclear weapons, estimated by PAX to be $748 billion.

The NGO has identified a total 325 financial institutions in 28 countries. Investments by American companies (almost 200) represent more than three quarters of the total. The top ten companies investing are all American.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

Join the conversation!