Strong franc gnaws deeper into Swiss economy

The sharply rising franc continues to hit the profitability of a wide range of industrial sectors with the Swiss currency approaching parity with the euro.

The value of the dollar sank below the franc some time ago, and there are no signs of the trend reversing with the Swiss economy performing so robustly compared to debt-laden European countries and the United States.

“It seems prophetic, and almost tragic, to say so now, but the Swiss economy has been the victim of its own success in surviving the financial crisis over the last couple of years,” Janwillem Acket, chief economist at Julius Bär bank, told swissinfo.ch.

“Something dramatic has taken place since the start of the year and our outlook is now a more sober one. We will really feel the pain of the over-valued franc in the coming months.”

Acket has downgraded his predictions for Swiss gross domestic product (GDP) growth for this year to 1.4 per cent, compared to a 2.2 per cent forecast in January and 2.6 per cent made last year.

Bankruptcy fears

Joseph Jimenez, chief executive of Novartis warned on Tuesday that the drug maker would have to “reduce the total cost we have in Swiss francs” while referring to the damage caused by the strong currency.

Also on Tuesday cabinet ministers interrupted their holidays to discuss via teleconference the strong franc. However, no measures were taken.

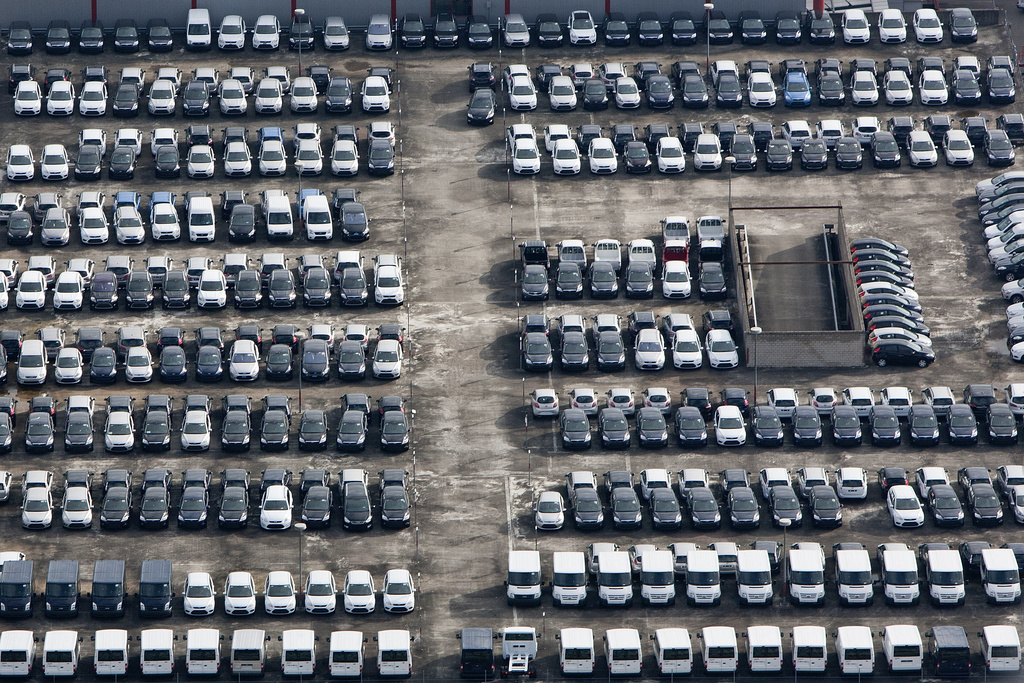

This week, the franc recorded more gains against the euro – with one unit of the European currency costing SFr1.14 compared with SFr1.50 at the end of 2009. Many companies would go to the wall if the franc reaches parity with the euro, Peter Widmer, president of the Swiss export association, told the Blick newspaper in May.

“If that really happens then thousands of companies would face bankruptcy,” he said.

And it is not just engineering companies that face problems. The textiles industry has appealed to the government to provide bridging loans to stave off a looming crisis in that sector.

There are also reports of traditional, small cheese makers failing as exports melted by 3.5 per cent in the first quarter of this year. Imports of foreign cheeses rose by 7.4 per cent in the same period, according to the cheese marketing board.

Other milk products also face a currency squeeze. Milk products producer Emmi reported that a SFr100 million hole has been blown through its turnover in the last three years as a result of the strong franc.

Consumers bite back

Private bankers, thought to be the main beneficiaries of the strong franc as investors flock to Switzerland, insist that they are not as well off as believed because new assets are denominated in euros, while their cost base remains in francs.

The tourism sector has also suffered from the effects of the strong franc. The NZZ am Sonntag newspaper reported on Sunday that a thousand Swiss hotels were threatened with extinction as fewer tourists visited high price Switzerland.

The head of the Swiss tourist board, Jürg Schmid, appealed to the patriotism of Swiss holidaymakers in a SonntagsBlick article on Sunday, urging them to stay at home and spend their money in the domestic market.

Hansueli Loosli, chief executive of supermarket chain Coop, has also being banging the patriotic drum, accusing Swiss consumers that drive over the borders to buy cheaper euro products of costing homegrown retailers some SFr2 billion a year in lost sales.

On the other side of the coin, the Swiss price watchdog has leveled an accusing finger at retailers, saying they are doing too little to pass on the reduced cost of imports to consumers.

Swiss consumers typically pay some 20 to 30 per cent more than European counterparts for the same goods, but official statistics showed that the high street cost of goods and services imported from the euro-zone have hardly dropped despite being cheaper to buy with the Swiss franc.

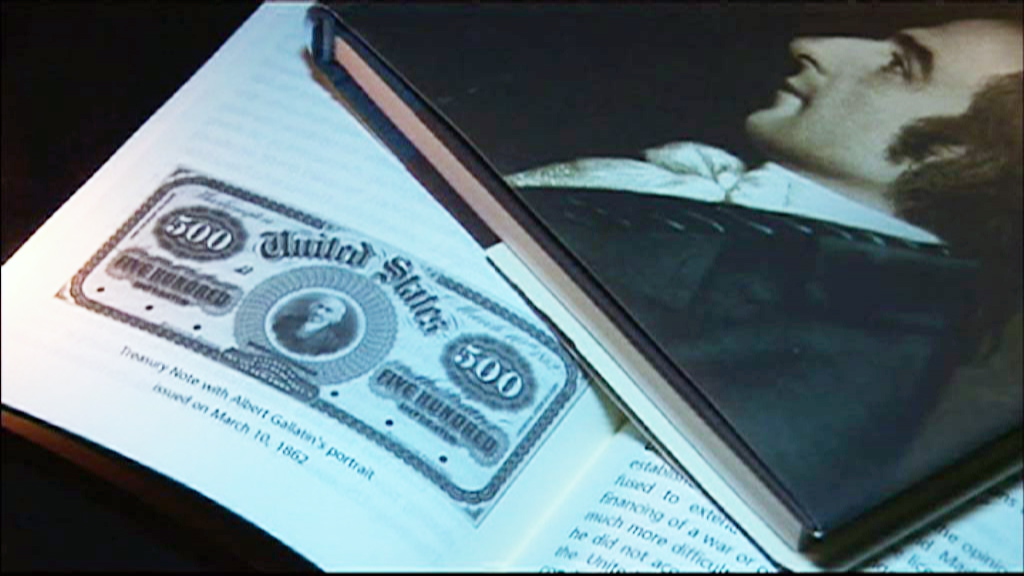

The Swiss franc is a so-called “safe haven” currency, which means that investors and speculators buy it when other currencies, including the euro and the dollar, are under pressure.

The franc has gained 25 per cent in value against the euro and the dollar over the past four years.

The Swiss National Bank has emphasised that it does not pursue an exchange rate target, but consistently bases its monetary policy on its legal mandate.

This mandate stipulates that “the SNB is required to ensure price stability, while taking due account of economic developments”.

Starting in March 2009 the SNB intervened in currency markets. But after pumping in 15 per cent of GDP in May 2010 to little effect as the Swiss franc surged during the first round of the Greek debt crisis, it dropped them in June 2010.

These forays led it to a loss of SFr21 billion last year, its biggest ever, and its chairman, Philipp Hildebrand, has faced calls to resign.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.