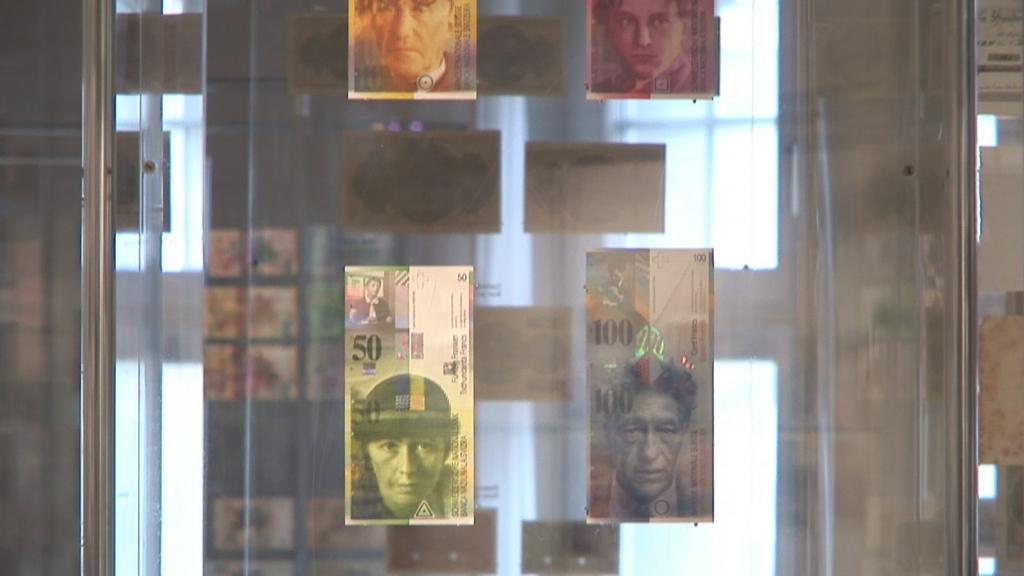

Swiss franc a magnet in times of strife

The aftermath of the financial crisis saw a rebound in the popularity of the Swiss franc as investors galloped away from more volatile currencies.

The Swiss franc, or “Swissie” as it is known by traders, first gained a reputation as a safe haven currency after the First World War. But will it continue to attract investors in times of economic hardship?

The fundamental reasons behind the attractiveness of the franc as a safe haven are much the same now as they were in the 1920s.

Switzerland has long benefited from a stable, conservative economic and political system that has keeps volatility to a minimum. The country has also developed a world class financial and banking system that facilitates inward investment.

Switzerland’s neutrality during both world wars of the last century was one of the major catalysts to attracting investors. Along with the Dutch guilder and Swedish krona, the Swiss franc became an attractive alternative to the war torn currencies of Europe.

Dependable fall-back

With the Netherlands being occupied during the Second World war and Sweden imposing tighter capital controls, the Swissie assumed even greater importance as a safe haven currency in the second post-war period, according to Swiss financial historian Tobias Straumann.

“The Swiss franc gained a special status as a global reserve currency despite its relatively small size,” he told swissinfo.ch.

Governments and central banks got into the habit of holding some Swiss francs in their reserves as a hedge against economic downturns, increasing these amounts when the bad times inevitably arrived.

The growing importance of the United States dollar and the emergence of the Japanese yen as a so-called “hard” – or strong – currency did little to dampen enthusiasm for the franc as a fallback option.

Switzerland’s advantage was that it operated a more open financial system than Japan, according to Straumann, and that it fought inflation more successfully than many other countries during the 1970s.

Euro challenge

Many economists believed that the introduction of the euro in 1995 would reduce the franc’s status as a safe haven currency.

Early indications showed that the strength of the euro had eroded the importance of the franc. But the financial crisis and resultant recession saw renewed enthusiasm for the Swissie that suggested its importance during times of hardship remained undiminished.

Switzerland’s traditional conservative economic approach ensured that it did not become mired in the same crippling debts as other European countries. And although the financial centre did not escape the crisis completely unscathed, Swiss banks by and large – UBS the exception – remained relatively stable without government assistance.

The franc has been in such high demand since the crisis that it has caused problems for Swiss exporters and the tourism industry. The once mighty euro has nosedived as investors fear yet more countries may need bailing out of debt problems.

The volatility will most likely die down in future, but not enthusiasm for the franc as a safe haven, according to Straumann.

“The franc should continue to play a function as a small reserve currency,” he told swissinfo.ch. “It will not be an essential part of the global monetary system, but investors like a safe alternative.”

Losing allure?

“The turbulent times are not over and who knows if the financial crisis will repeat itself?”

But Charles Wyplosz, a professor of international finance at Geneva’s Graduate Institute, believes there are reasons why the franc will lose some of its allure in years to come.

Top of his list are the erosion of banking secrecy, one of the pillars of the Swiss financial system, combined with other central banks achieving political independence and pursuing more conservative policies.

Added to these factors, Wyplosz argued that the increasing importance of emerging economies and their vastly expanding reserves will simply dwarf the limited supply of the franc, further diluting the impact of the currency.

“The franc will lose some of its allure,” Wyplosz told swissinfo.ch. “But it will likely remain an oddity that attracts investors in severe economic downturns.”

In short, conditions would have to sink to the near catastrophic – as they did recently – to attract an investor stampede in future.

Swiss cantons adopted a decimalised silver currency based on the Bernese Thaler in 1798.

But with each canton, plus abbeys, banks and foreign sources minting their own version of the currency, there were still hundreds of different coins in circulation.

It was only in 1848 that the newly created Swiss federal government was given sole power to mint money in Switzerland. In 1850, the Swiss franc – pegged to the French franc – replaced the various currencies that were in use around the country.

In 1865, Switzerland joined France, Belgium and Italy to form the Latin Monetary Union that set a unified value of their currencies based on their gold and silver content to make them interchangeable. The union was disbanded in 1927.

Switzerland stuck to the gold standard, backing up currency in circulation with gold reserves, until 2000.

The Swiss National Bank was created in 1907, and one of its responsibilities was to take over the task of printing money.

In 1945, the franc joined the Bretton Woods system that set up a new set of rules for the international monetary system.

In 2010, some 6.4% of foreign exchange transaction involved the Swiss franc, making it the fifth most traded currency in the world, according to the Bank for International Settlements.

In recent years the Swiss franc has accounted for around 0.1-0.2% of all currency reserves held by central banks. But this still makes it the fifth most popular reserve currency in the world.

In compliance with the JTI standards

More: SWI swissinfo.ch certified by the Journalism Trust Initiative

You can find an overview of ongoing debates with our journalists here. Please join us!

If you want to start a conversation about a topic raised in this article or want to report factual errors, email us at english@swissinfo.ch.