Can the art market regulate itself against illicit activity?

The billion-dollar global art market still struggles to shake off its image as a refuge for money laundering. A group of Geneva-based art dealers, lawyers and specialists are now trying to raise awareness about business risks and to repair the sector’s damaged reputation.

“The thing about the art market is that it enables money to disappear quickly,” declared Geneva prosecutor Jean-Bernard Schmid last month in Geneva. “You very often deal in small objects like paintings, which can travel very quickly and be hidden easily and moved around.”

The investigator was lecturing a room of art dealers, lawyers and consultants at a seminar held during the Art Genève fair External linkon the risks of money laundering and terrorist financing.

“The art market makes it easier than in other businesses to launder the proceeds of other crimes and to introduce cash generated by illicit activities into the legitimate economy,” he added. “If we go to an art dealer and we cannot reconstruct who the client is, where the money is from, if the work of art was bought with cash or if invoices have disappeared, I cannot do my job.”

Global art market sales peaked at $63.2 billion (CHF62.9 billion) in 2014 – 53% via dealers and private sales and the rest at auctions – but have since fallen back.

Switzerland accounts for only 2% of the global art market but is a major player with the Art Basel fairExternal link and a network of free ports, like the one in Geneva – the largest tax-free storage site for art in the world. But they are not risk-free. A 2014 reportExternal link by the Swiss Federal Audit Office warned free ports could be used for fiscal optimisation or to circumvent laws on “cultural goods, war materials, medicines or the trade in raw diamonds”.

‘Attractive for laundering’

The International Financial Action Task Force (GAFI), an intergovernmental body that closely follows issues such as money laundering and terrorism financing, has been urging Switzerland to tighten up. A 2015 national risk assessment warned that Switzerland remained ‘attractive for laundering assets derived from offences that are mostly committed abroad.’

The authorities have not been idle, however. Since 1 January 2016, art collectors and businesses must comply with a new anti-money laundering law. Measures include higher transparency on beneficial ownership, serious tax offences being considered a predicate offence to money laundering and enhanced due diligence for cash payments over CHF100,000.

In their latest report published in December External linkGAFI suggested the Swiss art market had a good overview of the risks but warned that existing risk-reduction measures were ‘limited to cash purchases of goods and could not establish overall transparency in the art market’. However, it made no specific recommendations for the sector.

“The report recognizes that the measures in place are good. Of course you can always do more but for the moment no additional measures are needed,” Ricardo Sansonetti, head of financial crime at the Swiss State Secretariat for International Finance, told swissinfo.ch.

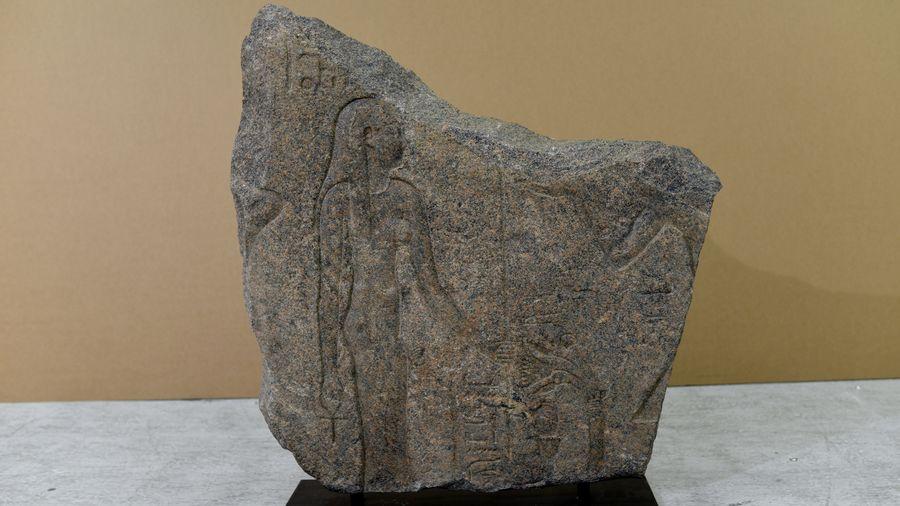

Despite apparent progress, doubts remain. French Finance Minister Michel Sapin complained last October that free ports were a ‘weak link’ in countering terrorist financing. In November Geneva’s art world suffered a blow to its reputation when prosecutors seized cultural relics looted from Syria’s ancient city of PalmyraExternal link, as well as from Libya and Yemen, which were being stored in the Geneva free port.

Responsible art market

Worried about the reputational damage caused by negative newspaper headlines, a group of Geneva-based art dealers, lawyers, and consultants are trying to fight back.

“Our aim is to raise awareness of the risks faced by the art industry in Switzerland and abroad,” Sandrine Giroud, a lawyer and co-director of the Art Law FoundationExternal link, told participants at the Geneva seminar.

Under the banner of the Responsible Art Market InitiativeExternal link, the group has published a set of guidelines to counter illicit activity, including ten principles for vetting buyers and sellers of art.

The guidelines encourage art businesses to properly identify risks, know their clients and be alert to ‘red flags’ or suspicious behaviour.

“People in banking world know all about knowing your client but it also applies to the art world,” said Giroud. “Do you know your customer and do they have sufficient funds? You need to be very careful when dealing with politically exposed persons (PEPs). Where are they from? Are they from a more challenging legislation? Is the client a legal structure and who is the ultimate beneficial owner?”

“It’s a complex world and confidentiality makes it more difficult so you have to be careful,” she added.

Not a panacea

Ursula Cassani, a law professor at the University of GenevaExternal link, felt the Responsible Art Market initiative was interesting, as it was a collective action. She added that it was important for art businesses to be alert to red flags and to know how to behave, accordingly.

“The offence of money laundering is punishable if it is committed by intent. If you see a red flag and ignore it it’s a form of intent,” she said.

But the Geneva law professor said guidelines and self-regulation were not a panacea.

She said: “I think the art business should go beyond the legal requirements as the preventive regime is not very stringent. They are stringent for financial intermediaries and some major art houses acting as financial intermediaries are submitted to strict rules. Preventive measures exist for people who accept cash payments over CHF100,000, but there are no preventive rules for other dealers, merchants and art players. This is where I see a big need.”

Although most art dealers and specialists attending the seminar appeared to welcome the industry-led guidelines, a number complained they were up against a distorted image of the art market painted by the media.

“In 1960s there was grey money with people using cars to transport works of art across borders and not declaring them or barely. The art market has changed a lot since then,” said Geneva-based dealer Simon StuderExternal link.

Sylvia Furrer Hoffmann, managing director of the Swiss Art Market AssociationExternal link, was more combative.

“The art market is one of the most transparent. You have a description of the work, where it’s from, its condition, estimated value and final price and sometimes even the names of the vendor and buyer are public. Yes there are some criminal activities but Switzerland is not a hub for money laundering or trafficking of looted goods. There is no evidence, no criminal sentences, just rumours,” she said.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.