Microtax: the latest in a line of big-idea citizen initiatives

An initiative in Switzerland is giving new life to the old idea of taxing financial transactions. But can the “microtax” make it beyond the status of mere idea?

Since the “Tobin tax” on currency speculation was proposed in the 1970s, calls for taxes on financial transactions more generally have been heard, especially from anti-globalisation movements, but have rarely had a huge impact.

Some countries do operate taxes on certain types of financial taxes. France and Italy, for example, levy high-frequency trading; Switzerland charges a transfer tax on the trading of equities and bonds, when one of the parties is a Swiss securities dealer.

At the European Union level, too, the idea lives on: the latest seven-year EU budget, a €1.8 trillion (CHF1.94 trillion) package agreed last month, mentions a possible financial transaction tax as part of a “roadmap” for new funding sources.

But it “lives on” tenuously: the Commission will propose something by 2024, the roadmap says – well over a decade after it was first proposed. Current EU plans also only have the backing of a group of ten member states, less than half of the countries in the bloc.

More

Sovereign money: the answer to financial crises?

Swiss case

In Switzerland, an initiative is now proposing something both more limited (in that it only affects one country) and more expansive (it amounts to a radical overhaul of the taxation system).

The “microtax” people’s initiative wants to introduce a levy on all online electronic transactions, whether buying a coffee with a debit card, paying an employee’s salary, or trading billions of francs on financial markets.

If implemented, all such transactions would be taxed at 0.005% during the first year, a rate that would later rise to around 0.1%.

The microtax also wants to supersede and abolish three existing taxes: the value added tax, stamp duty, and the federal income tax (in Switzerland, federal levies make up a minor amount paid by taxpayers each year; most income tax is taken by cantons.)

In its basic principles, the initiative is different to what’s talked about at the EU level, which is more focussed on taxing financial transactions on share purchases; it’s also different to the much-heard “Tobin Tax” idea, which was centred on currency speculation, says Marc Chesney from the University of Zurich.

Chesney, a professor of quantitative finance, is one of the instigators of the people’s initiative along with a diverse committee with finance, politics, and other backgrounds. The initiative is unaffiliated with any political party.

Chesney reckons that at the European level, the noise around financial transaction taxes is mainly “communications”.

Rather, the motivations behind the Swiss initiative are about efficiency and progress: unlike elsewhere, it’s not about bringing in a new tax, he says, it’s about “getting rid of three taxes” and updating the entire taxation system for the modern digital age.

The initiators estimate the tax would bring in more than CHF100 billion a year for the Swiss exchequer (enough to replace the three other taxes) and would lead to savings of around CHF4,500 each year for a middle-class Swiss household of four.

As for trading and speculating, the initiative aims to curb the excesses of a sector which has expanded disproportionally and which now trades massive volumes that have nothing to do with the “real” economy, as Chesney told SWI swissinfo.ch last year.

For Chesney – who has written a book, A Permanent Crisis, about abuses in the financial sector – this is also a democratic question. Switzerland allows for citizen action which is elsewhere not possible.

“It is inconceivable that in so-called democratic countries, essential issues – be they of a political, energy, social, economic, or financial nature – are not addressed democratically and that at the end of the day they are only the result of a government decision,” he writes.

More

What’s a people’s or citizens’ initiative?

Can it work?

From a purely practical perspective, the initiative faces a battle.

Jean-Pierre Ghelfi, a former Vice-President of the Federal Banking Commission, has written that the microtax would do nothing to stop future bailouts of big banks by the government. He also worries that financial institutions would simply pass on the cost of the tax to their customers – i.e. citizens.

University of Fribourg economics professor Reiner Eichenberger says the idea is nonsense and that neither policymakers nor the population would ever accept it.

“The tax could not be counted on to feed national finances, because it would simply push high-frequency traders to move to another country or do something else”, he said.

“If you want to attack high-frequency transactions in Switzerland that’s one thing, but it shouldn’t be done as a way to finance the government,” the professor added.

But Eichenberger says it’s still good to discuss such ideas, and that the Swiss system at least allows for such a discussion. Elsewhere, people shout about such things, but they can’t have a serious debate, he says. In Switzerland, even if such ideas are rejected, voting on them means people at least get a “political education”.

The 2016 Unconditional Basic Income initiative – which proposed a CHF2,500 monthly payment for every citizen – was a similar case. Eichenberger says the idea amounted to “the same nonsense”, and that the numbers didn’t add up. But it came in a coherent form, and even if voters threw it out, “it’s better to debate such things than just watching crime series on TV”.

More

Basic income: A 500-year-old idea whose time has come?

The idea also wasn’t obliterated. It won over 23% of voters in 2016, and it still hasn’t gone away: in Zurich, an initiative has recently been launched at the city level to start a UBI pilot project. This time, left-wing politicians, rather than non-party activists, are behind it.

“Catalyst” function

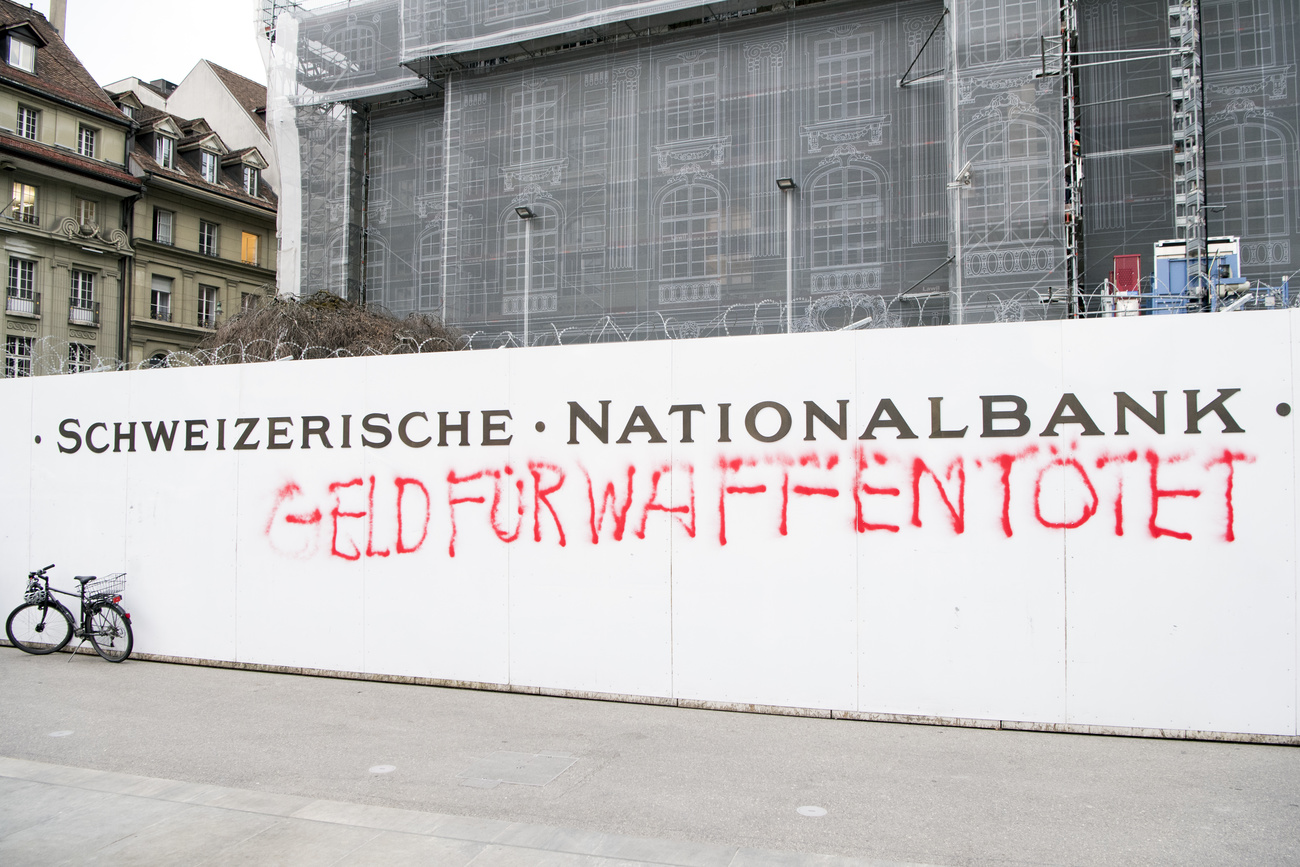

Another similar (and also rejected) idea was the 2018 Sovereign Money initiative, which proposed a bigger role for the Swiss National Bank in supplying credit.

Anja Heidelberger, a researcher with the “Année Politique Suisse” political information platform, says the Sovereign Money example is perhaps the most directly comparable to the microtax – both are “highly technical” (rather than emotional) ideas and both aim for a “revolutionary overhaul” of the system, she says.

Beyond winning, Heidelberger says the main goal of such revolutionary initiatives, from a democratic theory standpoint, is to put ideas on the table that wouldn’t otherwise be there.

While some initiatives serve a pressure-valve function (e.g. heated topics like immigration), and others are used as political tools (e.g. to boost a party’s profile), another category works more like “catalysts” to spark debate, she says. The microtax could fall under this heading.

Like Eichenberger, Heidelberger says voters are usually too fond of the status quo to accept such an upheaval, but they do manage to “broaden the discussion”.

Whether this will be the case for microtax will depend on whether the initiative will come to vote in the first place. According to Chesney, the campaign has collected 40,000 signatures to date. They have about a year left to collect the 100,000 needed for a vote.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

Join the conversation!