Raw materials have Swiss industry in a lather

Swiss manufacturers have demanded concerted global action to tame the high volatility of raw material prices that can wreck profits at a stroke.

Commodity-poor Switzerland has more to lose than most countries as it battles its way out of economic gloom, according to Swissmem, which represents the electronic and machinery industries.

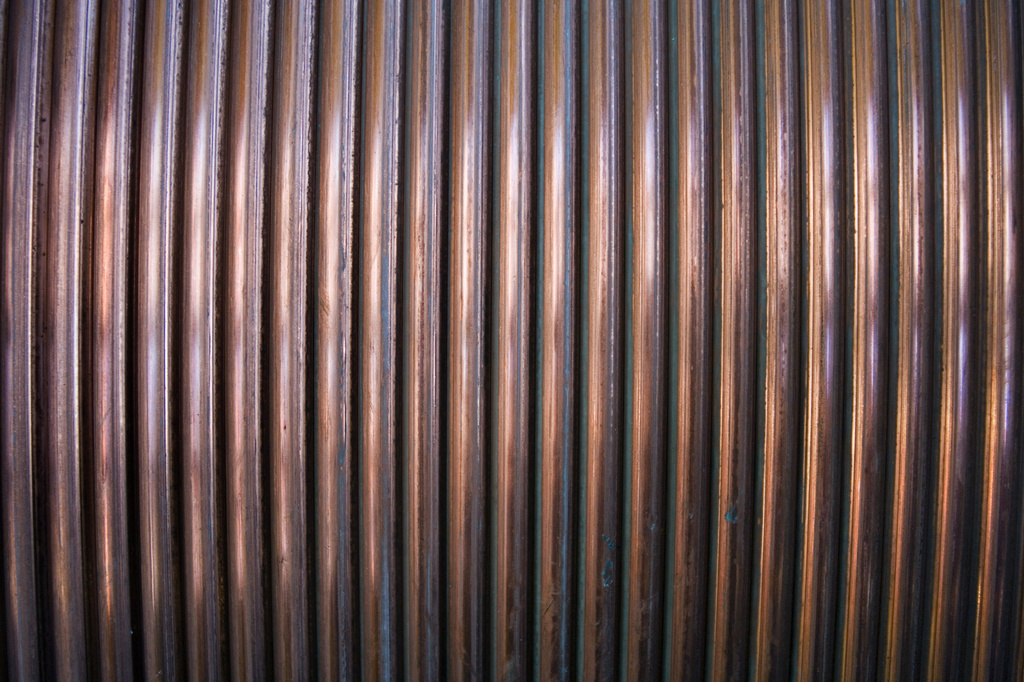

The prices of vital manufacturing commodities, such as oil, copper, rubber, zinc and steel, have again risen dramatically since the start of the year. Part of the higher cost burden is due to increasing demand from emerging economies, but financial speculators and manipulation of prices by commodity-rich countries has also been blamed.

“The worldwide crisis of demand [for industrial goods] and the euro crisis has clogged up our industry,” Swissmen president Johann Schneider-Ammann said at the organisation’s annual Industry Day conference in Zurich on Thursday.

“As if that wasn’t bad enough, the acquisition of raw materials is getting harder by the day,” he added.

Speculation

Rising raw materials costs is hardly a new theme for Swiss industry – Swissmem raised the same subject at its Industry Day two years ago. But the thrust of Swissmem’s comments this time around differed from calls made in 2008 to modernise Switzerland’s ageing nuclear power plants.

This time, attention was focused on the role of speculators and countries that have a monopoly on commodity production fixing prices.

Schneider-Ammann blamed hedge funds and investment bankers for artificially raising the price of nickel five-fold. He called for global regulations to control the trade of commodity derivatives that bet on future prices.

“This speculation driven price development opens the doors to further speculation and manipulation,” he said. “Raw materials speculation can lead to a dangerous threat for the global economy.”

Switzerland is not the only country worried about the volatility of commodity prices. German politician Heinrich Kraft pointed to the policy of China of buying up the rights to mine minerals in African countries.

“More than half the global production of raw materials takes place in politically instable countries,” he said. “There is a high risk that these countries could fail as suppliers because of military conflict, terrorism or privatisation of raw material sources.”

Control needed

The regulation and control of raw material supply needs concerted and coordinated global attention, according to Schneider-Ammann.

But one body that might be able to take a leading role, the World Trade Organisation (WTO), does not currently have a mandate to do so. The WTO’s mission is to reduce trade barriers, but raw materials are not top of the agenda during rounds of negotiations, deputy director general Rufus Yerxa told swissinfo.ch.

“Of course industry in countries such as Switzerland takes a deep interest in the price of raw materials,” he said. “The subject is related to the discussions we are having in the Doha rounds, but we have traditionally focused on import tariffs rather than issues around exports.”

Yerxa pointed out that the cartel of oil producing countries, Opec, has been controlling prices for decades. The issue of cartels and price fixing does not presently come under the WTO’s mandate, he added.

Schneider-Ammann recognised that no single organisation or country could deal with the issue of raw materials pricing. “We cannot simply delegate the finding of a solution to this problem to others,” he said. “We must contribute our part and take the opportunity of working together internationally.”

Matthew Allen, swissinfo.ch

Industry has always had to contend with the fluctuating cost of raw materials which can be influenced as much by political instability as supply and demand factors.

The rapid rise of emerging economies, such as China, coupled with the recent economic crisis has added more volatility to the price of vital commodities.

Recently, financial speculators have also been blamed for influencing the cost of manufacturing raw materials thanks to the increased use of complex financial instruments that can be used to bet on prices.

In January 1999 the price of crude oil stood at $16 a barrel. It rocketed to over $140 in July 2008 before crashing down to $40 a few months later.

The price of many other commodities, such as copper, zinc, steel and rubber, followed a similar path, making it difficult for companies to manage margins.

Demand for many commodities has been further increased by breakthroughs in technology that have produced ever more complex products for consumers.

Copper, cobalt, nickel, zinc, silver, chrome and cadmium are just a few of the minerals essential to the production of mobile telephones.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.